10 signs that you shouldn’t take out a loan

In our modern financial landscape, debt is often presented as a quick fix. Need a car? Get a loan. Want to renovate the kitchen? Get a loan. Facing an unexpected medical bill? A loan can cover it. But while debt can be a powerful tool to build wealth or manage emergencies, it’s also a serious financial commitment that can just as easily destroy your financial future if mishandled.

A loan isn’t free money. It’s a product you are buying. You are paying a lender for the privilege of using their money now, and that privilege comes at a cost—namely, interest and fees.

Before you sign on the dotted line, it’s crucial to stop and perform a “financial health check.” Lenders are in the business of selling money, and they will often approve you for a loan you have no realistic way of paying back. It’s your job, and yours alone, to protect your own financial well-being.

How do you know if you’re making a smart decision or walking into a debt trap? Here are the 10 critical signs that you should absolutely not get a loan right now.

1. You Don’t Have a Clear “Why” or a Specific Repayment Plan

This is the most fundamental sign of all. If you’re considering a loan for vague reasons like “having extra cash,” “buying some new things,” or “just in case,” stop immediately. A loan should never be an impulse decision. It must have a specific, defined purpose.

If you can’t articulate exactly what the money is for and exactly how it will improve your financial position, you don’t need a loan; you’re just window-shopping for debt.

Equally important is the repayment plan. It’s not enough for the lender to tell you the monthly payment. You need to look at your own finances and know, with 100% certainty, where that payment is coming from.

- Bad “Why”: “I just want a cushion in my checking account.”

- Good “Why”: “I need to consolidate $10,000 in 22% APR credit card debt into a single 9% APR personal loan, which will save me $1,500 in interest and allow me to be debt-free in 36 months.”

If your “why” is fuzzy, the answer is no.

2. You Plan to Use the Loan for Basic Living Expenses

This is a four-alarm fire. If you are borrowing money to pay for your rent, groceries, utility bills, or gas, you are not solving a problem—you are creating a bigger one.

Using debt to cover essential needs means you have a fundamental cash flow problem: your expenses are higher than your income. A loan doesn’t fix this. It just patches the hole for one month, while adding a new monthly bill (the loan payment) on top of your already-too-high expenses.

This is how the “debt spiral” begins. You take a loan to pay rent in Month 1. In Month 2, you still have to pay rent, but now you also have to pay the loan payment. You fall further behind, forcing you to take another loan.

What to do instead: This situation requires a drastic budget overhaul, not a loan. You must either cut expenses immediately or find a way to increase your income (a second job, a side hustle) to cover your core needs.

3. Your Debt-to-Income (DTI) Ratio Is Already in the Danger Zone

Your Debt-to-Income (DTI) ratio is one of the most important numbers in your financial life. In simple terms, it’s the percentage of your gross monthly income (before taxes) that goes toward paying your total monthly debt payments (mortgage, auto loan, student loans, credit card minimums).

How to Calculate DTI:

(Total Monthly Debt Payments) / (Gross Monthly Income) = DTI

Example: $2,000 in debt payments / $6,000 in gross income = 0.33, or 33% DTI.

Lenders use this to gauge your ability to take on new debt. Here’s a general guide:

- 36% or less: You are in a strong financial position.

- 37% to 42%: You are manageable, but new debt will cause strain.

- 43% to 49%: You are considered high-risk. Many lenders will deny you.

- 50% or more: You are severely over-leveraged and in a financial danger zone.

If your DTI is already creeping into the 40s or higher, you cannot afford another payment. You are “house poor” or “car poor,” and adding another loan is like trying to balance one more brick on a collapsing wall.

4. You Don’t Have a Detailed, Written Monthly Budget

This sign is related to DTI, but it’s more personal. A DTI is what a lender sees. A budget is what you see. If you don’t know exactly where your money goes each month, you have no business promising a portion of it to a bank for the next 3-5 years.

A budget is simply a plan for your money. If you can’t answer these questions, you don’t have a budget:

- How much did you spend on groceries last month?

- How much did you spend on “subscriptions & memberships”?

- How much did you spend on dining out or entertainment?

- After all your bills and spending, how much money was left over?

If you don’t know the answer to that last question, you cannot safely afford a new loan payment. A guess is not good enough. You must know you have a $300 surplus before you agree to a $300 payment.

5. You Have No Emergency Fund (Or You’re Draining It)

An emergency fund—a savings account with 3-6 months’ worth of living expenses—is the ultimate defense against debt. It’s the buffer between you and financial disaster.

When you take on a loan, you are adding a new, non-negotiable fixed expense to your life. But what happens when life, inevitably, happens?

- Your car transmission fails.

- Your A/C unit dies in July.

- You have a medical emergency.

- Your company cuts your hours.

Without an emergency fund, your only option is to default on your new loan (destroying your credit) or take on even more debt (like a high-interest credit card) to cover the emergency.

If you have no savings, your first priority is to build a starter emergency fund (at least $1,000) before you even think about taking on new, optional debt.

6. The Loan Is for a Highly Speculative Investment

This is a cardinal sin of personal finance: Never borrow money to invest in something you can’t afford to lose.

This includes:

- Taking a personal loan to buy cryptocurrency.

- Borrowing to invest in a “hot” new stock.

- Taking out a home equity loan to give to a friend for their unproven business startup.

When you do this, you are taking on a double risk. First, the investment itself could go to zero. Second, you are still on the hook for the full loan amount, plus interest. This is how people go bankrupt.

Legitimate investments (like buying a rental property) are backed by a solid business plan and a tangible asset. Speculative “investments” are gambling, and you should never borrow money to gamble.

7. You’re Making an Emotional or Impulsive Decision

Lenders love emotional borrowers. Emotions make you impulsive, and impulsive people don’t read the fine print. Ask yourself if your desire for this loan is driven by a genuine need or by a powerful want.

Emotional triggers for bad loans include:

- “Keeping Up with the Joneses”: Your neighbor got a new boat, so you feel you “deserve” one too.

- Retail Therapy: You feel sad or stressed, and you think a shopping spree or a fancy vacation (all funded by a loan) will make you feel better.

- Life Events: The pressure to have a lavish wedding, a perfect baby nursery, or an extravagant holiday celebration can push people into debt they will regret for years.

A loan is a cold, hard business transaction. If your decision-making process is a hot, emotional mess, you are being set up to fail. Wait at least 30 days. If the “need” is still there after the emotions have cooled, you can re-evaluate.

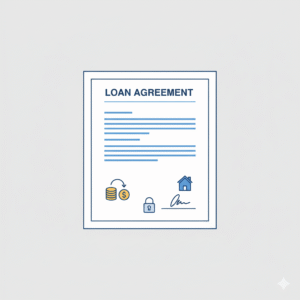

8. You Haven’t Read (or Don’t Understand) the Terms

The loan agreement is a legally binding contract, and lenders often hide the most dangerous parts in dense legal language. If you haven’t read every single word, or if you read it and felt confused, do not sign it.

A lender who says, “Oh, that’s just standard legal stuff, don’t worry about it,” is a major red flag. You should be very worried about it.

Key things to find and understand:

- APR (Annual Percentage Rate): This is the true cost. It includes the interest rate plus all origination fees, processing fees, etc. A 7% interest rate could be a 12% APR.

- Prepayment Penalties: Is there a fee if you try to pay the loan off early? This is a predatory feature designed to keep you in debt.

- Balloon Payments: Are the payments small for 35 months, but then you owe a massive, single payment in Month 36?

- Fixed vs. Variable Rate: Is your interest rate locked in (fixed), or can it suddenly skyrocket after six months (variable)?

If you can’t explain the full cost and terms of your loan to a 15-year-old, you don’t understand it well enough to sign it.

9. You Feel Rushed or Pressured by the Lender

This is a classic predatory lending tactic. A legitimate lender will give you time to read the documents, consult a financial advisor, and shop around. A predatory lender wants to close the deal before you have time to think.

Be on high alert for these pressure phrases:

- “This special rate is only good for today.”

- “You have to sign now, or the offer is off the table.”

- “We’re the only ones who will approve you.”

- “Just sign here, and we’ll fill in the details later.” (Never, ever sign a blank or incomplete document).

A loan is a major decision. If the person offering it is treating it with the urgency of a late-night infomercial, walk away. They do not have your best interests at heart.

10. You Haven’t Shopped Around and Compared Offers

Would you buy the very first car you saw at the very first dealership you visited? Of course not. You’d compare prices, features, and financing.

Getting a loan is no different. Taking the first offer you receive (especially if it was an “pre-approved” offer in the mail) is a guaranteed way to overpay.

You must get quotes from at least three different sources:

- A Local Credit Union: They are non-profits and often have the best rates and lowest fees.

- A Traditional Bank: (Especially one where you have a checking account).

- A Reputable Online Lender: They can be competitive, but you must verify their reputation.

By comparing the APRs, you could discover that your credit union offers the same loan for 8% APR that the mail-in offer listed at 15% APR. On a $15,000 loan, that’s a difference of thousands of dollars in interest.

Smart Alternatives: What to Do Instead of Borrowing

If you’ve recognized yourself in any of the signs above, the answer isn’t to despair. It’s to take action. Instead of borrowing, focus on these wealth-building steps.

1. Build (or Rebuild) Your Budget

This is Step Zero. You must have a plan for your income. Use a simple system like the 50/30/20 rule (50% Needs, 30% Wants, 20% Savings/Debt) or a “zero-based budget” (where every dollar is given a job). You cannot get ahead if you don’t control where your money is going.

2. Attack High-Interest Debt

If you’re already carrying credit card debt, taking on more debt is not the answer. Focus all your financial energy on paying that off. Use the “Debt Snowball” method (paying smallest balances first for psychological wins) or the “Debt Avalanche” method (paying highest-interest balances first to save the most money).

3. Start Your Starter Emergency Fund

Open a high-yield savings account (HYSA) at a separate bank and set up an automatic transfer from your paycheck. Even $25 a week is a start. Your first goal is $1,000. This single step will solve more of your future financial “emergencies” than any loan ever could.

4. Increase Your Income

Sometimes, you can’t cut expenses any further. The only solution is to earn more. This doesn’t have to be a permanent second job. It could be a temporary side hustle (DoorDash, freelance writing, babysitting) with one specific goal: to build your emergency fund or pay off a specific debt.

5. Explore Non-Profit Credit Counseling

If you feel like you are drowning in debt and can’t see a way out, contact a non-profit credit counselor, such as one affiliated with the National Foundation for Credit Counseling (NFCC). They are not a “debt settlement” scam. They are legitimate advisors who can review your entire financial picture and help you create a Debt Management Plan (DMP), which can consolidate your payments and lower your interest rates without a new loan.

When Does a Loan Actually Make Sense?

This article isn’t meant to say that all debt is bad. “Good debt” is typically used to purchase an asset that will grow in value or increase your income.

- A sensible mortgage on a home you can afford.

- A federal student loan for a high-demand degree.

- A business loan with a solid plan to generate more revenue than the loan’s cost.

The warning signs are about avoiding bad debt—debt taken on for depreciating assets, consumption, or out of desperation.

A loan is a commitment you are making to your future self. Before you sign, make sure you aren’t robbing your future self of their financial peace and freedom. True financial health doesn’t come from the next loan; it comes from having a plan, living within your means, and saving for the future.