5 common mistakes when buying insurance

Buying insurance is rarely anyone’s favorite pastime. Whether it’s auto, home, life, or health insurance, the process often feels like a maze of complex jargon, confusing numbers, and fine print. Because it can be tedious, many people rush through the process just to get it over with, often settling for the cheapest option they can find on a comparison website.

However, treating insurance as a mere commodity rather than a critical financial safety net is a dangerous game. Insurance is meant to be the barrier between you and financial ruin. When you make mistakes during the purchasing process, you aren’t just risking a denied claim; you are risking your savings, your assets, and your peace of mind.

To help you navigate this complex landscape, we have compiled a detailed guide on the 5 common mistakes when buying insurance. We will also dive deep into how to rectify these errors, understand the nuances of policy structures, and ensure you are getting the best value for your hard-earned money.

Mistake #1: Prioritizing Low Premiums Over Adequate Coverage

The most prevalent mistake consumers make is shopping solely on price. It is understandable; nobody wants to pay more than they have to for a monthly bill. However, in the insurance world, the phrase “you get what you pay for” is often painfully true.

The Illusion of the “Cheap” Policy

When you select the policy with the absolute lowest premium, you are often sacrificing essential coverage. A “bare-bones” policy might meet the legal state minimums (for car insurance, for example), but it may leave you exposed to massive liabilities.

If you cause an accident and the damages exceed your coverage limits, you are personally responsible for the difference. If you saved $20 a month on premiums but are now on the hook for $50,000 in medical bills because your liability limit was too low, that “savings” has cost you a fortune.

The Premium vs. Coverage Balance

Instead of looking for the cheapest number, look for the best value. Value is defined as the highest amount of coverage you can afford at a competitive price. Always ask yourself: If the worst-case scenario happens tomorrow, will this policy actually protect me, or will I still go bankrupt?

Mistake #2: Ignoring the Fine Print and Policy Exclusions

Insurance contracts are legally binding documents, and they are defined as much by what they don’t cover as what they do. Ignoring the exclusions page is a recipe for disaster.

The “All-Risk” Misconception

Many homeowners assume that a standard home insurance policy covers everything. This is false. For example, standard policies in the US typically exclude damage caused by floods and earthquakes. If you live in a flood-prone area and rely solely on your standard homeowner’s policy, you have zero coverage for water rising from the ground.

How to Read Your Declarations Page

You don’t need to be a lawyer to understand your policy, but you must read the Declarations Page. This document summarizes your coverage limits, deductibles, and specifically lists endorsements and exclusions. If you see a term you don’t understand, such as “Actual Cash Value” versus “Replacement Cost,” you must clarify it with your agent immediately. Ignoring these details leads to shocked policyholders when a claim is denied.

Mistake #3: Underestimating Your Liability Risk

When people buy insurance, they usually think about protecting their own property—their car, their house, their jewelry. While this is important, the biggest financial threat to most Americans is liability.

The High Cost of Lawsuits

We live in a litigious society. If someone is injured on your property, or if you cause a severe car accident, the medical bills and legal fees can escalate into the hundreds of thousands—or even millions—of dollars.

The Umbrella Policy Solution

A common mistake is sticking to standard liability limits (e.g., $100,000 or $300,000). If you own a home or have significant savings, these limits may not be enough. Once your insurance limit is exhausted, lawyers can come after your personal assets, including your home equity and future wages.

To fix this, consider an Umbrella Policy. This is an extra layer of liability protection that sits on top of your auto and home policies. It is surprisingly affordable and offers coverage often up to $1 million or more, providing a crucial buffer for your net worth.

Mistake #4: Failing to Shop Around and Compare Quotes

Loyalty is a virtue, but in the insurance industry, it rarely pays to be blindly loyal to one company for decades. Prices fluctuate based on algorithms, risk pools, and market conditions.

The “Price Creep” Phenomenon

Insurers often rely on customer inertia. You might notice your rates creeping up slightly every renewal period. Over five years, you could be paying 20% or 30% more than the market rate simply because you haven’t checked competitors.

The Power of Independent Quotes

It is recommended to shop your insurance rates every 12 to 24 months. This doesn’t mean you have to switch every time, but getting quotes keeps your current insurer honest. Furthermore, life changes—like getting married, improving your credit score, or turning 25—can drastically change your risk profile, making you eligible for better rates elsewhere.

Mistake #5: Providing Inaccurate or Incomplete Application Details

Whether intentional or accidental, providing wrong information on your insurance application is a critical error that can void your coverage entirely.

The Consequences of “Soft Fraud”

Some people might list a rural address for their car insurance while living in a city to get lower rates, or a smoker might identify as a non-smoker on a life insurance application. This is known as material misrepresentation.

If you file a claim and the insurance company investigates (which they will, especially for large claims), and they discover you lied on the application, they have the right to deny the claim and cancel your policy retroactively. It is never worth the risk. Always be 100% transparent about your driving history, health, living situation, and property details.

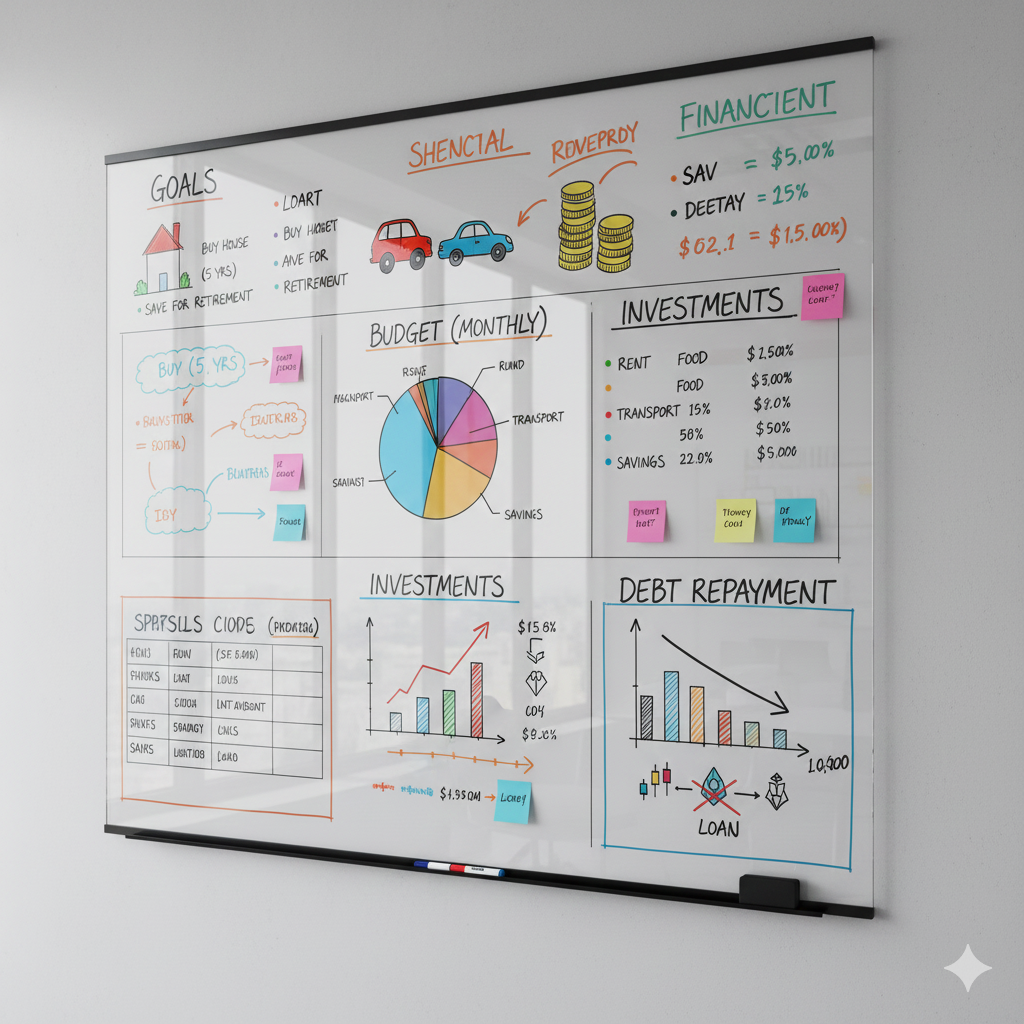

Understanding the Deductible Dilemma: High vs. Low

Beyond the top 5 mistakes, a major area of confusion for consumers is the deductible. This is the amount of money you must pay out-of-pocket before your insurance kicks in. Understanding how to leverage your deductible is a key strategy in financial planning.

The Mathematical Trade-Off

There is an inverse relationship between your deductible and your premium:

-

Low Deductible ($250 – $500): You pay less when you have an accident, but your monthly premium is significantly higher.

-

High Deductible ($1,000 – $2,500): You pay more out-of-pocket during a claim, but your monthly premium is much lower.

Which Should You Choose?

The mistake many make is choosing a low deductible because they are afraid of a large bill. However, if you have an emergency fund effectively saved up, raising your deductible is one of the smartest ways to lower your insurance costs.

Ask yourself: Can I afford to pay $1,000 suddenly if I have an accident? If the answer is yes, switch to a higher deductible. The savings on your monthly premiums will often pay for the difference in the deductible within just a few years of claim-free driving or homeownership.

Actual Cash Value vs. Replacement Cost: A Vital Distinction

This is a technical concept that ruins finances if misunderstood. It usually applies to Homeowners and Renters insurance, particularly regarding personal property.

Actual Cash Value (ACV)

ACV takes depreciation into account. If your 5-year-old laptop is stolen, an ACV policy will pay you what the laptop is worth today (which might be $200), not what you paid for it. This often leaves people without enough money to replace their lost items.

Replacement Cost Value (RCV)

RCV pays you what it costs to buy a brand-new version of the lost item today, regardless of how old the original was.

The Strategy: Always opt for Replacement Cost coverage whenever possible. The premium difference is usually negligible, but the payout difference during a total loss (like a fire or theft) can be tens of thousands of dollars.

The “Set It and Forget It” Trap: Why Annual Reviews Matter

Insurance is not a crockpot; you cannot simply set it and forget it. Your life is dynamic, and your insurance needs to evolve with it. Failing to update your policy is a passive mistake that leads to coverage gaps.

Triggers for Policy Review

You should contact your agent or review your policy if any of the following occur:

-

Home Renovations: Did you finish your basement or add a deck? Your home’s replacement cost has increased, and your old limits may no longer cover a rebuild.

-

Major Purchases: Buying expensive jewelry, art, or electronics may require “riders” or “floaters” because standard policies have caps on these categories.

-

Changes in Household: Marriage, divorce, a teen driver getting a license, or a child heading to college all impact your liability and coverage needs.

-

Retirement: As you drive less, you may qualify for low-mileage discounts.

Missed Opportunities: The Power of Bundling and Discounts

Many consumers leave money on the table simply by not asking for discounts. Insurance companies offer a wide variety of price breaks, but they don’t always apply them automatically.

The Bundling Advantage

The most powerful discount is usually “bundling” (also called multi-line discount). This involves purchasing your home and auto insurance from the same carrier. It simplifies your billing and can save you anywhere from 10% to 25% on both policies.

Other Hidden Discounts

Make sure you ask your agent about:

-

Telematics Programs: Using an app to track your safe driving habits.

-

Good Student Discounts: For teen drivers with a B average or higher.

-

Safety Features: Discounts for home security systems, smoke detectors, or anti-lock brakes.

-

Profession/Alumni Associations: Some carriers offer group rates for engineers, teachers, or graduates of certain universities.

Captive Agents vs. Independent Brokers: Who Should You Choose?

When buying insurance, the channel you use matters. Understanding who is selling you the policy can help you avoid the mistake of limited options.

Captive Agents

These agents work for one specific insurance company (e.g., State Farm, Allstate). They know their specific products inside and out. However, if their company raises rates, they cannot shop around for you. They can only offer what their parent company sells.

Independent Brokers

Independent brokers represent multiple insurance carriers. They can take your information and run it through 10 or 15 different companies to find the best mix of price and coverage.

The Recommendation: If you have a complex insurance situation (e.g., multiple properties, a business, high net worth), an independent broker is often invaluable. They act as a consultant rather than just a salesperson for one brand.

Insurance as a Pillar of Financial Health

Avoiding these common mistakes requires a shift in mindset. Insurance should not be viewed as a mandatory tax you are forced to pay, but rather as a sophisticated financial tool designed to protect your wealth.

By moving beyond the obsession with the lowest premium, reading the fine print, ensuring your liability limits are high enough, and reviewing your policies annually, you transform from a passive consumer into a smart policyholder.

Remember, the goal of insurance is to ensure that a bad day—a car crash, a storm, or a medical emergency—doesn’t turn into a bad life. Take the time today to pull out your policies, review your declarations pages, and call your agent. A few hours of due diligence now could save you everything later.