Financial Mistakes to Avoid in Your 20s and 30s

Your 20s and 30s are the most pivotal decades for your financial life. The 20s are for laying the foundation, and the 30s are for building the structure. The choices you make during this 20-year span will have an outsized impact on whether you achieve financial freedom or spend your life playing catch-up.

The problem? We’re not taught this in school. We’re thrown into the world with new careers, new responsibilities, and a barrage of financial products—from student loans to credit cards to investment apps—with no instruction manual. It’s incredibly easy to make small, seemingly insignificant mistakes that compound into massive regrets by the time you reach 40 or 50.

But here’s the good news: you are in the perfect position to get it right. By avoiding a few common pitfalls, you can set yourself on a trajectory for wealth, security, and a life of choice. This guide isn’t about restriction; it’s about freedom. Let’s dive into the critical financial mistakes you must avoid.

Why Ignoring the “Time Value of Money” Is Your Biggest Mistake

This is the most important concept in all of finance, and it’s the one advantage you have in your 20s that you will never get back: time.

The “Time Value of Money” is the idea that a dollar today is worth more than a dollar tomorrow, thanks to its potential to earn interest. This is the magic of compound interest—where your interest earns its own interest, creating a snowball of wealth.

- Mistake: Thinking, “I’m only 25. I’ll start saving for retirement when I’m 35 and making more money.”

- The Reality: Let’s say you invest $300 a month starting at age 25. Assuming an 8% average annual return, you’d have approximately $1.07 million by age 65.

- The Cost of Waiting: If you wait just 10 years and start investing the same $300 a month at age 35, you’d have only $474,000 by age 65.

That 10-year delay cost you over half a million dollars. Time is your greatest asset. Not starting to invest—even small amounts—is the single biggest financial error you can make.

The Dangers of “Good Vibes Only” Spending (And No Budget)

We live in an “experience” economy. The pressure to travel, eat at the best restaurants, and live an Instagram-worthy life is immense. This often leads to a “YOLO” (You Only Live Once) spending mentality, which is just another way of saying “I have no financial plan.”

A budget isn’t a financial diet; it’s a spending plan. It’s you telling your money where to go, instead of wondering where it went.

- Mistake: Swiping your card and “hoping for the best” at the end of the month. You feel rich on payday and broke a week later.

- The Solution: The 50/30/20 Rule. If you hate spreadsheets, use this simple framework:

- 50% of your take-home pay goes to Needs (rent/mortgage, utilities, groceries, transportation).

- 30% goes to Wants (dining out, subscriptions, travel, hobbies).

- 20% goes to Savings & Debt Repayment (this is non-negotiable).

Without a plan, you are virtually guaranteed to overspend on “Wants” and shortchange your “Savings,” forever trapping yourself in the paycheck-to-paycheck cycle.

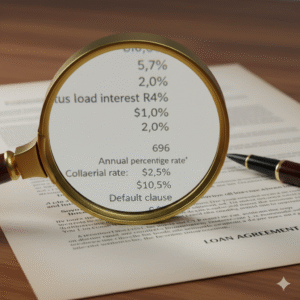

How High-Interest Debt Sabotages Your Financial Future

If compounding interest is your best friend, high-interest debt is your worst enemy. It’s “reverse compounding”—a wealth-destroying fire you have to put out.

We’re talking specifically about credit card debt. The average credit card APR is over 20%. When you carry a balance, you are paying a 20%+ “tax” on everything you buy. It is impossible to build wealth when you are simultaneously servicing debt at that rate.

- Mistake: Using credit cards to fund a lifestyle you can’t afford. You buy a $1,000 laptop on a card and only make the minimum payments. That laptop could end up costing you over $2,000 and take years to pay off.

- The Mindset Shift: A credit card should be used as a transaction tool (for points, security, and building credit), not a loan. The rule is simple: If you can’t pay the statement balance in full every single month, you can’t afford it.

Skipping This One Thing Can Ruin You: The Emergency Fund

Life is unpredictable. Your car will break down. Your A/C will die in the middle of summer. You will have an unexpected medical bill. And a job loss is always a possibility.

An emergency fund is your personal insurance policy against life. It’s 3-6 months’ worth of essential living expenses parked in a liquid, high-yield savings account (HYSA).

- Mistake: Thinking your credit card is your emergency fund. This is a catastrophic error. When a $2,000 car repair hits, you put it on a 22% APR credit card. You’ve now turned a one-time emergency into a long-term debt problem.

- The Reality: An emergency fund creates a financial firewall. When that $2,000 repair hits, you pay for it in cash from your HYSA. You’re annoyed, but you’re not in debt. You simply replenish the fund over the next few months. This is the difference between a financial inconvenience and a financial crisis.

“I’m Too Young for That”: The Myth of Ignoring Retirement

“Retirement is for old people.” This is a 20-something’s classic blunder. The single easiest money you will ever make is your employer’s 401(k) match.

If your company offers a “50% match on up to 6% of your salary,” that means if you contribute 6% of your pay, they will add an additional 3% for free. This is an instant, guaranteed 50% return on your investment. You will not find that return anywhere else.

- Mistake: Not contributing enough to your 401(k) to get the full employer match. You are literally turning down free money.

- The Action: The very first financial move you should make at a new job is to set your 401(k) contribution to, at minimum, get the full company match. Do this before you even get your first paycheck. You won’t even miss the money.

Are You Suffering from Lifestyle Creep? How to Spot and Stop It

This is the big trap of your 30s. You finally get that big promotion and a $20,000 raise. What happens next?

For most people, their “needs” and “wants” expand to meet their new income. Your $1,500/mo apartment becomes a $2,200/mo apartment. Your reliable Honda becomes a luxury SUV with a $600/mo payment. You start ordering takeout more.

At the end of the year, despite making $20,000 more, you have nothing extra to show for it. This is lifestyle creep (or lifestyle inflation), and it’s the invisible force that keeps even high-earners poor.

- Mistake: Automatically upgrading your lifestyle every time you get a raise.

- The Solution: The 50/50 Rule for Raises. When you get a raise, automate this decision. Commit to saving/investing 50% of the new (after-tax) money. The other 50%? You can use that to upgrade your lifestyle guilt-free. This allows you to enjoy the fruits of your labor while still aggressively accelerating your wealth.

“Keeping Up with the Joneses” Is a Game You Can’t Win

In your 30s, you’ll watch your friends buy bigger houses, drive nicer cars, and take exotic vacations. Social media is an endless highlight reel of other people’s consumption. The pressure to “keep up” is immense, and it leads to financially destructive decisions.

- Mistake: Making financial decisions based on social pressure rather than your own goals. You buy a 3,000 sq. ft. house you don’t need (and can’t really afford) because “that’s what people our age do.”

- The Reality: The “Joneses” are probably broke. That fancy car is leased. That huge house is mortgaged to the hilt. They are financing an image with debt. True wealth is what you don’t see—the robust investment portfolio, the fully-funded retirement accounts, the absence of debt. Run your own race.

Why Your Career Stagnation Is a Major Financial Error

We talk a lot about saving and cutting costs, but we often neglect the other side of the equation: your income. Your ability to earn money is your single greatest wealth-building tool.

In your 20s and 30s, you should be in growth mode.

- Mistake: Getting too comfortable. You stay at the same job for 5-7 years with no significant raise or promotion because it’s “easy” or you “like your boss.”

- The Cost of Complacency: The data is clear: people who change jobs every 2-3 years (strategically) tend to earn significantly more over their lifetimes than those who stay put. You must be proactive.

- Ask for raises: Annually, come prepared with a list of your accomplishments and market data for your role.

- Upskill: Continuously learn new skills, get certifications, and make yourself more valuable.

- Always be open: Even if you’re happy, take the call from a recruiter. Know your market value.

Don’t let your income stagnate. A $10,000 raise, invested, is worth hundreds of thousands of dollars in retirement.

The Real Risk of Emotional Investing and Market Timing

Once you do start investing, the new challenge is managing your own emotions. You’ll be tempted to “time the market”—sell when you think a crash is coming, or pile in when a “hot stock” is all over the news.

- Mistake #1 (Fear): The market drops 20%. You panic, sell all your investments to “cut your losses,” and wait in cash. You then miss the inevitable rebound and lock in your losses permanently.

- Mistake #2 (Greed): Your friend tells you about a “guaranteed” crypto or meme stock. You get FOMO (Fear Of Missing Out) and dump a huge portion of your savings into one speculative asset, ignoring all principles of diversification.

- The Solution: “Time in the market, not timing the market.” The best strategy for 99% of people is to buy broad-market index funds (like an S&P 500 fund) and hold them for decades. You automate your contributions every single month, whether the market is up or down. This is called dollar-cost averaging, and it removes emotion from the equation.

Buying “Too Much House” and the Trap of Being House-Poor

Buying a home is a cornerstone of the American dream. But buying too much home can turn that dream into a nightmare.

Being “house-poor” means so much of your monthly income is consumed by your housing payment (and all the related costs) that you have no money left for anything else—savings, investing, travel, or even basic fun.

- Mistake: Trusting the bank to tell you what you can afford. The bank will pre-approve you for the absolute maximum loan you can technically carry, not what you can comfortably afford.

- The Guideline: The 28/36 Rule. A solid financial rule of thumb:

- Your total PITI (Principal, Interest, Taxes, and Insurance) should not exceed 28% of your gross monthly income.

- Your total debt (PITI + car payments + student loans + credit cards) should not exceed 36% of your gross monthly income.

And remember: the mortgage is just the entrance fee. You also have to pay for utilities, maintenance, repairs, property taxes, and furniture.

Neglecting “Financial Adulthood”: Insurance, Wills, and Beneficiaries

As you move through your 30s, your financial life gets more complex. You may get married, have children, and accumulate assets. This is when you must protect what you’re building.

- Mistake: Thinking “I’m young, I don’t need a will.” or “Life insurance is a scam.”

- The Non-Negotiables:

- Life Insurance: If anyone depends on your income (a spouse, a child), you need term life insurance. It’s incredibly cheap in your 30s and provides a massive financial safety net for your family if the worst happens.

- Disability Insurance: You are far more likely to become disabled during your working years than you are to die. Disability insurance protects your income if you’re unable to work.

- A Will: If you have assets or children, you need a will. Period. You decide who gets your assets and who would care for your children—not a court.

- Beneficiaries: Go check your 401(k), IRA, and life insurance policies right now. Are the beneficiaries up to date? This simple form supersedes your will. You don’t want your $500,000 life insurance policy going to an ex-partner by mistake.

Understanding the Debt Snowball vs. Debt Avalanche Methods

If you are currently in high-interest debt, your primary goal must be to get out. But what’s the best way? There are two main, proven strategies.

- The Debt Avalanche (The Math Method): You list all your debts from highest interest rate to lowest. You pay the minimum on all of them, and throw every extra dollar you have at the debt with the highest interest rate. Once that’s paid off, you “avalanche” that full payment onto the next-highest-interest debt. This is the fastest and mathematically cheapest way to get out of debt.

- The Debt Snowball (The Psychology Method): You list your debts from smallest balance to largest, regardless of interest rate. You pay minimums on all, and throw every extra dollar at the smallest debt. When it’s paid off, you get a quick psychological win, which builds momentum. You then “snowball” that payment onto the next-smallest debt.

Which is better? The one you will actually stick with.

The Power of Automation: Set It and Forget Your Finances

Here is the secret to tying all this together: automation.

Human willpower is a finite resource. You can’t rely on “remembering” to save or “feeling like” investing. You must build a system where the default choice is the correct one.

- Step 1: Set up your direct deposit.

- Step 2: Have a portion automatically transfer to your 401(k) (at least to the match).

- Step 3: Have a portion automatically transfer to your High-Yield Savings Account (for your emergency fund).

- Step 4: Have a portion automatically transfer to your investment account (like a Roth IRA).

- Step 5: Have all your bills set to autopay.

What’s left in your checking account is what you have to live on. You’ve already paid yourself first, hit your savings goals, and paid your bills. You have removed failure as an option.

Your Future Is Written in Today’s Decisions

Your 20s and 30s are not a dress rehearsal. They are the main event. The financial habits you build today will compound for decades, for better or for worse.

The mistakes listed here are not a judgment; they are a roadmap of what to avoid. You don’t have to be perfect. You don’t need to be a Wall Street genius. You just need to be consistent.

Start by avoiding the big errors: live on less than you make, destroy high-interest debt, build an emergency fund, and invest for the long term (starting today). If you can do that, your future self will thank you profoundly.