When is the right time for me to sell my shares?

In the world of investing, knowing when to buy is hard. But knowing when to sell? It’s a decision that can paralyze even the most seasoned investors.

We are all haunted by two equal-and-opposite fears: the fear of selling too early and missing out on future gains (FOMO), and the fear of selling too late and watching our hard-earned profits evaporate in a market crash.

When a stock you own is soaring, your brain screams, “Sell! Take the profit!” But another part whispers, “What if it doubles again?”

When that same stock is crashing, your gut clenches. “Sell! Get out before it goes to zero!” But your heart says, “What if it bounces back tomorrow and I locked in this loss for nothing?”

This emotional tug-of-war is why so many people underperform in the market. They let fear and greed drive their decisions.

The truth is, for a successful long-term investor, the answer to “When should I sell?” is… rarely.

But “rarely” isn’t “never.” There are logical, strategic, and even good reasons to sell a stock. This guide is your blueprint for creating a rational framework. It will help you understand the worst reasons to sell and, more importantly, the very few smart reasons to hit that button.

What Are the Worst Reasons to Sell Stocks? (And How to Avoid Emotional Traps)

Before we cover the right reasons to sell, we must cover the wrong ones. These are the emotional, knee-jerk reactions that destroy wealth. If you find yourself wanting to sell for one of these reasons, stop and take a deep breath.

1. Panic-Selling During a Market Crash

This is, without question, the #1 mistake an investor can make.

The market is volatile. Crashes and corrections (drops of 10% or more) are not a risk; they are a certainty. They are the normal, unavoidable price of admission for the high long-term returns the stock market provides.

When the market is in a freefall, and you sell your stocks, you are doing one thing: You are turning a temporary, “on-paper” loss into a permanent, real-life loss.

- The Wrong Mindset: “The market is down 25%! My $10,000 is only $7,500. I have to sell before I lose everything!”

- The Right Mindset: “The market is down 25%. My $10,000 is only $7,500. But I still own the exact same number of shares in the exact same companies. Those shares are just ‘on sale’ right now. Since I’m a long-term investor, I will do nothing… or even buy more.”

History has shown, 100% of the time, that the U.S. stock market has recovered from every single crash and gone on to new all-time highs. The only people who permanently lost money were the ones who sold at the bottom.

2. Trying to ‘Time the Top’ (The Greed Trap)

This is the flip side of panic-selling. Your stock has doubled. You feel like a genius. You think, “This is the peak. It has to be. I’m going to sell now and lock in my profit.”

The problem? Nobody can consistently predict the top. You might sell, only to watch that stock triple again over the next five years.

This “timing” mentality is a fool’s errand. You’re trying to outsmart the entire market. A far better strategy is to “ride your winners.” If you own a high-quality company or a broad market index fund, its job is to grow for decades. Let it.

3. Because of a Scary News Headline or TV Pundit

The financial news industry is not paid to make you rich. It is paid to get your eyeballs and clicks. And nothing gets clicks like fear.

Headlines about “The Coming Recession,” “This Analyst’s Dire Warning,” or “The Impending Market Collapse” are designed to make you panic. If you sold your stocks every time a TV expert predicted a crash, you would have been out of the market since 1980 and missed decades of compound growth.

4. Because the Stock Got ‘Boring’

Many beginners confuse “investing” with “excitement.” They buy a “hot” stock, it does well, and then… it just sits there. It gets boring. So they sell it to chase the next hot trend.

This is a recipe for disaster. Wealth isn’t built on excitement; it’s built on boredom. The most successful investors own “boring” index funds or high-quality companies for decades, letting compound interest do the “exciting” work for them.

What Are the 4 Good Reasons to Sell Your Stocks? (A Logical Framework)

If you’re not selling out of fear or greed, when do you sell? There are only a few logical, strategic reasons.

1. You Have Reached Your Financial Goal

This is the best and happiest reason to sell.

You shouldn’t be investing just “to make money.” You should be investing to fund a specific goal.

- Goal: A down payment for a house in 5 years.

- Plan: You invest $10,000 in a balanced portfolio. In 5 years, it’s worth $15,000.

- Action: You have reached your goal. You need the cash now for your down payment. You sell your investments and buy your house.

This is a complete investment victory. The same goes for retirement. When you retire, you will systematically sell shares to fund your living expenses. You’re not “losing”; you’re using the money for its intended purpose.

2. The ‘Fundamental’ Reason You Bought a Stock Has Changed

This reason applies primarily to individual stocks, not broad index funds.

When you buy a single stock, you should have a “thesis”—a reason for owning it.

- Thesis: “I am buying Company X because its new technology is revolutionary, it has zero debt, and its management team is brilliant.”

You should only sell that stock if your thesis is broken.

- Broken Thesis: “Company X’s new technology failed its trial, they just took on massive debt to survive, and the brilliant CEO just resigned.”

Notice you are not selling because the stock price went down. You are selling because the business itself is no longer the one you wanted to own.

3. To Rebalance Your Portfolio (The Disciplined Investor’s Secret)

This is the most strategic and disciplined reason to sell, and it’s one all long-term investors must do. It sounds complex, but it’s simple.

Your portfolio should have a target “asset allocation”—a recipe. For example, a “moderate” portfolio might be:

- 60% Stocks

- 40% Bonds

Now, let’s say stocks have a fantastic year. Your portfolio “drifts” and is now:

- 70% Stocks

- 30% Bonds

You are now taking on more risk than you originally planned. Rebalancing is the act of restoring your 60/40 recipe. To do this, you would sell 10% of your “winner” stocks (selling high) and use that money to buy 10% more bonds (buying low).

This is a non-emotional, automatic decision. You are systematically “selling high and buying low” and locking in some of your gains, all while sticking to your original, long-term plan.

4. You Have a Dire Emergency and Your Cash Is Gone

This is the “last resort” reason. Ideally, you have a 3-6 month emergency fund in a high-yield savings account for this exact purpose. But if your car explodes and your emergency fund is empty, selling stocks to cover a true, life-altering emergency is a valid reason. It’s not ideal, but it’s better than taking on 25% APR credit card debt.

How Do You Sell an Index Fund vs. an Individual Stock?

The “when to sell” question changes dramatically depending on what you own.

Selling an Index Fund (like an S&P 500 ETF)

For most beginners, this is what you should own. And the good news? The “when to sell” question is infinitely simpler.

You don’t need to worry about a “broken thesis” (Reason #2). Your “thesis” for an S&P 500 fund is “I believe the 500 largest companies in America, as a whole, will be more valuable in the future.” This is the safest long-term bet in finance.

Therefore, the only reasons you would ever sell a broad index fund are:

- You have reached your goal (retirement, house payment).

- You are rebalancing your portfolio.

That’s it. You never sell an index fund because “the market crashed” or “the economy looks bad.” You buy it and hold it (and keep buying it) for decades.

Selling an Individual Stock

This is where Reason #2 becomes critical. You must act like an owner, not a speculator. You need to ask yourself: “Is this still a high-quality business I want to partner with for the next 10 years?”

- If the stock price falls 30% but the business is stronger than ever: You should buy more, not sell.

- If the stock price rises 30% but the business is failing: This is a good time to sell and cut your losses (or take your lucky gains).

This is hard work, which is why most people are better off just sticking to index funds.

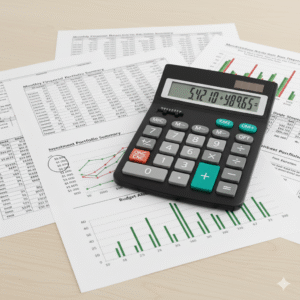

Understanding the Tax Implications: Short-Term vs. Long-Term Capital Gains

Before you hit “sell,” you MUST understand the tax bill you are about to create. When you sell a stock for a profit, that profit is called a “capital gain,” and the IRS will want its cut.

But how much they take depends entirely on how long you held the stock.

Short-Term Capital Gains

- What it is: A profit from an asset you held for one year or less.

- The Tax: This is the “bad” one. Short-term gains are taxed at your ordinary income tax rate—the same high rate you pay on your paycheck (e.g., 22%, 24%, 32%, etc.).

Long-Term Capital Gains

- What it is: A profit from an asset you held for more than one year.

- The Tax: This is the “good” one. Long-term gains are taxed at much lower, preferential rates: 0%, 15%, or 20%, depending on your total income.

Why This Is a Game-Changer:

Let’s say you’re in the 24% tax bracket. You have a $5,000 profit on a stock.

- You sell after 11 months (Short-Term): Your tax bill is $1,200 ($5,000 x 24%).

- You wait one more month and sell after 13 months (Long-Term): Your tax rate is 15%. Your tax bill is $750 ($5,000 x 15%).

You just saved $450 simply by waiting 30 more days. This creates a massive financial incentive to not be an active trader and to hold your investments for at least one year.

What Is Tax-Loss Harvesting? (An Advanced Selling Strategy)

While we’re on taxes, there is one “smart” selling strategy called Tax-Loss Harvesting. This is the act of intentionally selling an investment that is at a loss.

Why on earth would you do that?

To offset your gains. The IRS lets you use your capital losses to cancel out your capital gains.

- Example:

- You sell Stock A for a $4,000 profit (a capital gain).

- You own Stock B, which is down $4,000 (a capital loss).

- The Strategy: You sell both stocks.

- The Result: Your $4,000 gain is completely offset by your $4,000 loss. Your net capital gain is $0. You now owe $0 in taxes on that gain.

This is a powerful tool for rebalancing your portfolio and managing your tax bill, but it comes with one critical rule.

The Wash Sale Rule:

The IRS is not stupid. They know you’d just sell a stock for a loss and immediately buy it back. The Wash Sale Rule says you cannot claim a capital loss if you buy the same or a “substantially identical” security within 30 days (before or after) of the sale.

- Example: You can’t sell a Ford stock for a loss, claim the tax break, and buy Ford stock back the next day. You could, however, sell an S&P 500 fund and buy a “Total Stock Market” fund, as they are not “substantially identical.”

Reframe the Question from ‘When to Sell’ to ‘Why Am I Selling?’

The most successful investors (think Warren Buffett) have a “forever” holding period. They don’t think about “when to sell.” They think about “what to buy.”

For you, as a long-term investor, the answer should be the same. Your default setting should be “hold.”

The next time you feel the itch to sell, don’t ask, “Is now the right time?”

Instead, ask, “What is my logical reason for selling?”

- Is it because I’m scared? (Don’t sell.)

- Is it because I’m greedy? (Don’t sell.)

- Is it because I need to rebalance my portfolio back to my original, long-term plan? (Good reason.)

- Is it because I have finally reached the financial goal I was investing for? (The best reason.)

By building a plan, automating your investments, and focusing on the business (not the stock price), you can remove the emotion and make “selling” a boring, strategic, and rare part of your financial life.