Why do some stocks surge after mass layoffs?

It’s one of the most confusing and seemingly cruel paradoxes in finance.

You wake up, grab your coffee, and see a breaking news headline: “Tech Giant Announces 10,000 Job Cuts.” Your heart sinks. You think of the families, the economic hardship, and the general fear that news creates. It feels like a sign of failure, a company in retreat.

Then, out of curiosity, you check its stock ticker. To your astonishment, the stock is up 5%, 8%, maybe even 10%.

This jarring disconnect is what many call the “Wall Street vs. Main Street” divide. It can feel like investors are “cheering” for a human tragedy. But what’s really going on?

The stock market doesn’t operate on emotion; it operates on a cold, forward-looking calculation of one thing: future profitability.

A surge in stock price after layoffs isn’t a celebration of job losses. It’s a financial reaction to a sudden and significant change in the company’s expenses. This article will break down the precise logic behind this common phenomenon, why it happens, when it can backfire, and what you, as an investor, should look for beyond the headline.

The Primary Driver: Cutting Costs to Boost Profits

To understand this, you must first understand the most basic equation in business:

Revenue - Expenses = Profit

A company’s stock price is (in theory) the value of all its future profits, all added together and “discounted” to today’s dollars. Investors are constantly trying to guess what those future profits will be.

For the vast majority of companies, especially in tech and service industries, the single largest expense is labor. Salaries, benefits, stock-based compensation, and payroll taxes make up a massive chunk of a company’s “Operating Expenses” (OpEx).

When a company announces mass layoffs, it is taking a giant axe to its biggest expense line item.

Let’s use a simple example:

- Company A makes $100 million in revenue.

- Its expenses (labor, rent, R&D, marketing) are $90 million.

- Its profit is $10 million (a 10% profit margin).

Now, the CEO announces a major layoff plan that will cut $20 million in annual labor costs.

- Company A (post-layoff) still makes $100 million in revenue.

- Its expenses are now $70 million ($90M – $20M).

- Its profit is now $30 million (a 30% profit margin).

The company’s profitability has tripled overnight. Wall Street’s analysts, who run these exact numbers, update their financial models. Their new calculation of the company’s future profits is now significantly higher. The stock is “re-rated” at a higher value, and the price surges.

It’s not personal; it’s just math. The market is betting that the company will now be a more efficient, profitable machine.

A Signal of New Strategy: Pivoting and Restructuring

The stock market loves a decisive leader. Often, a company’s stock has been slowly declining for months or years precisely because investors believe it’s bloated, inefficient, or stuck in the past.

In this context, a layoff isn’t seen as a new problem; it’s seen as the solution to an old problem.

This action signals several things to investors:

- Management is “Serious”: It shows that the CEO and board are willing to make the “tough decisions” necessary to right the ship. This can restore investor confidence that leadership is in control.

- The “Cutting the Fat” Argument: Investors may have long believed the company grew too fast during boom times (like the 2020-2021 tech bubble) and hired thousands of people for projects that weren’t profitable. The layoffs are seen as trimming this “fat” and returning the company to a lean, focused operation.

- A Strategic Pivot: Often, the layoffs are concentrated in one specific area. A company might cut 5,000 jobs from its “legacy” division (e.g., hardware sales) while simultaneously hiring 1,000 engineers for its new “AI” division. The market sees this as a smart pivot—pruning a dying branch to feed a growing one.

In this light, the stock surge is a vote of confidence in a new, more disciplined, and forward-looking strategy.

The AI Revolution: How Automation Is Changing the Layoff Narrative

This factor has become increasingly dominant in the 2020s. Today, layoffs are frequently linked to the adoption of new technology, specifically artificial intelligence.

When a company lays off 1,000 customer service agents and announces it’s replacing them with an advanced AI chatbot, investors don’t just see a one-time cost cut. They see a fundamental shift in the company’s business model.

- Human Labor: This is a variable cost that increases as the company grows. It’s expensive, requires management, and is prone to human error.

- AI/Automation: This is often a fixed cost (you pay for the software license or development). It can handle 100 customers or 10 million customers for roughly the same price.

This is called “operating leverage.” By replacing variable human costs with fixed technology costs, the company can scale its profits exponentially without scaling its expenses.

The stock market loves this. A company that successfully integrates AI to reduce its workforce is seen as innovative, efficient, and built for a more profitable future. The stock surge reflects this newfound potential for massive, scalable earnings.

When Layoffs Backfire: Why This Strategy Can Fail

Of course, this isn’t a magic bullet. While the initial market reaction is often positive, the long-term consequences of layoffs can be disastrous. A smart investor knows how to tell the difference.

This is why the initial “pop” can often fade, and the stock may end up underperforming its peers over the next few years.

Here’s why layoffs can be a terrible long-term move:

1. The “Survivor’s Sickness” and Morale Collapse

The people left behind after a mass layoff are often the most critical factor. They just saw their friends and colleagues walked out the door.

- Fear: They are terrified they are next. They stop taking risks, innovating, or speaking up.

- Low Productivity: They are distracted, demoralized, and often forced to pick up the slack for their departed colleagues, leading to burnout.

- Brain Drain: The most talented employees—the “A-Players” who can easily get a job anywhere—see the layoff as a sign of instability. They immediately update their resumes and are the first to leave, “quitting in place” or leaving entirely. The company is left with a demoralized and often less-skilled workforce.

2. Loss of “Tribal Knowledge”

Companies don’t just run on spreadsheets; they run on the informal, undocumented “tribal knowledge” of their experienced employees. These are the people who “know how things really get done,” who know the key customer relationships, or who remember why a certain piece of code was written a specific way.

When you fire them, that knowledge walks out the door. The result can be catastrophic: subtle product failures, broken processes, and a complete inability to solve new problems.

3. Cutting “Muscle,” Not Just “Fat”

This is the most critical error. In a desperate rush to cut costs, management often makes horizontal cuts, like “every department must cut 10%.”

- Good Cut: Firing a bloated, inefficient middle-management layer.

- Bad Cut: Firing 10% of your top-performing sales team.

- Terrible Cut: Firing 10% of your core Research & Development (R&D) engineers.

The market may cheer at the initial cost savings, but the company has just crippled its ability to generate future revenue. They’ve “saved” $10 million in salary but lost $100 million in future innovation and sales.

Short-Term Pop vs. Long-Term Performance: What the Data Shows

So, what’s the real story? Is the short-term pop real, or does the long-term pain win out?

Countless academic studies have analyzed this. The results are broadly consistent:

- Short-Term Pop: Yes, the immediate stock price reaction to a layoff announcement is, on average, positive. This is the market reacting to the cost-cutting math.

- Long-Term Performance: On average, companies that announce mass layoffs tend to underperform their peers over the following one- to three-year period.

The reason? Layoffs are often a symptom, not a cure.

They are a symptom of deeper problems: a failure of management to innovate, a weak position in the marketplace, or an inability to adapt to changing trends. The layoffs are a temporary band-aid on a much more serious wound.

The companies that do succeed long-term after layoffs are almost always the ones that combine the cuts with a clear, credible, and aggressive new plan for growth.

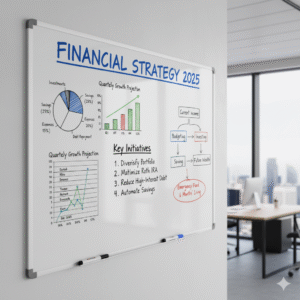

How to Analyze a Layoff Announcement as an Investor

As a retail investor, you should never buy or sell a stock based on a single headline. When you see a layoff announcement, you need to be a detective.

Here is a simple checklist to determine if the layoff is a “good” sign (strategic) or a “bad” sign (desperate).

1. Is this Proactive or Reactive?

- Proactive (Good): The company is doing this from a position of strength. The stock is high, earnings are fine, but they are announcing, “To get ahead of the AI curve, we are eliminating 5,000 roles in our legacy division and investing $2 billion in our new R&D hub.” This is strategic.

- Reactive (Bad): The company just announced a massive earnings miss, the stock is crashing, and they are saying, “Due to unforeseen market weakness, we are cutting 20% of our workforce to survive.” This is desperation.

2. Where Are the Cuts?

Read the details. Is the company cutting “sales and marketing” and “R&D”? That’s bad. Those are the departments that create revenue. Is it cutting “General & Administrative” (G&A) or redundant middle management? That is often seen as a healthy, efficient move.

3. What Is the Cost of the Layoffs?

Layoffs aren’t free. Companies have to pay severance, legal fees, and other “restructuring charges.” This will show up in the next earnings report as a big, one-time loss.

You must ask: How long will it take for the savings from the layoffs to pay back this cost? A good company will be transparent about this.

4. Is This the Whole Plan?

This is the most important question. Is the layoff all they are doing? Or is it just Step 1 of a much larger, more exciting plan?

- Bad Plan: “We are cutting 10,000 jobs. That’s it.”

- Good Plan: “We are cutting 10,000 jobs in order to free up $1.5 billion, which we will use to acquire a new, faster-growing company and triple our R&D budget.”

Beyond the Headline, A Sober Look at Layoffs

The stock market’s positive reaction to layoffs isn’t rooted in malice; it’s rooted in the cold, unemotional mathematics of profitability. The market is a forward-looking mechanism, and it will reward any action—even a painful one—that it believes will lead to higher future earnings.

The initial surge is a simple bet that lower expenses will equal higher profits.

But your job as an investor is to look deeper. The real, long-term value of a company is not determined by what it cuts, but by what it builds.

Is the company cutting “fat” to become a lean, innovative competitor? Or is it cutting “muscle” in a desperate, last-ditch attempt to stay alive? The answer to that question will be the difference between a short-term stock pop and a true, long-term investment.