Financial organization guide for beginners

Money is one of the leading causes of stress in America. For many, opening a bank app or checking a credit card statement induces a genuine physical reaction of anxiety. If you feel this way, you are not alone.

Most of us were never taught how to manage money in school. We learned the Pythagorean theorem, but not how a credit score works, how to choose a health insurance deductible, or the difference between a Roth and a Traditional IRA. As a result, many adults are “winging it,” living paycheck to paycheck not because they lack income, but because they lack a system.

Financial organization isn’t about being a math genius or depriving yourself of everything you enjoy. It is about clarity. It is about knowing exactly where your money is coming from, where it is going, and how to make it work for you.

This guide is your roadmap. We are going to strip away the jargon and walk through a step-by-step process to organize your financial life, build a safety net, and set the foundation for long-term wealth.

The Financial Audit: Knowing Your Numbers

You cannot improve what you do not measure. Before you can set goals or create a budget, you need a clear snapshot of your current reality. This is often the scariest step, but it is also the most liberating.

To perform a financial audit, you need to calculate two main numbers: Net Worth and Cash Flow.

Calculating Your Net Worth

Your net worth is your financial scorecard. It is a simple formula: Assets – Liabilities = Net Worth.

-

List Your Assets: Everything you own that has cash value.

-

Cash in checking/savings accounts

-

Investment accounts (401k, IRA, Brokerage)

-

Real estate equity (Home value)

-

Vehicles (Current market value)

-

-

List Your Liabilities: Everything you owe to others.

-

Credit card balances

-

Student loans

-

Car loans

-

Mortgage balance

-

Personal loans

-

Subtract the total liabilities from the total assets. If the number is negative, don’t panic. This is very common for beginners, especially those with student loans. The goal is simply to know the number so you can track its growth over time.

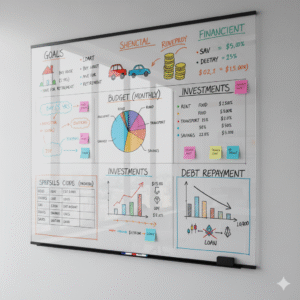

Budgeting Strategies That Actually Work for Real People

The word “budget” often feels like a punishment. It sounds like a diet for your wallet. Instead, think of it as a “Spending Plan.” A budget doesn’t tell you that you can’t spend money; it tells you how you can spend money guilt-free.

There are two primary methods recommended for beginners:

The 50/30/20 Rule

Popularized by Senator Elizabeth Warren, this is the easiest method for beginners because it is broad and flexible. You divide your after-tax income into three buckets:

-

50% Needs: Housing, utilities, groceries, transportation, minimum debt payments, and insurance.

-

30% Wants: Dining out, streaming subscriptions, hobbies, travel, and shopping.

-

20% Savings & Debt Repayment: Emergency fund contributions, retirement investing, and extra debt payments above the minimums.

Zero-Based Budgeting

This method is more detailed and is excellent if things are tight. In a zero-based budget, every single dollar has a job.

If you earn $4,000 a month, you allocate every cent until you hit $0.

-

$1,200 Rent

-

$400 Groceries

-

$100 Electric

-

$500 Savings

-

…and so on.

If you have money left over at the end of the math, you assign it to savings. If you are negative, you must cut a category. This method forces you to be intentional with every purchase.

Optimizing Your Banking Architecture

Most people have one checking account and maybe one savings account at the same big bank they’ve used since college. This is usually a mistake. To organize your finances, you need a structure that separates your “spending money” from your “future money.”

The High-Yield Savings Account (HYSA)

This is the single biggest quick win for beginners. Traditional brick-and-mortar banks often pay an APY (Annual Percentage Yield) of 0.01% on savings.

Online banks, because they don’t have the overhead of physical branches, offer High-Yield Savings Accounts that pay significantly more—often 4% to 5% depending on the Federal Reserve rates.

Action Step: Open an HYSA. Keep your checking account for paying bills, but move your emergency fund and short-term savings to the HYSA. This allows your money to earn money while it sits there, with zero risk.

Taming the Debt Monster: Snowball vs. Avalanche

Consumer debt (credit cards, personal loans) is the biggest obstacle to wealth. The average credit card interest rate in the US is often over 20%. At that rate, your debt grows faster than most investments can keep up.

To get organized, you need a plan of attack. There are two schools of thought:

The Debt Snowball (Psychological Focus)

With this method, you ignore the interest rates. You list your debts from smallest balance to largest balance.

-

Pay minimums on everything.

-

Throw every extra dollar at the smallest debt.

-

Once that is paid off, take the money you were paying on it and roll it into the next smallest debt.

Why it works: It gives you quick wins. eliminating a bill entirely feels good and keeps you motivated.

The Debt Avalanche (Mathematical Focus)

Here, you list debts from highest interest rate to lowest interest rate. You attack the debt with the highest APR first.

Why it works: Mathematically, this saves you the most money in interest over the long run. However, it takes longer to see a debt completely disappear.

Choose the method that fits your personality. If you need motivation, choose the Snowball. If you are purely analytical, choose the Avalanche.

Building Your Financial Fortress: The Emergency Fund

Life is unpredictable. Cars break down, layoffs happen, and medical emergencies arise. Without savings, these events force you back into debt.

Your first major financial goal should be an Emergency Fund.

-

Starter Fund: Aim for $1,000 to $2,000 immediately. This covers minor issues like a blown tire or a dental co-pay.

-

Full Fund: Once high-interest debt is gone, build this up to cover 3 to 6 months of living expenses.

Keep this money in your High-Yield Savings Account. It is not for investing; it is insurance. It is there to buy you peace of mind.

Understanding Credit Scores and Credit Cards

In the US financial system, your credit score (FICO score) acts as your reputation. It determines whether you can rent an apartment, buy a house, get a cell phone plan, and even impacts your car insurance rates.

How to Hack Your Credit Score

-

Payment History (35%): Never miss a payment. Set up auto-pay for the minimum amount on every card so you never accidentally miss a due date.

-

Credit Utilization (30%): This is the ratio of how much credit you use vs. your limit. If you have a $10,000 limit and spend $9,000, your score will drop. Aim to keep utilization below 30% (ideally below 10%).

-

Length of History (15%): Don’t close your oldest credit card accounts, even if you don’t use them often (unless they have an annual fee). The age of your accounts matters.

A Note on Credit Cards: If you pay your balance in full every month, credit cards are wonderful tools that offer fraud protection and 1-2% cash back on purchases. If you carry a balance, they are dangerous traps. If you cannot control your spending, stick to debit cards until you build the discipline.

Risk Management: A Beginner’s Guide to Insurance

Financial organization isn’t just about growing money; it’s about protecting it. One bad accident can wipe out a lifetime of savings if you aren’t insured.

-

Health Insurance: Essential. Understand your “Deductible” (what you pay before insurance kicks in) and your “Out-of-Pocket Max” (the most you will pay in a year).

-

Auto Insurance: Don’t just get the state minimums. If you hit a luxury car or cause an injury, state minimums often won’t cover the cost, and you could be sued for the difference. Look for adequate liability coverage.

-

Renters/Homeowners Insurance: If your apartment burns down or you are robbed, your landlord’s insurance covers the building, not your stuff. Renters insurance is incredibly cheap (often $15/month) and covers your belongings and liability.

-

Life Insurance: If anyone relies on your income (spouse, children), you need life insurance. Term Life Insurance is generally the best choice for most people—it is affordable and covers you for a set period (e.g., 20 years) while you build your own assets.

Investing 101: Making Your Money Work for You

Once you have an emergency fund and have tackled high-interest debt, you must start investing. Investing is the only way to beat inflation.

The 401(k) and The Employer Match

If your employer offers a 401(k) with a “match,” this is your priority. If they match 50% of your contributions up to 6% of your salary, that is an immediate, guaranteed 50% return on your money. No market investment can beat that. Always take the match.

The IRA (Individual Retirement Account)

These are accounts you open yourself (at brokerages like Vanguard, Fidelity, or Schwab).

-

Traditional IRA: You get a tax break now, but pay taxes when you withdraw the money in retirement.

-

Roth IRA: You pay taxes on the money now, but it grows tax-free and you pay zero taxes when you withdraw it in retirement. For many young people or those in lower tax brackets, the Roth IRA is a powerful tool.

What to Invest In?

For beginners, picking individual stocks (like trying to guess the next Amazon) is risky. The standard advice from financial experts like Warren Buffett is to buy Low-Cost Index Funds.

An S&P 500 Index Fund buys a tiny piece of the 500 largest companies in America. If the US economy grows, your money grows. It provides instant diversification and requires zero maintenance.

Automating Your Finances: The Secret to Consistency

The final step in organizing your finances is to remove the “human error.” We are emotional creatures. We get tempted to spend. We forget to transfer money to savings.

Automation solves this.

-

Direct Deposit Split: Ask your payroll department to split your paycheck. Send 80% to Checking and 20% to Savings automatically. You’ll learn to live on what lands in your checking account.

-

Auto-Pay Bills: Set all fixed bills (internet, utilities, insurance) to auto-pay on a credit card (to earn points), and set the credit card to auto-pay the full statement balance from your checking account.

-

Auto-Invest: Set up a recurring transfer from your bank to your IRA or brokerage account to buy index funds every month.

When you automate, you make the “right decision” once, and it pays dividends forever.

Start Today, Not Tomorrow

Financial organization is a journey, not a destination. You don’t need to be perfect. You don’t need to cut out every latte or never go on vacation. You just need a system.

By understanding your net worth, creating a spending plan, building a safety net, and automating your good habits, you move from a position of vulnerability to a position of strength.

The best time to start managing your money was ten years ago. The second best time is right now. Open that spreadsheet, check your bank accounts, and take the first step toward financial freedom.