How Loans Affect Your Credit Score: The Good and the Bad

Your credit score is like your financial report card. It’s a three-digit number that tells lenders how responsibly you handle borrowed money. A high score can unlock better interest rates on future loans, credit cards, and even help you get approved for an apartment or a job. A low score, on the other hand, can close doors and make borrowing a lot more expensive.

But what role do loans, specifically, play in building or hurting that all-important number? The relationship is complex, but it’s built on a few key principles. This guide will break down exactly how different types of loans—from mortgages to personal loans—can either be your best friend or your worst enemy when it comes to your credit score. We’ll explore the positive effects of responsible borrowing and the potential pitfalls that can cause your score to plummet.

The Positive Impact of Loans on Your Credit Score

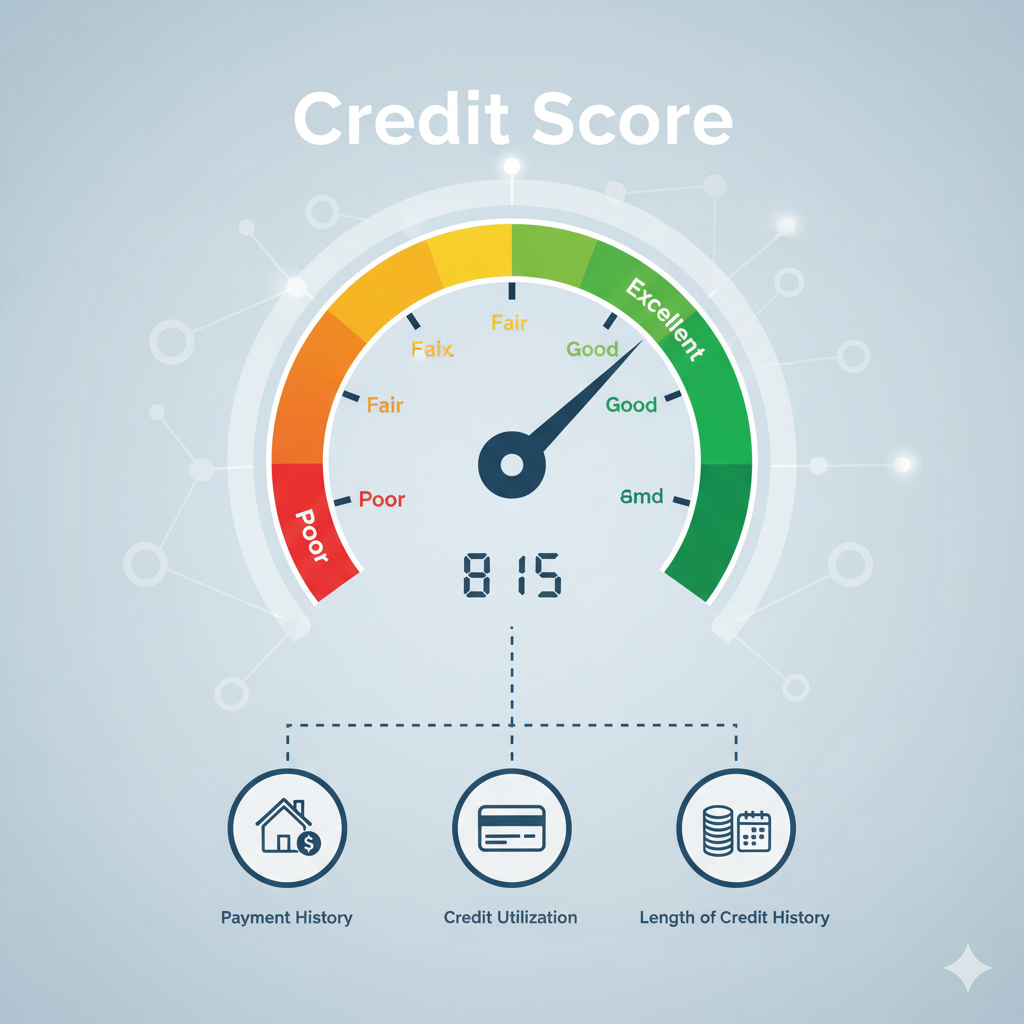

When used wisely, a loan can be a powerful tool for building a strong credit history. Your credit score is calculated using several factors, and a loan can positively influence many of them.

Building a Strong Payment History

This is the most crucial factor in your credit score, making up about 35% of the FICO score. Every time you make an on-time payment on a loan—whether it’s a student loan, a car loan, or a mortgage—the lender reports it to the credit bureaus. These reports show that you are reliable and responsible. A long history of on-time payments is the single best way to build a solid credit score over time. It demonstrates to future lenders that you are a low-risk borrower.

Adding to Your Credit Mix

Your credit mix accounts for about 10% of your FICO score. It’s the variety of credit accounts you have. Lenders like to see that you can handle different types of credit responsibly. There are two main types:

- Revolving Credit: This is credit you can use repeatedly, like a credit card.

- Installment Credit: This is a loan for a fixed amount that you pay back in equal installments over a set period, like an auto loan or a mortgage.

Having a mix of both types of credit can positively impact your score. Taking out and successfully repaying an installment loan shows lenders you can handle a large debt with a set repayment schedule, which is different from managing a revolving credit card balance.

Lowering Your Credit Utilization Ratio

Your credit utilization ratio (or credit utilization rate) is the amount of revolving credit you’re using compared to your total available revolving credit. This factor makes up about 30% of your FICO score. Lenders prefer to see this ratio at 30% or less.

While a loan is not revolving credit, it can indirectly help lower your credit utilization. For example, if you use a personal loan to consolidate high-interest credit card debt, you’re paying off your credit card balances. This immediately lowers your credit utilization ratio, which can lead to a significant boost in your credit score.

The Negative Impact of Loans on Your Credit Score

While loans can be a force for good, they can also cause serious damage if you’re not careful. Knowing the potential downsides is just as important as knowing the benefits.

The Impact of Missing Payments

This is the single fastest way to damage your credit score. A single late payment—especially if it’s 30, 60, or 90 days past due—can cause a sharp drop in your score. Multiple late payments can make it difficult, if not impossible, to get approved for new credit in the future. The longer the payment is late, the more severe the negative impact. Missed payments will stay on your credit report for seven years.

The Effect of a Hard Inquiry

When you apply for a loan, the lender performs a hard inquiry (or hard pull) on your credit report. This is a request to view your full credit history to make a lending decision. A hard inquiry can cause a small, temporary dip in your credit score, usually by a few points.

The good news is that credit scoring models are smart. They know that people shop around for the best interest rates. If you have multiple hard inquiries for the same type of loan—like a mortgage or car loan—within a short period (typically 14 to 45 days), the credit bureaus will treat them as a single inquiry. This is why it’s a good idea to do all your loan shopping within a brief window of time to minimize the impact on your score.

The Dangers of Defaulting on a Loan

Defaulting on a loan means you’ve stopped making payments as agreed. This is the ultimate negative mark on your credit report. When you default, the lender will likely send your account to a collections agency. This can lead to a lawsuit, wage garnishment, and a serious hit to your credit score that can take years to recover from. Defaulting is a major red flag for all future lenders.

Too Much Debt Can Signal Risk

While having a loan can be good for your credit mix, having too much debt can be a problem. Lenders look at your debt-to-income ratio (DTI), which is the percentage of your gross monthly income that goes toward paying your monthly debt payments. A high DTI can signal that you are over-extended and may not be able to handle a new loan, regardless of your good payment history. Taking on multiple loans at once or a loan that is too large for your income can make you seem like a risky borrower.

The Lifecycle of a Loan’s Effect on Your Credit

The impact of a loan on your credit score isn’t a one-time event; it’s a journey.

Application and The Initial Dip

When you first apply for a loan, the hard inquiry causes a small dip in your score. This is normal and to be expected.

Building Your Credit with On-Time Payments

For the life of the loan, your score will benefit from a consistent history of on-time payments. Each month, your credit report gets a fresh update, showing that you are paying your debts as agreed. This consistent positive activity builds a stronger and stronger credit history.

The Final Payment and The End of the Loan

When you make your final loan payment, the account is marked as “paid in full” or “closed” on your credit report. This is a huge positive milestone. The account will remain on your credit report for up to 10 years, continuing to show your history of responsible borrowing. Your score may experience a small, temporary dip when the account is closed because your credit mix has changed, but this is minor compared to the overall positive impact of a successfully repaid loan.

The Difference Between Revolving and Installment Loans

Understanding the two main types of credit is key to managing your score.

- Installment Loans (e.g., Car Loans, Mortgages, Student Loans): These loans have a fixed end date and a set payment schedule. Your credit score is affected by on-time payments and the initial hard inquiry. The total amount of the loan doesn’t factor into your credit utilization ratio.

- Revolving Credit (e.g., Credit Cards): With this type of credit, your credit utilization ratio is a key factor. Using a high percentage of your available credit will hurt your score, even if you make your payments on time.

The smart strategy is to manage both types of credit well. Use installment loans to build a solid history of on-time, fixed payments, and use revolving credit cards to maintain a low balance relative to your credit limit.

The Road to Good Credit

A loan is not just a tool for borrowing; it’s a tool for building your financial future. When you take out a loan and make every payment on time, you’re not just paying off a debt—you’re building a foundation of financial trust and reliability.

Before you apply for a loan, take the time to check your credit report, understand what you can afford, and shop for the best rates. Remember that every financial decision you make has an impact on your credit score. By being mindful of that impact, you can turn a loan into a powerful asset that helps you unlock a world of financial opportunities.