Rent or buy a house in 2025?

The decision to rent or buy a home is one of the most significant financial milestones in a person’s life. It’s far more than a simple calculation of a monthly rent check versus a mortgage payment; it’s a profound choice that impacts your lifestyle, your long-term wealth, and your personal freedom. For decades, the American dream has been synonymous with homeownership, but in the economic landscape of 2025—shaped by fluctuating interest rates, evolving housing markets, and a shift in lifestyle priorities—the classic answer isn’t always the right one.

This comprehensive guide will cut through the noise and the outdated advice. We’ll dissect the true costs and benefits of both renting and buying, explore the hidden financial traps, and provide you with a clear framework to determine which path makes the most sense for you right now. This isn’t just about finding a place to live; it’s about making a strategic decision that aligns with your financial and personal goals.

The Financial Case for Buying: Building Equity and Long-Term Wealth

The single most powerful financial argument for buying a home is the concept of equity. Equity is the portion of your home that you actually own. It’s the difference between the market value of the property and the amount you still owe on your mortgage.

When you pay rent, that money is gone forever. It’s the cost of shelter, and nothing more. But when you make a mortgage payment, a portion of that payment goes toward the principal loan balance, directly increasing your equity. It’s a form of forced savings. Every month, you are systematically converting your housing expense into a tangible asset.

How Equity Grows:

- Principal Payments: With each mortgage payment you make, your loan balance decreases, and your ownership stake increases.

- Market Appreciation: Historically, over the long term, real estate values tend to appreciate. If the value of your home increases from $350,000 to $400,000, that extra $50,000 is added directly to your equity.

This equity becomes a powerful tool for wealth creation. You can borrow against it through a home equity loan or line of credit (HELOC) to fund major expenses like a college education or a business venture. Ultimately, when you sell the home, the equity you’ve built up is returned to you as cash, which can be a cornerstone of your retirement savings. Furthermore, the U.S. tax code provides significant advantages to homeowners, including the ability to deduct mortgage interest and property taxes, which can lower your overall tax burden each year.

The Hidden Costs of Homeownership: Unpacking the Expenses Beyond the Mortgage

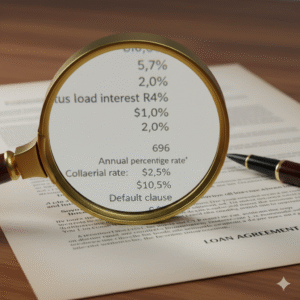

A common mistake first-time homebuyers make is underestimating the true cost of owning a property. Your monthly mortgage payment, which consists of principal and interest, is just the beginning. The real number to focus on is your PITI, and even that doesn’t tell the whole story.

- PITI (Principal, Interest, Taxes, and Insurance): This is the core of your monthly housing expense.

- Taxes: Property taxes are levied by local governments and can add hundreds of dollars to your monthly payment. They vary dramatically by state and county.

- Insurance: Homeowner’s insurance is mandatory by lenders and protects your property against damage from events like fires, storms, or theft.

- Private Mortgage Insurance (PMI): If you put down less than 20% on a conventional loan, your lender will require you to pay PMI. This insurance protects the lender—not you—in case you default on the loan. It can be a significant monthly expense until you reach 20% equity.

- Maintenance and Repairs: This is the financial wildcard of homeownership. As a homeowner, you are the landlord. When the water heater breaks, the roof leaks, or the HVAC system fails, you are 100% responsible for the repair or replacement costs. A good rule of thumb is to budget at least 1-2% of your home’s value for annual maintenance. For a $400,000 home, that’s $4,000 to $8,000 per year.

- Closing Costs: These are the fees you pay to finalize the purchase of a home, typically ranging from 2% to 5% of the loan amount. On a $350,000 loan, this could be anywhere from $7,000 to $17,500 in upfront cash you’ll need in addition to your down payment.

When you add up all these expenses, the total monthly cost of owning a home is often significantly higher than the mortgage payment alone.

The Financial Case for Renting: Unlocking Flexibility and Opportunity

Renting is often framed as “throwing money away,” but this is a dangerously oversimplified view. In many scenarios, renting is the smarter, more strategic financial choice.

The primary benefit of renting is flexibility. Life is unpredictable. You might get a dream job offer in another state, decide to travel the world, or need to downsize or upsize due to a change in family circumstances. Renting allows you to adapt to these changes with minimal friction. Breaking a lease is far simpler and less expensive than selling a house, which involves a lengthy process and significant transaction costs (realtor commissions can be 5-6% of the sale price).

This flexibility creates financial opportunity. By not being tied down to a single location, you are free to pursue higher-paying jobs or move to a lower-cost-of-living area to accelerate your savings.

Furthermore, renting provides predictable expenses. Your monthly rent payment is fixed, and you have no responsibility for maintenance, repairs, or property taxes. This financial predictability makes it easier to budget and allocate more of your income toward other high-growth investments, such as stocks and ETFs in a 401(k) or IRA. The money that a homeowner would spend on a new roof could instead be invested in the S&P 500, potentially generating a higher return over time than the appreciation of a property.

The Rent vs. Buy Break-Even Point: How to Run the Numbers for Your City

The decision to rent or buy often comes down to your time horizon. In almost any market, there is a “break-even point”—the number of years you need to live in a home for the financial benefits of owning to outweigh the high upfront costs.

Selling a house is expensive. Between realtor commissions, closing costs, and other fees, you can easily spend 8-10% of the home’s value just to sell it. If you buy a home and need to sell it in only one or two years, these transaction costs can wipe out any equity you’ve built and any appreciation you’ve gained, likely resulting in a financial loss.

How to Calculate Your Break-Even Point:

While a precise calculation can be complex, you can get a good estimate using a Rent vs. Buy calculator (many are available for free online from sources like the New York Times or NerdWallet). These tools will ask for inputs like:

- The price of the home you’re considering

- Your expected down payment

- The current mortgage interest rate

- Property tax and homeowner’s insurance estimates

- The equivalent monthly rent for a similar property

- Your expected home appreciation rate

The calculator will then analyze these variables to estimate how many years it will take before the total cost of owning becomes less than the total cost of renting. In many markets, this break-even horizon is between 4 and 7 years. If you aren’t confident you’ll stay in one place for at least that long, renting is almost always the more prudent financial decision.

The Final Verdict: Making the Decision That’s Right for You in 2025

The choice between renting and buying is deeply personal and cannot be answered with a simple formula. It requires an honest assessment of your financial situation, career path, and lifestyle preferences.

You should lean towards buying if:

- You are financially stable: You have a secure job, a solid emergency fund (3-6 months of living expenses), and have saved a down payment of at least 10-20%.

- You plan to stay put: You are confident you will live in the same location for at least 5-7 years, allowing you to ride out short-term market fluctuations and surpass the break-even point.

- You desire stability and control: You want to put down roots in a community, have the freedom to renovate and customize your living space, and value the emotional security of ownership.

- You are prepared for the responsibilities: You are ready and able to handle the costs and labor of home maintenance and repairs.

You should lean towards renting if:

- Your career or life is in flux: You anticipate a possible relocation for a job or personal reasons in the next few years.

- You prioritize flexibility and simplicity: You value the freedom to move easily and prefer not to deal with the hassles of home maintenance.

- You want to maximize your investment returns elsewhere: You believe you can generate greater wealth by investing the money you would have spent on a down payment and maintenance into the stock market.

- You live in a high-cost-of-living area: In some expensive urban markets, the cost of owning is so prohibitive that renting is a significantly more affordable and financially sound option.

Ultimately, the American dream is not about a white picket fence. It’s about financial freedom and personal well-being. Whether that’s achieved through the equity-building power of homeownership or the flexible, opportunity-driven path of renting depends entirely on you.