What is the role of a stock exchange in the economy?

When you hear “stock exchange,” you probably picture the opening bell at the New York Stock Exchange (NYSE), a frantic trading floor, or a green and red ticker scrolling across the bottom of a news channel. It’s easy to dismiss this as a high-stakes casino for Wall Street bankers, a complex game completely disconnected from your day-to-day life.

But what if you were told that this “game” is one of the most critical pieces of infrastructure in our entire economy?

The stock exchange is far more than just a place to trade. It’s an engine. It’s a rule-book. It’s a communication system. It’s the fundamental mechanism that allows companies—from the tech giant that made your phone to the pharmaceutical company that developed a life-saving drug—to be born, to grow, and to create jobs.

This comprehensive guide will demystify the stock exchange. We’ll explore its true, vital roles in the economy, in simple terms, and show you how its performance is directly linked to your job, your retirement savings, and even the interest rate on your next loan.

What Is a Stock Exchange? A Simple Analogy

At its simplest, a stock exchange is a marketplace. It’s not all that different from a farmer’s market or a high-end auction house. But instead of trading apples or art, this marketplace facilitates the buying and selling of securities.

These securities are most commonly “stocks” (also called “shares” or “equity”), which represent a tiny piece of ownership in a public company.

- If you buy one share of Apple ($AAPL), you are not just buying a digital receipt; you are a part-owner of Apple Inc. You own a tiny fraction of its brand, its factories, and its future profits.

The stock exchange (like the NYSE or the NASDAQ) is the central, regulated location where all these “pieces of ownership” are bought and sold in a fair, orderly, and transparent way. It’s the “supermarket for stocks,” where millions of buyers and sellers from all over the world meet every day to agree on a price.

The #1 Role: Fueling Growth as a Capital-Raising Engine

This is the single most important, and most misunderstood, function of a stock exchange. Its primary purpose is not trading; it’s capital formation.

Think of it this way: You have a brilliant idea for a new business, like a local bakery that makes amazing cookies. You use your own savings to open one store. It’s a huge hit. Now, you want to expand and open 50 stores across the country. Where do you get the millions of dollars needed to do that?

You have two main choices:

- Get a Loan (Debt): You can go to a bank. But you’ll have to pay it all back, with interest, whether your expansion succeeds or fails.

- Sell Ownership (Equity): You can find partners and sell them a piece of your bakery’s future. The money they give you is theirs to lose, but if you succeed, you all get rich together.

A stock exchange is the ultimate platform for that second choice. It allows a company to sell small pieces of itself to the public to raise a massive amount of “capital” (cash). This is done through an Initial Public Offering (IPO).

When a company like Rivian (RIVN) wants to build a giant new factory to produce electric trucks, it holds an IPO. It sells shares on the NASDAQ exchange. The money from that sale—billions of dollars—doesn’t go to traders; it goes directly to the company’s bank account.

This cash is the “rocket fuel” for the real economy. It’s used to:

- Build new factories and offices.

- Hire thousands of engineers, marketers, and factory workers.

- Fund years of research and development (R&D) for new products.

- Expand into new international markets.

- Acquire smaller companies to gain new technology.

Without this capital-raising function, industrial innovation would slow to a crawl. We might not have the life-saving biotech drugs, the cloud computing networks, or the advanced software that power our modern world.

Understanding the Primary vs. Secondary Market (The IPO vs. Your Trades)

To understand the exchange’s role, you must know the difference between these two markets. The stock exchange is home to both.

The Primary Market: Where Money Goes to the Company

This is where securities are created. The main event here is the IPO.

- Who trades: The company sells its new shares to large investors (and sometimes the public).

- Where the money goes: Directly to the company’s treasury.

- The Analogy: This is the “new car dealership.” You are buying a brand new 2025 model car directly from the factory. The money goes to the car manufacturer.

This is the “capital formation” role we just discussed. It’s the economic engine.

The Secondary Market: Where Money Goes to Other Investors

This is what you see on the news every day. This is what happens when you open your brokerage account.

- Who trades: You (an investor) buy 10 shares of Apple from someone else (another investor) who already owned them.

- Where the money goes: The money goes from you to the other investor. Apple Inc. does not receive a single penny from this transaction.

- The Analogy: This is the “used car lot.” You are buying a 2019 model car from its previous owner. The money goes to the previous owner, not the car manufacturer.

You might be thinking, “If the company doesn’t get the money, what’s the point? Isn’t it just gambling?” This leads to the exchange’s next critical role.

Creating Liquidity: The “Cash-Out” Function That Makes Investing Possible

The secondary market’s main function is to provide liquidity.

Liquidity is a simple concept: it’s the ability to convert an asset into cash, quickly and at a fair price.

Imagine if you bought a house, but there was a new rule: you could never sell it. You just had to live in it forever. Would you be willing to pay as much for it? Would you even buy it at all? Probably not.

The same is true for investments. Why would any investor buy shares in an IPO (in the primary market) if they had no way to ever sell those shares? They’d be stuck.

The secondary market is the “exit strategy.” It gives investors the confidence to provide the initial capital in the primary market because they know that if they need their money back, they can go to the stock exchange (the secondary market) any business day and sell their shares to someone else.

This liquidity is essential. It’s the “grease” that keeps the “capital engine” (the primary market) running smoothly. A liquid, active, and fair secondary market is the single greatest incentive for investors to risk their capital on new, innovative companies.

How Stock Exchanges Discover a Company’s “True” Value (Price Discovery)

How do we know what a company is “worth”? Is it what the CEO says? Is it what’s written in an old financial report?

The stock exchange provides the answer in real-time. This function is called price discovery.

The price of a stock on an exchange (like $AAPL at $170) is the single point where supply and demand meet. It’s the “equilibrium price” discovered through the actions of millions of people around the world.

- Buyers (Demand): People who believe the company’s future is bright and its stock is worth more than the current price.

- Sellers (Supply): People who believe the company’s future is weak and its stock is worth less (or they just need the cash).

When these millions of “votes” are cast every millisecond in the form of buy and sell orders, the exchange’s high-tech platform finds the “clearing price” that satisfies both sides.

This real-time price tag is vital for the whole economy:

- It tells a company what the world thinks of its performance.

- It allows investors to track the value of their portfolio (like your 401(k)).

- It gives a company a “currency” (its own stock) that it can use to acquire other companies.

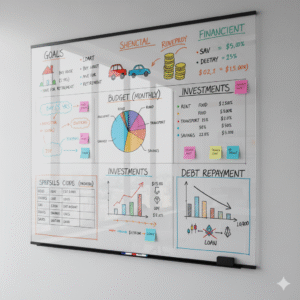

The Market’s Barometer: How Indexes Reflect Economic Health

When a news anchor says “the market is up today,” they are referring to a stock market index (like the S&P 500 or the Dow Jones Industrial Average).

An index is a “basket” of stocks that gives a quick snapshot of the overall market’s performance. The S&P 500, for example, tracks the performance of 500 of the largest and most important U.S. companies.

Because of this, the stock exchange acts as a giant economic barometer, or a “mood ring” for the entire economy.

- If the S&P 500 is rising, it generally means investors are optimistic about the future. They believe companies will be profitable, the economy will grow, and they are willing to buy.

- If the S&P 500 is falling, it means investors are fearful. They may be worried about a recession, inflation, or geopolitical conflict, and they are selling.

The stock market is not the economy. But it is a powerful leading indicator. It reflects what millions of people think will happen to the economy 6-12 months from now. This “investor confidence” signal is watched closely by the Federal Reserve, corporate CEOs, and the government when they make critical economic decisions.

The “Sheriff” of Wall Street: Ensuring Transparency and Regulation

A market only works if people trust it. You wouldn’t buy vegetables from a farmer you knew was selling rotten food. You wouldn’t buy a car from a dealer you knew was rolling back the odometer.

The stock exchange’s most important, and often invisible, role is to be the regulator. It works with government bodies like the Securities and Exchange Commission (SEC) to create and enforce the rules of the game.

This is a massive job that includes:

- Setting Listing Standards: A company can’t just “be on” the NYSE. It must qualify. It must have a minimum market value, a minimum number of shareholders, and a history of operation.

- Enforcing Financial Reporting: The exchange requires all its listed companies to file regular, audited financial reports (like the 10-K and 10-Q). This transparency allows you to look “under the hood” and see if a company is actually profitable before you invest.

- Monitoring for Fraud: The exchanges use sophisticated surveillance technology to watch for illegal activity, like “insider trading” (when an executive trades on secret information) or market manipulation.

This regulatory framework is the bedrock of investor confidence. It’s the “trust” that allows you to put your retirement savings into the market, knowing the game is not (entirely) rigged.

How Does the Stock Exchange Affect Your Daily Life? (The Real-World Impact)

This is where it all comes together. It’s easy to see these functions as abstract, but they have a direct, tangible impact on your personal finances.

1. Your 401(k) and Retirement

If you have a 401(k), an IRA, or any retirement plan, you are almost certainly an investor. The “index funds” in your account hold a basket of the very stocks that trade on the NYSE and NASDAQ. The stock exchange is the “home” where your nest egg grows (or shrinks). Its fairness, liquidity, and stability are directly responsible for your ability to retire.

2. Your Job and Your Company’s Health

The company you work for might be publicly traded. Its ability to give you a raise, invest in new technology for your department, or even avoid layoffs is directly tied to its stock price and its ability to raise capital from the exchange. Even if you work for a small, private business, that business’s customers are likely public companies. The stock market’s health has a “ripple effect” that touches almost every job.

3. The Interest Rates on Your Loans

Remember the “economic barometer” role? The Federal Reserve watches the stock market closely as a signal of economic health and investor confidence.

- If the market is “overheating,” the Fed may raise interest rates to cool things down. This makes your mortgage, car loan, and credit card rates go up.

- If the market is crashing (signaling a recession), the Fed may lower interest rates to stimulate the economy. This makes borrowing cheaper.

4. Consumer Confidence (The “Wealth Effect”)

When the stock market is doing well, people feel wealthier. Their 401(k) statements look good. This “wealth effect” makes them more confident about the future, so they are more willing to spend money on a new car, a home renovation, or a vacation. This spending, in turn, fuels the real economy.

A Pillar of the Modern Economy

The stock exchange is not a casino. It’s a complex and vital piece of economic infrastructure, just like the power grid, the banking system, or the interstate highway network.

It provides the “fuel” for companies to grow, creates the “exit” that encourages investment, sets the “price” that tells us a company’s value, and enforces the “rules” that build our trust.

While the day-to-day noise can be distracting, the stock exchange’s core function is to connect the people who have capital (like you, through your 401(k)) with the companies that need capital to innovate, build, and create the economy of the future.