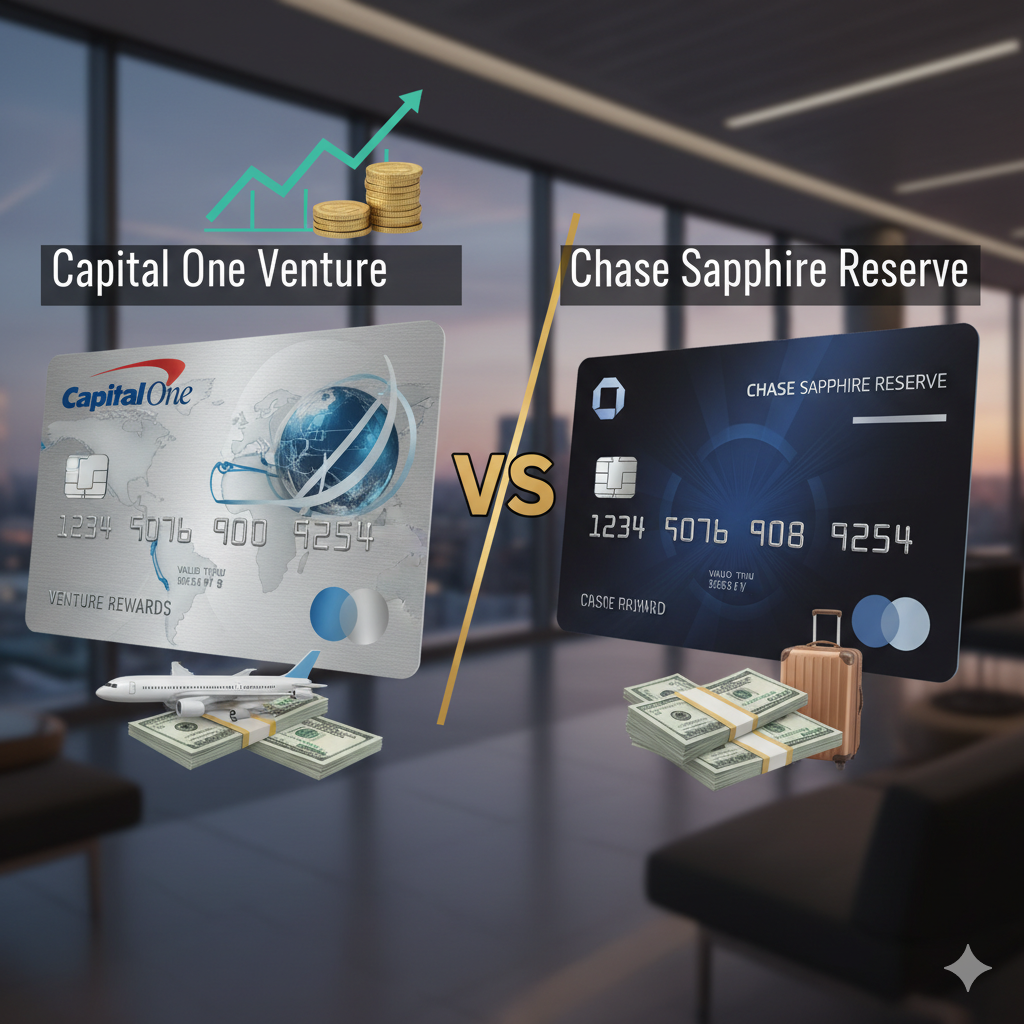

Capital One Venture vs Chase Sapphire: Which Travel Card Fits You Best?

In the bustling world of travel rewards credit cards, two contenders consistently rise to the top for both newcomers and seasoned travelers: the Capital One Venture Rewards Credit Card and the Chase Sapphire Preferred® Card. Both offer the promise of turning everyday spending into exciting travel opportunities, but they cater to different styles of spending and travel planning. Choosing the right one can significantly impact the value you get from your rewards.

This comprehensive guide will break down everything you need to know about these two powerhouse cards. We’ll delve into their rewards structures, redemption options, travel benefits, and hidden perks. By the end, you’ll have a clear understanding of which card is the perfect co-pilot for your travel aspirations.

Decoding the Rewards: A Tale of Two Strategies

At the heart of any great travel card lies its ability to earn rewards. Here, the Capital One Venture and Chase Sapphire Preferred take distinctly different paths. Understanding these earning structures is the first step in determining which card aligns with your spending habits.

Capital One Venture: The Beauty of Simplicity

The Capital One Venture Card is renowned for its straightforward and easy-to-understand rewards program. Cardholders earn a consistent 2 miles per dollar on every purchase, with no categories to track or activate. This simplicity is its greatest strength, making it an excellent choice for those who value a “set it and forget it” approach to earning rewards.

For larger travel-related purchases, the Venture card offers an elevated earning rate of 5 miles per dollar on hotels and rental cars booked through Capital One Travel. This provides a significant boost for those who are comfortable using the issuer’s travel portal.

Chase Sapphire Preferred: Mastering the Bonus Categories

In contrast, the Chase Sapphire Preferred Card employs a bonus category system. This means you’ll earn more rewards in specific spending areas. For those whose budgets heavily feature dining and travel, this card can be incredibly lucrative.

Here’s a breakdown of the Sapphire Preferred’s earning rates:

- 5x points on travel purchased through Chase Ultimate Rewards®

- 3x points on dining at restaurants, including takeout and eligible delivery services

- 3x points on online grocery purchases (excluding Target, Walmart, and wholesale clubs)

- 3x points on select streaming services

- 2x points on all other travel purchases

- 1x point on all other purchases

While this structure requires a bit more strategic thinking to maximize, the potential for earning a high volume of points in common spending categories is substantial.

The True Value of Your Points: Redemption Showdown

Earning rewards is only half the battle; the real value lies in how you redeem them. Both cards offer flexible redemption options, but their approaches and the ultimate worth of your points can differ significantly.

Capital One Venture: Straightforward Redemptions for the Modern Traveler

Capital One miles are incredibly easy to redeem. The most popular option is using them to cover the cost of travel purchases made on your card within the last 90 days. This “Purchase Eraser” feature allows you to book travel however you want—directly with an airline, through a third-party site, or even for things like Uber rides and Airbnb stays—and then redeem your miles for a statement credit at a rate of 1 cent per mile. This flexibility is a major draw for travelers who don’t want to be tied to a specific booking portal.

Additionally, you can book travel directly through the Capital One Travel portal, where your miles are also worth 1 cent each.

Chase Sapphire Preferred: Unlocking Outsized Value with Travel Partners

Chase Ultimate Rewards points also offer a 1 cent per point value when redeemed for cash back or statement credits. However, their true power is unlocked in two key ways:

- Chase Ultimate Rewards® Travel Portal: When you book travel through the Chase portal, your points are worth 25% more, making each point worth 1.25 cents. This is a significant step up in value compared to a simple statement credit.

- Transfer Partners: This is where the Chase Sapphire Preferred truly shines for savvy travelers. Chase has a robust network of airline and hotel transfer partners, allowing you to move your points to these programs at a 1:1 ratio. By leveraging these partners, you can often find award redemptions that offer a value far exceeding 1.25 cents per point. For example, transferring points to a partner airline for a business class flight could yield a value of 5 cents per point or even higher.

Beyond the Points: A Deep Dive into Travel Benefits and Protections

A top-tier travel card offers more than just rewards; it provides peace of mind through a suite of travel benefits and insurance protections. Here’s how the Capital One Venture and Chase Sapphire Preferred stack up in this crucial area.

Annual Fees and Sign-Up Bonuses: The Initial Investment and Return

Both cards typically come with an annual fee of around $95. However, they also offer generous sign-up bonuses for new cardmembers who meet a minimum spending requirement within the first few months. These bonuses can often be worth several hundred dollars in travel, effectively offsetting the annual fee for the first year and beyond. It’s always wise to check for the current offers as they can fluctuate.

Travel Insurance: Your Safety Net on the Road

Chase Sapphire Preferred has long been a leader in this category, offering a comprehensive suite of travel insurance benefits that can be incredibly valuable when the unexpected occurs. These include:

- Primary Auto Rental Collision Damage Waiver: This means you can decline the rental company’s insurance, and your card will be the first in line to cover theft or damage to the vehicle.

- Trip Cancellation/Interruption Insurance: If your trip is cut short or canceled due to a covered reason like sickness or severe weather, you can be reimbursed for prepaid, non-refundable travel expenses.

- Baggage Delay Insurance: If your bags are delayed by a covered amount of time, you can be reimbursed for essential purchases like toiletries and clothing.

- Trip Delay Reimbursement: If your travel is delayed by a covered event, you can be reimbursed for expenses like meals and lodging.

The Capital One Venture Card offers some travel protections as well, including an auto rental collision damage waiver (which is typically secondary coverage) and travel accident insurance. However, it generally does not offer the same breadth of coverage for trip cancellations, interruptions, and delays as the Sapphire Preferred. For frequent travelers who want a robust safety net, the Sapphire Preferred has a clear edge.

Additional Perks and Credits

Both cards offer no foreign transaction fees, a must-have for international travel.

The Chase Sapphire Preferred also provides a $50 annual hotel credit for stays booked through the Chase Ultimate Rewards® portal. This can help to further offset the annual fee.

The Capital One Venture offers a credit of up to $100 for the application fee for either TSA PreCheck® or Global Entry, a valuable perk for frequent flyers.

Maximizing Your Rewards: A Look at Travel Transfer Partners

For those who want to extract the maximum possible value from their points and miles, understanding the transfer partner networks of each card is essential. This is where you can turn your rewards into truly aspirational travel experiences.

Capital One’s Growing Network of Airline and Hotel Partners

Capital One has significantly expanded its list of transfer partners in recent years, making Venture miles more valuable and flexible than ever before. Key airline partners include:

- Air Canada (Aeroplan)

- Air France/KLM (Flying Blue)

- British Airways

- Cathay Pacific

- Etihad Airways

- Singapore Airlines

- Turkish Airlines

- And many more.

Most transfers are at a 1:1 ratio. This growing network allows for strategic redemptions, such as booking international business class flights for a fraction of the cash price.

Chase’s Established and High-Value Transfer Partner Portfolio

Chase Ultimate Rewards has long been a favorite among points and miles enthusiasts due to its high-quality transfer partners. Notable partners include:

- Airlines: United Airlines, Southwest Airlines, British Airways, Air France/KLM, Singapore Airlines, and more.

- Hotels: World of Hyatt, Marriott Bonvoy, and IHG Rewards Club.

The inclusion of domestic carriers like United and Southwest, and the exceptionally high value that can be found by transferring points to World of Hyatt, make the Chase ecosystem incredibly powerful for a wide range of travelers. The ability to top off an airline or hotel account to book an award is a significant advantage.

Who Should Get the Capital One Venture Card?

The Capital One Venture Card is an excellent choice for a few key types of consumers:

- The Simplicity Seeker: If you want to earn a solid, consistent rate of return on all your spending without having to think about bonus categories, the Venture card’s 2x miles on everything is hard to beat.

- The Flexible Booker: For those who prefer to find the best deal on travel and then pay for it with rewards, the Purchase Eraser feature offers unparalleled flexibility.

- The Infrequent Category Spender: If your spending doesn’t align with the Sapphire Preferred’s bonus categories (for example, you don’t dine out frequently or have high grocery bills), the flat 2x earning of the Venture card will likely be more rewarding for you.

Who Should Get the Chase Sapphire Preferred Card?

The Chase Sapphire Preferred Card is ideal for:

- The Strategic Spender: If you spend a significant amount on dining, travel, and online groceries, the bonus categories on this card will allow you to rack up points quickly.

- The Value Maximizer: For those who enjoy the process of finding sweet spots in airline and hotel loyalty programs, the ability to transfer points to high-value partners is a game-changer.

- The Traveler Who Values Protection: The comprehensive travel insurance benefits offered by the Sapphire Preferred provide a level of security that is hard to match in its class. This can save you a significant amount of money and stress if your travels go awry.

Making the Right Choice for Your Wallet and Wanderlust

Ultimately, the “better” card is the one that best complements your individual spending habits and travel style.

Choose the Capital One Venture Rewards Credit Card if you prioritize simplicity, a high flat-rate of earning on all purchases, and the flexibility to redeem miles for any travel expense. It’s a fantastic, low-maintenance option for earning travel rewards.

Opt for the Chase Sapphire Preferred® Card if you are a strategic spender who can take advantage of its lucrative bonus categories, and you’re excited by the prospect of unlocking outsized value through its travel portal and transfer partners. The superior travel insurance benefits also make it a top contender for frequent travelers who want comprehensive protection.

By carefully considering how you spend your money and what you value most in a travel rewards program, you can confidently select the card that will turn your travel dreams into reality.