How Having Less Can Make You Richer

We’ve all been sold a version of the American Dream. It’s a dream filled with more: a bigger house, a newer car, the latest smartphone, and a walk-in closet overflowing with clothes. We’re taught that success is tangible—you can see it, touch it, and park it in your two-car garage.

But what if this dream is actually a financial nightmare in disguise?

Many of us are dutifully accumulating all this “stuff,” only to find ourselves drowning. We’re drowning in clutter, drowning in debt, and drowning in the stress of managing, maintaining, and protecting all the things we’ve worked so hard to buy. We have more possessions than any generation in history, yet we report higher levels of anxiety and financial insecurity.

We’ve confused net worth with self-worth, and possessions with prosperity.

What if I told you the fastest path to building wealth and living a “rich” life isn’t about acquiring more, but about intentionally owning less? This isn’t about deprivation or living in a cold, empty room. It’s about a powerful mindset shift that can permanently fix your finances, buy back your time, and ultimately make you far richer than a house full of junk ever could.

What Does “Being Rich” Really Mean to You?

Before we can talk about getting rich, we have to define the term. For decades, “rich” has been a synonym for “having a lot of stuff.” But this definition is deeply flawed.

Think about it. If you earn $200,000 a year but have a $1.2 million mortgage on a house you barely use, two $800/month car payments, and $30,000 in credit card debt, are you rich? You may look rich to your neighbors, but you’re a slave to your payments. You are “house-poor” and “car-poor.” One missed paycheck, and the whole house of cards collapses.

Now, consider a different scenario. Imagine you earn $80,000 a year. You live in a modest, comfortable home. You own a reliable used car that you paid for in cash. You have zero debt. You have a six-month emergency fund, and you automatically invest 25% of your income every month.

Who is richer?

The second person is, by any real definition. They have what money is supposed to buy:

- Freedom: The ability to quit a job they hate.

- Security: The peace of mind that an emergency (like a medical bill or job loss) is just an inconvenience, not a catastrophe.

- Time: The most finite resource we have.

- Options: The power to choose their own path.

True wealth isn’t about the volume of your possessions. It’s about the abundance of your options. And the hard truth is that every piece of “stuff” you own chisels away at those options.

The Hidden Costs of Clutter: Why “More” Keeps You Poor

The problem with “stuff” is that its price tag is only the admission fee. The real financial drain comes from the hidden, ongoing costs that are never advertised.

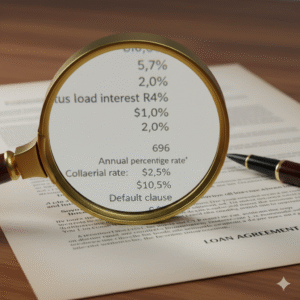

We often only calculate the initial purchase price. We see a boat for $50,000 and think, “Can I afford the monthly payment?” We never ask about the true, total cost of ownership.

Let’s break down the real costs of your possessions.

- The Carrying Cost: This is what it costs you just to have the item.

- Housing: A bigger house means higher property taxes, higher utility bills (heating/cooling), more expensive homeowners insurance, and more rooms to furnish.

- Vehicles: A new luxury car comes with higher insurance premiums, expensive maintenance, premium gas, and rapid depreciation.

- “Stuff”: That collection of expensive gadgets, clothes, or tools? It all needs to be stored (costing you square footage), cleaned, and insured on your homeowners/renters policy.

- The Time Cost: How much of your life does your “stuff” eat?

- You spend weekends cleaning the big house, mowing the big lawn, and organizing the cluttered garage.

- You spend time shopping for new things, researching purchases, and later, trying to sell or donate them.

- You spend time at the mechanic, managing repairs for the complex, expensive car.

- The Mental Cost (Stress & Anxiety):

- Debt Stress: The most obvious one. The “stuff” you bought on credit is a constant, low-level hum of anxiety in the back of your mind.

- Buyer’s Remorse: The sinking feeling after a large, impulsive purchase.

- Clutter Anxiety: Studies show a direct link between cluttered home environments and increased levels of cortisol (the stress hormone).

- Decision Fatigue: Every object you own demands a tiny piece of your attention. What to wear? What to use? Where to put it?

- The Opportunity Cost (The Real Wealth Killer):

This is the most important concept in all of finance, and it’s the #1 reason “stuff” keeps you poor.

Opportunity Cost is what you give up when you choose to do something.

When you buy a $1,000 new TV, you aren’t just “out” $1,000. You are out the $10,000 that $1,000 would have become if you had invested it in a simple S&P 500 index fund for 30 years (at an average 8-10% return).

- That $700/month new car payment isn’t just $700. Over five years, it’s $42,000. If that $42,000 had been invested over that same five years, and then left to grow for another 25… you are looking at hundreds of thousands of dollars in lost net worth.

- That daily $20 food delivery order? It’s not just $20. It’s $600 a month. It’s $7,200 a year. That’s your entire IRA contribution gone, in exchange for lukewarm food in a plastic box.

When you see it this way, you realize your “stuff” is astronomically expensive. You are trading your future freedom for temporary comfort.

Escaping the Hedonic Treadmill: The Psychology of “Enough”

So why do we do this? If “stuff” is so expensive and stressful, why do we keep buying it?

It’s called the Hedonic Treadmill (or “lifestyle inflation”).

It works like this:

- You want a new, fancy Thing. You believe Thing will make you happy.

- You work hard, save (or go into debt), and finally buy Thing.

- You get a short, powerful burst of happiness (dopamine).

- After a few weeks (or days), the newness wears off. Thing is just a normal part of your life.

- Your brain’s “happiness baseline” resets.

- You are now scanning the horizon for the next new Thing that will finally make you happy.

This is why people who get a big raise often feel just as “broke” as they did before, only with a nicer car and a bigger mortgage. Their spending rises exactly in line with their income. They are running faster, but they are still on the same treadmill, in the same place.

“Less” is how you get off the treadmill.

Owning less isn’t about deprivation. It’s about finding your personal “enough” point. It’s about consciously deciding, “This is the line. Everything past this line doesn’t actually add more happiness, it just adds more cost and complexity.”

When you stop trying to “upgrade” your life, you can finally start living it.

Financial Independence: How Minimalism is Your Ultimate Life Hack

There is a growing movement of people who have cracked this code. It’s called the FIRE (Financial Independence, Retire Early) movement. And its core principle is simple minimalism.

The most important number for building wealth is not your income. It’s your savings rate (the percentage of your income you save and invest).

- If you save 10% of your income, you must work for 9 years to save for 1 year of living expenses.

- If you save 50% of your income, you work for 1 year to save for 1 year of living expenses.

- If you save 75% of your income, you work for 1 year to save for 3 years of living expenses.

How do you dramatically increase your savings rate without a massive raise? You attack your expenses. You learn to live on less.

By intentionally owning less, you are not just saving a few bucks. You are buying your freedom.

- Less “stuff” = Lower expenses.

- Lower expenses = A much higher savings rate.

- A higher savings rate = You reach Financial Independence (the point where your investments can pay for your lifestyle) in decades less time.

A person who adopts a “less is more” mindset might reach FI in 10-15 years. The person on the hedonic treadmill will never reach it, no matter how high their salary gets.

“But I’m Not a Minimalist”: Practical Steps to Start Owning Less

Okay, this all sounds good in theory. But how do you apply it without moving into a tiny home and selling all your possessions?

This is not an all-or-nothing proposition. It’s a spectrum. The goal is to move from mindless consumption to intentional ownership.

1. Stop the Inflow: The 30-Day Rule

The most important step isn’t decluttering. It’s stopping the flow of new stuff. For any non-essential purchase over a set amount (say, $50), put it on a 30-day list. If you still truly want and need it 30 days later, you can consider buying it. 90% of the time, the impulse will have vanished.

2. Audit Your Subscriptions (The “Digital Clutter”)

Your $14.99/month subscriptions are the “death by a thousand cuts” for your budget. Go through your bank statement. Do you really need all five streaming services? The three app subscriptions? The “pro” level account you never use? Cancel them. This is the easiest, fastest “win” you can get.

3. Declutter and Invest the Profit

Now you can tackle the stuff you already have. Go through your closet, garage, and attic. For everything you haven’t used in a year, sell it. Take that money—$100, $500, $2,000—and immediately transfer it to your IRA or brokerage account. Don’t “reward” yourself with more stuff. Reward yourself with freedom.

4. The “One-In, One-Out” Rule

To maintain your new, simpler life, adopt this rule. If you buy a new pair of shoes, one old pair must be donated or thrown out. This forces you to be intentional about every new item that enters your home.

5. Shift Your Mindset: From “Can I Afford This?” to “Is This Worth It?”

“Can I afford this?” is a dangerous question. With credit cards and payment plans, the answer is almost always “yes.”

A better question is, “Is this item worth the 5 hours of my life I had to work to pay for it?”

Or, “Is this item worth the $5,000 in future wealth I’m giving up by not investing this money instead?”

Downsizing Your Biggest Expenses: The “Big 3” of Wealth

If you really want to turbo-charge your wealth, you can’t just focus on lattes and subscriptions. You have to apply the “less is more” principle to the “Big 3” expenses that consume 70% or more of the average American’s budget.

1. Housing:

The “American Dream” house is the #1 wealth-killer. People buy the biggest house they can “afford,” locking themselves into 30 years of massive payments. By choosing “less” here—a smaller, more efficient home, a condo, or even renting in a high-cost area—you can free up thousands of dollars a month. That difference, invested over 30 years, is literally millions of dollars.

2. Transportation:

The average new car payment is over $700. This is an anchor. The “less is more” approach is to buy a high-quality, reliable used car and pay cash. Then, drive it for 10+ years. The money you save on payments, full-coverage insurance, and personal property tax can fully fund your retirement accounts.

3. Food:

We are drowning in food delivery apps and convenience. By planning your meals, cooking at home, and being intentional about your “food waste,” you can easily save $500-$1,000 per person every month.

Redefining Your American Dream: From Ownership to Access

Here’s the final, powerful idea: We are moving into an “access economy.” You don’t need to own everything to experience it.

- You don’t need to own a boat (and its endless costs). You can rent one for the two days a year you actually want to use it.

- You don’t need to own a vacation home. You can rent an amazing Airbnb anywhere in the world.

- You don’t need to own a drill you’ll use once. You can borrow one from a friend or rent it from a hardware store.

By shifting your mindset from ownership to access, you get 100% of the experience with 1% of the cost and 0% of the long-term hassle.

The Richest Person Has the Most Options

In the end, “rich” is not a number in a bank account. It’s a feeling. It’s the feeling of waking up without a pit of financial dread in your stomach. It’s the freedom to choose work you love, not work you need just to pay for your possessions. It’s the ability to shrug off a financial emergency.

The “stuff” we buy to project an image of wealth is the very thing that prevents us from achieving it.

This isn’t a call to sell everything you own. It’s a call to be a ruthless, intentional gatekeeper. Question everything you let into your life. Does this add value? Or does it just add cost?

By owning less, you are not depriving yourself. You are making the single greatest trade in history: You are trading meaningless possessions for a meaningful life. You are trading clutter for clarity. And you are trading short-term consumption for long-term, generational wealth.