How Investors Make Stock Prices Go Up and Down

If you’re new to investing, the stock market can feel like a chaotic, blinking mystery. You watch a company’s ticker symbol on TV, and the price ticks up… down… up again… all in a matter of seconds. It’s tempting to think there’s a complex, secret formula or a “big button” in New York City that controls it all.

The truth is both simpler and more complex.

A stock’s price is not set by a committee, a bank, or the company itself. It is set by you—and millions of other investors, all making individual decisions at the same time.

At its core, the stock market is simply the world’s largest, fastest-moving auction. Every single price change, from a fraction of a cent to a 20% crash, is the direct result of one simple, timeless principle: supply and demand.

Understanding this “tug-of-war” is the first and most important step to becoming an intelligent investor. This guide will break down exactly how investors’ actions drive prices up and down, and what it means for your long-term financial plan.

The Absolute Core Principle: A Market of Buyers and Sellers

Forget about stocks for a second. Imagine you are at a giant flea market with 1,000 copies of a rare comic book.

- If 5,000 people show up all wanting to buy that comic book (high demand, low supply), the sellers can charge a very high price.

- If only 10 people show up (low demand, high supply), sellers will have to slash their prices to get anyone to buy.

The stock market works the exact same way, just on a global, digital scale.

Every stock has a supply (shares available for sale) and demand (investors who want to buy). This is represented by two key numbers you’ll see in any brokerage account:

- The “Bid” Price: This is the highest price a buyer in the market is currently willing to pay for a share.

- The “Ask” Price: This is the lowest price a seller in the market is currently willing to accept for a share.

A “trade” only happens when a buyer and seller agree on a price. This is called the “market price.” It’s the most recent price at which the stock was bought and sold.

- When buyers are more eager than sellers (Demand > Supply): Buyers have to raise their “bid” price to tempt sellers to sell. The price goes up.

- When sellers are more eager than buyers (Supply > Demand): Sellers have to lower their “ask” price to tempt buyers to buy. The price goes down.

So, the real question isn’t how the price moves, but WHY millions of people suddenly become more eager to buy or sell at the same time. The answer is based on their collective belief about the company’s future value.

What Makes More People Want to Buy? (Factors That Drive Prices Up)

When a stock’s price rises, it means that, on balance, the market’s investors believe the company will be more valuable in the future than it is today. This optimism (high demand) can come from many sources.

1. The Earnings Report: A Company’s “Report Card”

This is the single most important event for most stocks. Four times a year (every “quarter”), a public company is legally required to release an “earnings report.” This report tells investors exactly how the business is doing.

If a company reports:

- Higher-than-expected profits (an “earnings beat”)

- Growing revenue (more sales)

- Positive “forward guidance” (management says the next quarter looks great)

…investors get excited. They believe the company is succeeding and will be worth more. Buyers rush in, willing to pay a higher price, and current sellers hold onto their shares, raising their “ask” price. Demand swamps supply, and the price shoots up.

2. Good News & Positive Developments

Investors are constantly scanning for news that signals a company’s future is bright.

- A New Hit Product: Think of Apple launching the original iPhone. The news created a massive new wave of demand for the stock as investors realized the company’s profit potential had just exploded.

- A Major New Contract: A construction company ($CAT) that wins a $10 billion government infrastructure contract.

- A Successful Drug Trial: A pharmaceutical company ($PFE) whose new drug is approved by the FDA.

- A Merger or Acquisition (M&A): If Company A ($GOOG) announces it’s buying Company B, the stock price for Company B will almost always jump instantly to meet the agreed-upon sale price.

3. Favorable Economic Conditions (Macroeconomics)

Sometimes, a stock’s price rises for reasons that have nothing to do with the company itself. The whole “ocean” of the market rises, lifting all the boats.

- The Fed Lowers Interest Rates: This is a big one. When the Federal Reserve cuts rates, it’s cheaper for businesses to borrow money to grow. It also makes “safe” investments like savings accounts and bonds less attractive (they pay less interest). This “forces” investors to move their money into the stock market to find a decent return. This is the “TINA” principle: There Is No Alternative to stocks.

- Strong Economic Growth: Low unemployment and high consumer spending mean people are buying more products, which is good for almost all businesses.

4. Analyst Upgrades and Investor Hype

- Wall Street Upgrades: When a major investment bank like Goldman Sachs or J.P. Morgan upgrades a stock from “Hold” to “Strong Buy,” it’s a powerful signal that influences thousands of investors.

- Social Media & FOMO: Sometimes, a stock just becomes popular. Driven by social media (like the Reddit/GameStop phenomenon) or general media hype, people buy simply because they see it going up and have a Fear Of Missing Out (FOMO). This is “herd mentality” and can create dangerous bubbles.

What Makes More People Want to Sell? (Factors That Drive Prices Down)

When a stock’s price falls, it means the market’s collective belief has turned negative. Investors fear the company will be less valuable in the future than it is today. This pessimism (high supply) is the flip side of the coin.

1. A Bad Earnings Report

This is the fastest way to sink a stock. If a company reports:

- Lower-than-expected profits (an “earnings miss”)

- Declining revenue (fewer sales)

- Negative “forward guidance” (management warns the next quarter looks bad)

…investors panic. They believe the company is failing. Sellers rush to the “exit” (the “ask” button), willing to accept lower and lower prices just to get rid of their shares. Buyers step aside, lowering their “bid” price. Supply swamps demand, and the price plunges.

2. Bad News & Negative Developments

- A Product Flop or Recall: A new product that fails, or a recall that costs the company billions.

- A CEO Scandal or Departure: A beloved, visionary CEO (like Steve Jobs) leaving can create massive uncertainty.

- A Lawsuit or Government Regulation: A company getting sued, or the government announcing new rules that will hurt its business model.

- A Data Breach: A tech or finance company that loses millions of customers’ data, destroying trust and costing a fortune in fines.

3. Unfavorable Economic Conditions

This is what causes a “bear market” or a full-blown market crash.

- The Fed Raises Interest Rates: This is the market’s “brake pedal.” To fight inflation, the Fed raises rates. This makes it more expensive for businesses to borrow and grow. Worse, it makes “safe” investments (like a 5% U.S. Treasury bond) look very attractive compared to the risk of stocks. Investors sell stocks to buy bonds, and prices fall.

- Recession Fears: High unemployment and low consumer spending mean fewer sales, which is bad for business profits.

4. Analyst Downgrades and Market Panic

- Wall Street Downgrades: A “Sell” rating from a major analyst can trigger a wave of automated selling from large funds.

- General Panic: Sometimes, fear itself is the only driver. During the 2008 financial crisis or the 2020 pandemic crash, people sold everything—good companies and bad—in a desperate dash for the “safest” asset: cash.

Does Your $100 Trade Really Change the Price of Apple?

This is a critical question for beginners. When you buy $100 of Apple ($AAPL), a company worth trillions, does its price move?

No. But you are part of the “ocean” of demand.

The market is made of two types of investors:

- Retail Investors: This is you. We are the “minnows.” Our individual trades are tiny and are simply “filled” at the current market price by a market maker. Our collective action, however, can be powerful (as seen with “meme stocks”).

- Institutional Investors: These are the “whales.” This includes pension funds, mutual funds, hedge funds, and insurance companies. They trade in “blocks” of millions or even billions of dollars.

When a giant mutual fund decides to sell its entire $500 million position in a stock, that single action can create a massive wave of supply and visibly push the price down.

This is also why a company’s own stock buyback can raise its price. When Apple itself decides to buy $20 billion of its own stock, it is acting as a giant, consistent buyer, reducing the total supply of shares and helping to support the price.

The Psychology of Price: How Fear and Greed Drive the Market

Ultimately, the “beliefs” that drive supply and demand are not always rational. They are often pure, raw human emotion. This is the “animal spirits” of the market.

- Greed & FOMO: When a stock is rising, investors see others getting rich. They abandon their research and buy the stock only because it is going up, hoping to sell it to someone else (a “greater fool”) at a higher price. This is what creates market bubbles.

- Fear & Panic: When a stock is falling, investors see their money disappearing. They sell only because it is going down, fearing it will go to zero. This is what causes a market crash to “overshoot,” pushing prices of great companies far below their true, long-term value.

Warren Buffett famously described this with his “Mr. Market” parable. The market is like a manic-depressive partner. Some days he’s wildly optimistic and will offer you a crazy high price for your shares. Other days he’s in a deep depression and will offer to sell you his shares for pennies.

An intelligent investor doesn’t get swept up in Mr. Market’s mood. They use it. They ignore the “price” (the daily noise) and focus on the “value” (the company’s long-term business health).

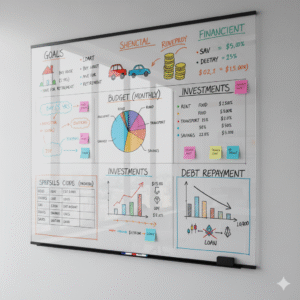

What This Means for You as a Long-Term Investor

As a beginner, it is tempting to try and “play this game”—to watch the news, guess the earnings, and trade in and out. This is called trading, and it is extraordinarily difficult and high-risk. Most people who try it lose money.

A long-term investor plays a different game.

Your strategy is to ignore the daily tug-of-war. Your goal is not to guess tomorrow’s price but to buy a piece of a great, growing business (or a “basket” of them) and hold it for decades.

By far the best way to do this is to buy a low-cost index fund, like an S&P 500 ETF. This “basket” holds 500 of the largest U.S. companies. You are instantly diversified. You own all the winners and losers.

When you do this, you no longer have to worry about one company’s bad earnings report or a CEO scandal. You are betting on the long-term success of the entire American economy. You let the daily “price” noise fade into the background, confident that the long-term “value” of human innovation and corporate earnings will rise over time, taking your portfolio with it.