How to Avoid Debt While Using Travel Credit Cards

Travel credit cards are one of the most alluring financial tools on the market. They promise a world of adventure—free flights, luxurious hotel stays, and VIP airport experiences—all funded by your everyday spending. The marketing is brilliant, painting a picture of effortless rewards. Yet, for many, this dream can quietly morph into a nightmare of high-interest debt that grounds travel plans indefinitely.

The truth is, the incredible perks of these cards are funded by a business model that relies on interest payments and fees. The key to winning this game is to reap all the rewards without paying a single dollar in interest. It’s a discipline, a mindset, and a strategy. This comprehensive guide will provide you with the essential blueprint for leveraging travel credit cards to see the world, not the inside of a debt cycle. We’ll explore the psychological traps, the practical habits, and the unwavering rules you must follow to ensure your points-and-miles journey is one of financial empowerment, not regret.

The Golden Rule of Rewards Cards: Your Foundation for Debt-Free Travel

Before we dive into any complex strategy, we must establish the single most important principle of using travel credit cards. It is the bedrock upon which all success is built, and it is non-negotiable: Always, without exception, pay your statement balance in full every single month.

Think of your credit card not as a tool for borrowing, but as a debit card with a delay and rewards. It is a payment method, not a loan. The moment you carry a balance from one month to the next, you start accruing interest. The annual percentage rates (APRs) on travel rewards cards are notoriously high, often soaring above 20% or even 25%. No sign-up bonus, no point multiplier, and no free flight can ever mathematically outweigh the cost of that kind of interest.

Let’s illustrate with a simple example. Suppose you charge a $2,000 flight to your new travel card to meet a sign-up bonus, but you only make the minimum payment. At a 22% APR, it could take you years to pay off that flight, and you could end up paying hundreds, if not thousands, of dollars in interest. The “free” trip you earned with your bonus points suddenly becomes one of the most expensive vacations you’ve ever taken. Make a pact with yourself right now: if you cannot pay the balance in full by the due date, the purchase does not go on the card.

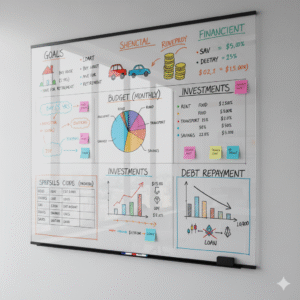

Budgeting Before Booking: How to Create a Travel-Specific Financial Plan

The allure of “buy now, pay later” is a significant trap. The most effective way to avoid this pitfall is to have the cash on hand before you make the purchase. This is where a dedicated travel budget, often called a “sinking fund,” becomes your most powerful ally.

A sinking fund is a savings account created for a specific, planned expense—in this case, travel. Here’s how to implement it:

- Define Your Travel Goal: Where do you want to go, and what is the estimated cost? Be realistic. Research flight prices, accommodation costs, and daily expenses. Let’s say your dream trip to Italy will cost $4,000.

- Set a Timeline: When do you want to take this trip? Let’s say your goal is in 10 months.

- Do the Math: Divide the total cost by your timeline. In our example, $4,000 / 10 months = $400 per month.

- Automate Your Savings: Set up an automatic transfer of $400 from your primary checking account to a separate, high-yield savings account each month. This automation is crucial. It treats your travel savings as a non-negotiable bill, just like rent or a car payment.

Now, when it’s time to book your flight or hotel, you have the $4,000 in cash sitting in your savings account. You can confidently charge the expenses to your travel credit card to earn the points, and then immediately transfer the money from your travel fund to your checking account to pay off the credit card bill in full when it arrives. This strategy allows you to earn rewards on purchases you’ve already saved for, completely eliminating the risk of debt.

Decoding the Rewards Game: Avoid Overspending in Pursuit of Points

Travel credit cards are masterfully designed to encourage spending. Bonus categories, tiered rewards, and limited-time offers can create a sense of urgency, leading to what’s known as “rewards-driven overspending.” This is the act of buying things you don’t need simply to earn more points.

Here are key strategies to stay focused and avoid this common trap:

- Focus on Your Natural Spending: The best rewards card for you is one that aligns with your existing budget. If you spend a lot on groceries and gas, a card that rewards those categories might be better than a premium travel card that only offers high multipliers on travel and dining. Don’t change your spending habits to fit the card; choose a card that fits your life.

- Ignore the Hype: You will be bombarded with emails and app notifications about “exclusive 5x point offers” at stores you never shop at. Recognize this for what it is: a marketing tactic. Buying a $100 item you don’t need to earn 500 points (worth about $5-$10) is not a winning financial move.

- Understand Diminishing Returns: Chasing the last few points for a specific status or bonus tier is often not worth the cost. Be content with the rewards you earn through your regular, budgeted spending.

The goal is to get a rebate on your life, not to inflate your lifestyle for a rebate.

The Psychology of the Sign-Up Bonus: How to Earn It Responsibly

The sign-up bonus is the most powerful magnet for new card applicants. Offers of 60,000, 80,000, or even 100,000 bonus points after spending a certain amount (e.g., $4,000 in the first three months) can be incredibly tempting. While these bonuses are the fastest way to accumulate a large number of points, they are also one of the biggest potential debt traps.

Before you apply for a card with a large sign-up bonus, you must have a concrete plan to meet the minimum spending requirement without manufacturing expenses or going into debt.

Good ways to meet the spend:

- Time it with a Large, Planned Purchase: Are you buying new appliances, paying a tuition bill, or booking a major vacation (that you’ve already saved for)? Time your card application so this large, budgeted expense can be used to meet the requirement.

- Prepay Regular Bills: Can you prepay your car insurance, phone bill, or streaming services for the next few months?

- Channel All Household Spending: For three months, make sure every single budgeted expense—from groceries and gas to utilities and dinners out—goes on that one card until the threshold is met.

Bad ways to meet the spend:

- Buying things you don’t need: This is the most common mistake. Don’t wander the aisles of Target looking for things to buy.

- Using payment services that charge fees: Services that let you pay rent or mortgages with a credit card often charge a 3% fee, which can negate the value of the rewards.

- Treating the spending requirement as a license to splurge: This is a recipe for a massive, interest-accruing balance that will haunt you long after the bonus points are gone.

Annual Fees and Automation: Your Final Checklist for Debt-Free Success

Finally, managing the logistics of your cards is crucial. Two areas can trip people up: annual fees and payment schedules.

The Annual Fee Analysis: Many top-tier travel cards come with annual fees ranging from $95 to nearly $700. Just like the sign-up bonus, you need a plan. Before your annual fee posts each year, perform a “value check.” Add up the value of the benefits you actually used in the past year—travel credits, lounge access, free night certificates, etc. If the value you received is significantly more than the annual fee, keep the card. If not, don’t be afraid to call the bank to downgrade to a no-fee card. Paying a high annual fee for benefits you don’t use is a slow financial drain.

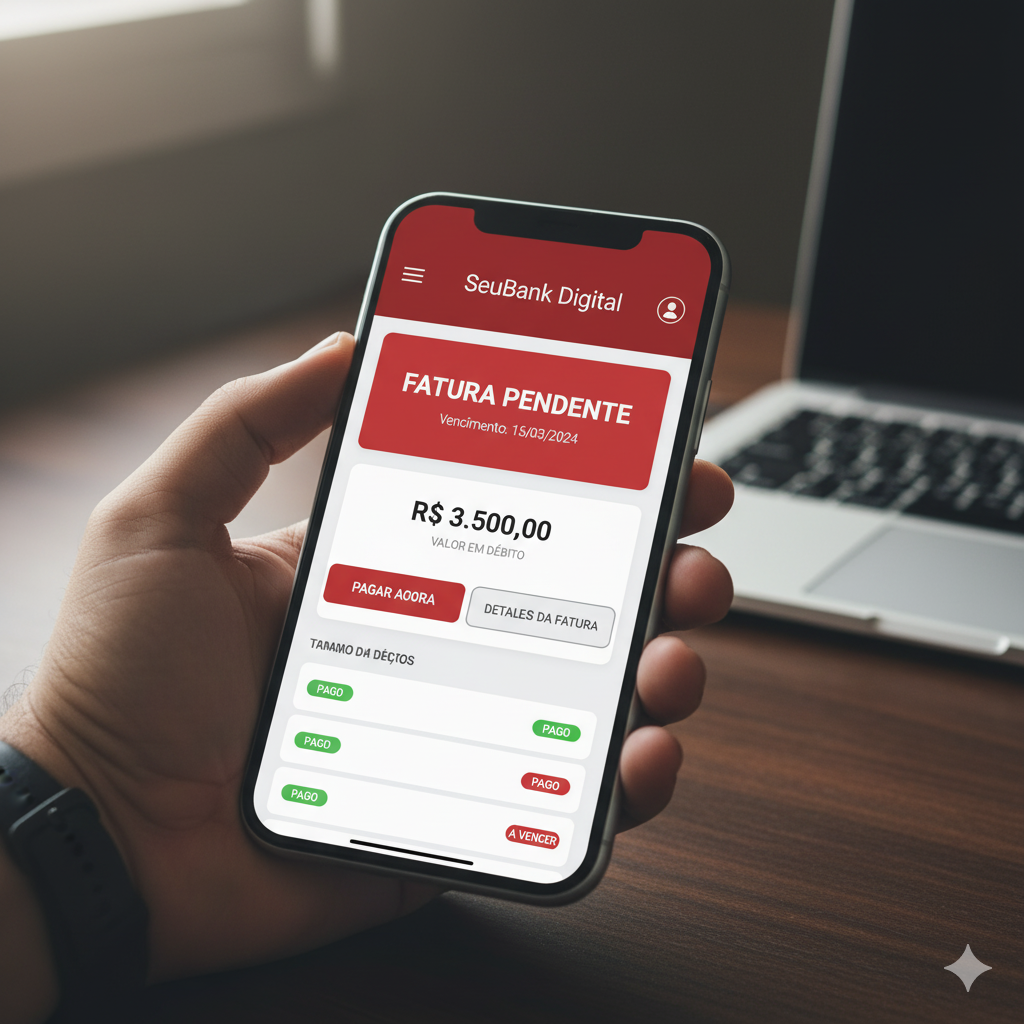

Set Up Autopay… The Right Way: Automating your payments is the best way to ensure you never miss a due date and incur late fees. However, there’s a right and a wrong way to do it.

- The Wrong Way: Setting up autopay for the “minimum payment due.” This is a direct path to carrying a balance and paying interest.

- The Right Way: Setting up autopay for the “statement balance.” This ensures the full amount you charged is paid off every month, keeping your account at a $0 balance and preventing any interest from ever accruing.

By embracing these disciplined habits—paying in full, budgeting first, spending naturally, and planning strategically—you can transform travel credit cards from a potential liability into a powerful asset. You can enjoy the incredible perks of the travel rewards world, secure in the knowledge that your journey is being funded by smart financial decisions, not by debt.