How to create an emergency fund in 30 days

Life doesn’t care about your budget.

It doesn’t wait until you’re “ready” to throw a $900 car repair, an unexpected $1,200 medical bill, or a sudden job loss your way. For millions of Americans living paycheck-to-paycheck, that one “life happens” moment is the only thing standing between financial stability and a spiral of high-interest credit card debt.

The anxiety of living with no safety net is exhausting.

What if you could change that? What if, in just 30 days, you could build a cash buffer that breaks this cycle? A buffer that lets you sleep at night, knowing that when life punches, you can take the hit.

This isn’t a long-term, “save $50 a month for five years” marathon. This is a 30-day financial sprint. It will be intense. It will require focus and temporary sacrifice. But at the end of this sprint, you will have the single most powerful tool in all of personal finance: an emergency fund.

This guide is your step-by-step plan. We’re not just going to talk about it; we’re going to do it.

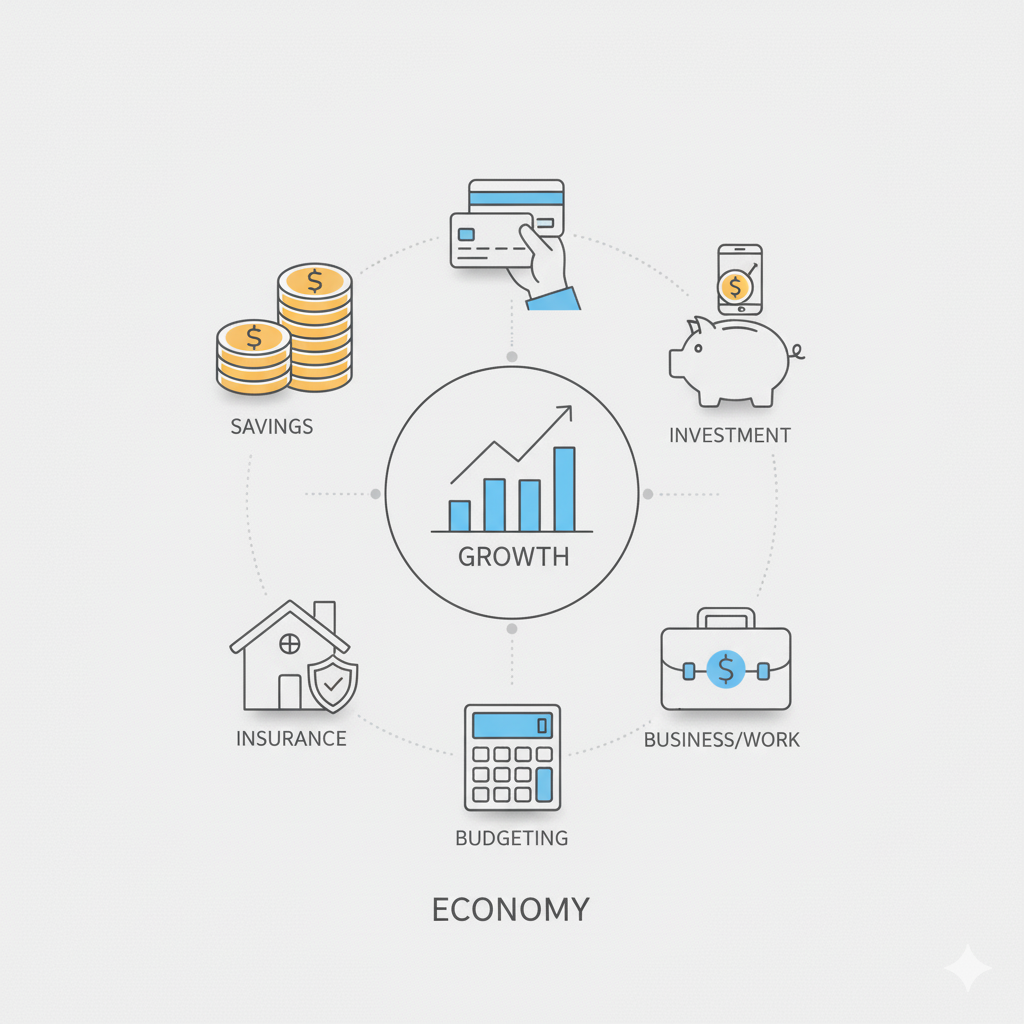

What Is an Emergency Fund and Why Do You Need One, Yesterday?

Before we sprint, we need to know our destination. An emergency fund is not an investment. It is not a vacation fund. It is not a “new car” fund.

An emergency fund is a stash of liquid cash (typically held in a separate savings account) with one job: to pay for large, unexpected, and necessary expenses.

Think of it as financial insurance that you pay to yourself. It’s the wall that stands between you and high-interest debt.

- When your car’s transmission fails, you use the emergency fund, not a 24% APR credit card.

- When your air conditioner dies in July, you use the emergency fund, not a payday loan.

- When you lose your job, you use the emergency fund to pay your rent, not to sell your investments at a loss.

Without this fund, you are always playing defense, one small emergency away from a crisis. With it, you take back control. It is the non-negotiable, foundational first step to building any real, long-term wealth.

How to Set a Realistic ’30-Day Sprint’ Financial Goal

Let’s be clear: A “fully-funded” emergency fund is typically 3 to 6 months of your essential living expenses. For most people, that’s $10,000, $20,000, or more.

You are not going to save that much in 30 days. And that’s okay.

Our 30-day sprint has a different, more immediate goal: building a “starter emergency fund.”

The most popular and effective target for a starter fund is $1,000.

Why $1,000? Because it’s a meaningful, achievable number. It’s not enough to cover a job loss, but it is enough to stop 90% of life’s “hiccups” from becoming disasters.

- $1,000 covers the average car insurance deductible.

- $1,000 covers most emergency room co-pays.

- $1,000 covers a new set of tires, a plumbing emergency, or an urgent flight.

This $1,000 “Baby Step 1,” as finance expert Dave Ramsey calls it, is the buffer that gives you the breathing room to start tackling your other financial goals (like paying off debt) without getting derailed.

Your 30-day goal is clear: Save $1,000 in 30 days. That’s an average of $33.33 every single day. Write this goal down. Tape it to your bathroom mirror. Make it your singular focus.

Where Should You Keep Your Emergency Fund for Safety and Access?

This is a critical step that many people get wrong. This money has two requirements: it must be 100% safe (no risk of losing it) and liquid (you can get to it in a day or two).

The WRONG Places to Keep It:

- Your regular checking account: It’s far too easy to accidentally spend it. This money must be separate.

- The stock market (or an investment account): This is not an investment. What if your emergency happens during a market crash? Your $1,000 could be worth $700, and you’d be forced to sell at a loss.

- Under your mattress: It’s not safe, and it’s earning 0%, meaning it’s losing purchasing power to inflation.

The RIGHT Place: A High-Yield Savings Account (HYSA)

This is the perfect tool for the job.

- What it is: An HYSA is a savings account, almost always from an online bank.

- Why it’s better: Because online banks don’t have the overhead of physical branches, they pay you much higher interest rates (often 40-50x more) than your brick-and-mortar bank’s 0.1% savings account.

- Is it safe? Yes. As long as it is FDIC-insured, your money is protected by the federal government up to $250,000.

Your Action Plan (Do This Today):

- Go online and open an HYSA. It takes about 10 minutes.

- Choose a bank that is different from your regular checking account. This “friction” makes it harder to dip into for non-emergencies.

- Nickname your new account. Don’t just call it “Savings.” Call it “Freedom Fund,” “Peace of Mind,” or “Do Not Touch.” This is a powerful psychological trick.

Part 1: How to Drastically Cut Your Spending for 30 Days (The ‘Financial Lockdown’)

You cannot reach a $1,000 goal in 30 days by “cutting back a little.” This is a sprint. You need to go on a temporary “financial lockdown.”

Remember: This is not forever. This is for 30 days. You are trading short-term comfort for long-term security.

1. Annihilate Your Food Budget (The #1 Leak)

This is the biggest and fastest win for most people. For 30 days, you will adopt two new rules:

- Rule #1: No Restaurants. Period. This includes drive-thrus, $7 lattes, and food delivery apps (delete them from your phone right now).

- Rule #2: You Are a Grocery Store Master. Go to the store with a list, a calculator, and a plan. Buy staples: rice, beans, oats, eggs, pasta. Buy generic. Cook all your meals at home. Brown-bag your lunch every single day.

- Bonus Challenge: Do a “pantry challenge” for the first week. Try to cook only with food you already have in your freezer, fridge, and pantry.

Potential 30-Day Savings: $250 – $600

2. Go on a “Subscription Fast”

We all have a “death by 1,000 cuts” from recurring subscriptions.

- The Action: Open your credit card and bank statements. Find every recurring charge.

- For 30 days, CANCEL IT ALL.

- Streaming services (Netflix, Hulu, Disney+, Spotify, etc. Pick one if you must, or use free options like your library’s app).

- Gym memberships (Do bodyweight exercises at home or run outside for free).

- Subscription boxes (clothes, coffee, snacks).

- Software you don’t use for work (apps, cloud storage, etc.).

You can always resubscribe in 31 days if you genuinely miss it. You probably won’t.

Potential 30-Day Savings: $50 – $150

3. Enforce a “No-Spend” Challenge

For 30 days, you will stop all non-essential spending.

- No new clothes.

- No new video games or electronics.

- No impulse buys from Amazon.

- No home decor, concerts, or movies (find free entertainment at the library or a park).

Before every single purchase, ask yourself one question: “Is this a want or a need?” If it’s a want, the answer is no. Not forever. Just for 30 days.

Potential 30-Day Savings: $100 – $400

4. Pause Everything Else

- Pause other savings goals: Are you auto-saving for a vacation or a new car? Pause it. For 30 days, 100% of your savings “firepower” goes to this one goal. (The only exception is your 401(k) match—never give up free money).

- Call your providers: Call your cell phone, car insurance, and cable/internet providers. Tell them you’re thinking of switching and ask if there’s a “promotional rate” you can have. This 15-minute call can often save you $20-$50.

Part 2: How to Aggressively Increase Your Income (The ‘Offense’ Strategy)

You can’t save money you don’t have. Cutting expenses is your defense, but to win in 30 days, you need a powerful offense. You need to find new money.

1. Sell. Your. Stuff. (The Fastest Cash)

This is the #1 way to get a huge chunk of your $1,000 goal in one weekend.

- The Action: Go through your house, room by room, with a box.

- What to Sell:

- Electronics: Old video game consoles, old phones, laptops, tablets.

- Clothes: Designer items or good-condition clothes on Poshmark or Mercari.

- Furniture: That chair in the corner, the extra bookshelf, the “starter” furniture you’ve upgraded.

- Hobby Gear: Old sports equipment, musical instruments you don’t play.

- Kid’s Stuff: Strollers, clothes, and toys your kids have outgrown.

- Where to Sell: Facebook Marketplace, eBay, Poshmark, Craigslist.

- Pro-Tip: Price it to sell, not to get the “best” price. Your goal is speed and cash, not to run a long-term business. A fast $50 is better than a “maybe” $75 that sits for three weeks.

Potential 30-Day Earnings: $200 – $800

2. Join the Gig Economy (Your ‘Sprint’ Job)

For 30 days, you are trading your free time for financial security.

- Drive & Deliver: Sign up for Uber, Lyft, DoorDash, or Instacart. Even 10-15 extra hours a week can generate a few hundred dollars.

- Get Your Hands Dirty: Use your local network or apps like TaskRabbit.

- Dog walking or pet sitting (Rover)

- Babysitting

- Mowing lawns / yard work

- Helping someone move

- Use Your Skills: If you have a professional skill, go on Upwork or Fiverr and look for short, quick gigs.

- Freelance writing or editing

- Graphic design

- Virtual assistant tasks

- Tutoring

Potential 30-Day Earnings: $150 – $500

3. Your Current Job and “Found” Money

- Overtime: Can you pick up any extra shifts at your 9-to-5? This is the most reliable “extra” money.

- The Windfall Rule: For this 30-day sprint, any “found” money is not “fun” money. It is “fund” money.

- Tax refund? Straight to the fund.

- Rebate check? Straight to the fund.

- $50 from your grandma for your birthday? Straight to the fund.

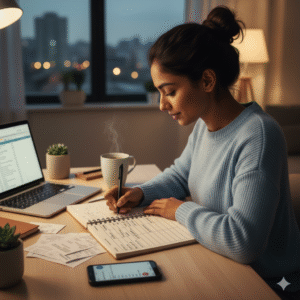

How to Track Your 30-Day Progress and Stay Motivated

This sprint is all about psychology. You need to stay motivated.

- Get Visual: Get a piece of paper and draw a “savings thermometer.” Mark it from $0 to $1,000. Every time you deposit money into your HYSA, color it in. Tape this on your fridge where you will see it every day.

- Get Addicted to the Balance: Log into your new HYSA every single morning. Watch the number go up. This creates a positive feedback loop that makes you want to sell one more item or skip one more latte.

- Get an Accountability Partner: Tell one person (a spouse, a best friend) what you’re doing. “I am on a 30-day sprint to save $1,000 for my emergency fund. My goal is to protect our family from debt.” This makes it real.

What Happens After Day 30? (From a Sprint to a Marathon)

You did it. You sprinted, you sacrificed, and you won. Your HYSA now has $1,000 in it. The immediate danger has passed.

First: Celebrate. (With a free activity, like a hike or a movie night at home). Acknowledge the hard work and the peace of mind you’ve just bought yourself.

Second: Do NOT stop.

You’ve built your “Baby Step 1.” The sprint is over. Now, the marathon begins. Your new goal is to build that full 3-to-6-month emergency fund.

But your strategy changes. You can’t live on a “financial lockdown” forever. You need a sustainable plan.

- Automate It: This is the key. Go back to your budget. You’ve now “found” money from all those canceled subscriptions and a new, lower food bill.

- The Action: Set up an automatic transfer from your checking account to your HYSA for the day after every payday.

- Maybe it’s $50. Maybe it’s $200. The amount doesn’t matter as much as the consistency.

You used the 30-day sprint to build the buffer. Now you use automation to build the fortress. You’ve proven you can do it. You’ve broken the cycle. You are no longer one bad day away from a disaster. You are in control.