Is it worth getting State Farm insurance?

You can’t drive down a U.S. highway or turn on your TV without seeing the iconic red logo. State Farm is the largest auto and home insurer in the nation, built on the century-old promise of being a “good neighbor.”

But in 2025, with dozens of tech-first, app-based competitors like Geico and Progressive promising rock-bottom rates, is the old-school, local-agent model still worth it?

When you buy insurance, you’re buying a promise—a promise that if your life is turned upside down by a car crash or a house fire, a company will be there to make you whole. State Farm’s entire brand is built on delivering that promise through a personal relationship.

This comprehensive review will dive deep into whether State Farm is the right financial partner for you. We’ll analyze its customer service, claims satisfaction, pricing, and the real-world value of its 19,000-agent army.

Who Is State Farm? A Quick Look at the Industry Giant

Founded in 1922, State Farm is a mutual insurance company. This is a critical, often-overlooked detail.

- What is a mutual company? Unlike a publicly-traded company (like Progressive or Allstate) that must answer to stockholders, a mutual company is technically “owned” by its policyholders.

- Why does this matter? In theory, this structure allows the company to focus on long-term policyholder value (like paying claims and keeping rates stable) rather than short-term quarterly profits for Wall Street.

This structure has allowed State Farm to grow into a financial behemoth. It is the #1 auto insurer and the #1 homeowners insurer in the United States by market share. It also writes nearly 1 in every 5 renters insurance policies and is a massive life insurance provider.

This market dominance is backed by unparalleled financial strength. State Farm consistently earns an A++ (Superior) rating from AM Best, the highest possible rating. This isn’t just jargon; it’s an independent audit that confirms State Farm has the capital to pay out all its claims, even in a widespread catastrophe.

State Farm Customer Satisfaction and Claims: The J.D. Power Perspective

An insurer’s true value is only revealed when you file a claim. A cheap policy from a company that fights you tooth and nail is worthless.

This is an area where State Farm consistently performs well, though not always perfectly.

- J.D. Power Rankings: This is the industry gold standard for customer satisfaction. State Farm’s performance in the 2024 studies (which inform 2025 decisions) paints a clear picture.

- Auto Insurance: State Farm typically ranks “above average” or in the top tier for overall satisfaction, claims, and shopping. It often scores just below the perennial (and eligibility-restricted) winner, USAA.

- Homeowners Insurance: It consistently scores “above average” and often competes for the top spot among major carriers.

- Life Insurance: State Farm is a powerhouse, frequently ranking #1 in J.D. Power’s Individual Life Insurance Study for overall customer satisfaction.

- NAIC Complaint Index: The National Association of Insurance Commissioners (NAIC) tracks consumer complaints. State Farm’s auto and home insurance complaint ratios are consistently at or better than (lower than) the national median. This means that relative to its massive size, it receives fewer consumer complaints than expected.

The takeaway: While you can always find individual horror stories online (as you can for any company of this size), the objective, large-scale data shows that State Farm policyholders are, on average, more satisfied with their service and claims process than customers of most competitors.

The Core Debate: State Farm’s Local Agent Model vs. The Competition

Here is the central question: Do you want an 800-number, or do you want a person’s cell phone number?

State Farm’s entire business is built on its 19,000+ local agents. These agents are not employees; they are independent business owners who only sell State Farm products.

The “Good Neighbor” Advantage: Why the Agent Model Works

When you buy a State Farm policy, you are assigned to a local agent’s office. This agent is your single point of contact.

- A Real Person, a Real Relationship: When you have a question, you call your agent’s office, not a massive call center. When you have a claim, your agent is supposed to be your advocate, helping you navigate the process. This human element is invaluable during a stressful event.

- Proactive Policy Reviews: A good agent will call you annually for a “policy review.” They’ll ask if you’ve gotten married, had a child, or bought a new car. This is designed to find new discounts and, more importantly, close coverage gaps you didn’t know you had.

- Holistic Financial Guidance: The agent’s goal is to become your “one-stop-shop.” They can bundle your auto, home, and life insurance. This “one agent” approach simplifies your financial life and often unlocks the deepest discounts. Need to raise your liability on your auto? Your agent will know it’s time to add an umbrella policy. This holistic view is something a website or a call-center rep (who only handles auto) cannot provide.

- Local Knowledge: Your agent lives and works in your community. They understand the local risks, from “that specific icy stretch of highway” to the “new hail storm trend” in your area.

The Downside: Why the Agent Model Can Be Frustrating

This model isn’t perfect, especially for a generation that prizes speed and digital access.

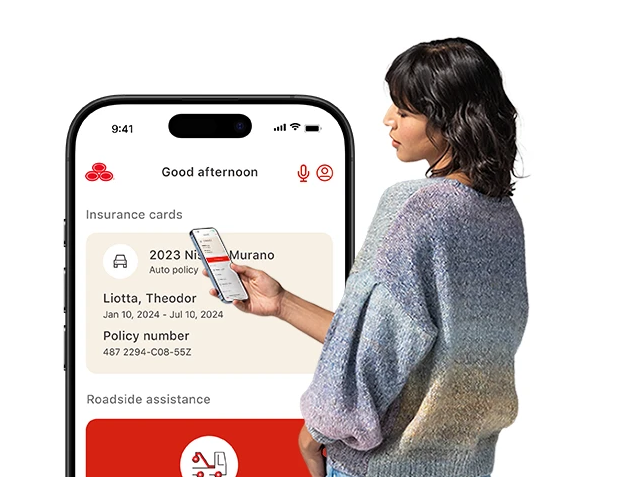

- It Can Be Slower: Need to add a new car to your policy at 9 PM on a Friday? With Geico, you can do it on their app in 60 seconds. With State Farm, you can use their app, but the system is still built around the agent. Many people just email their agent and wait until Monday morning.

- Your Experience Depends on Your Agent: State Farm is not monolithic. It’s a network of 19,000 small businesses. Your experience is almost entirely dependent on how good your specific agent and their office staff are. A great agent is a financial lifesaver. A lazy or unresponsive agent can be a nightmare, making you feel like you’re paying a premium for nothing.

- The “One-Size-Fits-All” Solution: Because agents only sell State Farm, they can’t shop around for you. If State Farm’s rates for your specific profile (e.g., a teen driver) are high, the agent can’t offer you a quote from Progressive. An independent broker can, but a State Farm agent cannot.

The Bottom Line: State Farm’s agent model is its greatest strength and its primary potential weakness. It’s a premium service, and you have to decide if that service is valuable to you.

How Do State Farm’s Insurance Rates Compare on Price?

This is the big one. Is State Farm expensive?

The honest answer is: It depends. State Farm is rarely the cheapest option, but it is often surprisingly competitive.

- If you are a price-only shopper: You will likely find a cheaper premium from a direct-to-consumer insurer like Geico or Progressive. Those companies have shed the cost of 19,000 brick-and-mortar offices and pass those savings on.

- If you are a “bundler”: This is where State Farm’s pricing shines. The multi-policy discounts for combining auto and home (or renters) are significant. It’s very common for State Farm’s bundled price to be cheaper than buying auto from Geico and home from another company.

- If you are a high-risk driver: State Farm is a “standard” insurer. If you have multiple at-fault accidents or a DUI, you will likely find much better rates from a non-standard insurer that specializes in high-risk profiles (Progressive is often a good fit here).

- If you are a family with young drivers: This can be a sweet spot. State Farm’s telematics and good student discounts are robust, and its rates for new drivers are often more stable than those of budget carriers.

In short, you are not just paying for a policy; you are paying for the agent, the strong financial rating, and the (statistically) good claims service.

Unlocking Savings: A Deep Dive into State Farm’s Discounts

State Farm’s base rates may not be the lowest, but they offer a deep well of discounts to make them competitive. The key is having an agent who actively applies them.

Top Auto Insurance Discounts

- Drive Safe & Save™ (Telematics): This is their usage-based insurance program. It tracks your driving habits via a smartphone app (or a small beacon) and provides a discount of up to 30%. It primarily rewards low mileage, smooth acceleration/braking, and not using your phone while driving.

- Steer Clear® Program: This is a fantastic program for new drivers (under 25). It’s a combination of online training modules, mentored driving, and safe driving habits (tracked by the app) that can lead to a significant discount.

- Good Student Discount: One of the most generous in the industry. If your high school or college student maintains a “B” average (3.0 GPA) or is in the top 20% of their class, you can save up to 25%.

- The Bundling Discounts: This is the heavyweight champion. Combining auto with a home, renters, or condo policy unlocks the “Multi-Policy” discount, which is almost always the largest one available.

- Standard Discounts: They also have all the discounts you’d expect:

- Multi-Vehicle

- Accident-Free (a large discount after 3+ years)

- Defensive Driving Course

- Anti-Theft Device

- Vehicle Safety (for cars with high safety ratings)

Top Homeowners Insurance Discounts

- Home/Auto Bundle: Again, this is the most significant discount.

- Home Alert Protection: You get a discount for having smoke detectors, fire extinguishers, and a home security system (like SimpliSafe or ADT).

- Roofing Discount: If you have newer, impact-resistant roofing materials (especially important in “hail alley”), you can get a notable discount.

Beyond Auto: A Look at State Farm Homeowners Insurance

State Farm is the #1 home insurer for a reason. Their policy is comprehensive and their service is, as noted by J.D. Power, consistently above average.

The “worth” of their home insurance comes from the agent’s ability to properly insure your home’s replacement cost. Many people buy cheap online policies that only cover their home’s market value. After a total fire, they discover they are $100,000 underinsured because the cost to rebuild is far higher than the market value.

A local State Farm agent is trained to prevent this. They will run a detailed replacement cost estimate on your home to ensure your “Coverage A” (Dwelling) limit is accurate. This single piece of advice is often worth any premium difference.

Does State Farm Offer Good Life Insurance?

This is one of State Farm’s strongest, yet most overlooked, offerings. They are a massive life insurance carrier and consistently win the J.D. Power award for it.

- Types Offered: Term Life, Whole Life, and Universal Life.

- The Value Proposition: Convenience and trust. People know they need life insurance, but it feels complicated. The ability to sit down in a local office with the same person who handles your auto and home insurance and get a simple 20-year term policy for your family is a huge benefit. It removes the friction.

- The Cost: Are they the absolute cheapest for a 30-year term policy? Maybe not. A healthy 30-year-old might save a few dollars a month by using an online brokerage. But for the convenience, trust, and quality of service, State Farm is considered a top-tier life insurance provider.

Pros and Cons: Is State Farm Good for You? (A Summary)

Let’s distill this entire 2,000-word review into a simple T-chart.

| Pros (Why State Farm is Worth It) | Cons (Why It Might Not Be) |

| Local Agent Model: You get a real, human advisor. | Not the Cheapest: Price-shoppers will likely find lower rates online. |

| Financial Strength: A++ (Superior) rating from AM Best. | Agent-Dependent: Your experience hinges on the quality of your specific agent. |

| Customer Satisfaction: Consistently ranks “above average” in J.D. Power studies. | Slower for Digital Natives: App is good, but processes can be agent-focused. |

| Excellent Bundling: Deep discounts for combining auto, home, and life. | No “Shopping Around”: Agents are “captive” and can only sell State Farm products. |

| Top-Tier Life Insurance: #1 in J.D. Power for life insurance satisfaction. | Average for High-Risk: Not the best or cheapest for drivers with poor records. |

| Robust Discount Programs: Drive Safe & Save and Good Student are very strong. | Fewer Niche Coverages: Competitors may offer more “a la carte” add-ons. |

Who is State Farm Really Worth It For in 2025?

So, back to the original question: Is State Farm insurance worth it?

State Farm is absolutely worth it for:

- The “One-Stop-Shop” Family: You have a home, two cars, and are thinking about life insurance. You want one agent, one phone number, and one company to handle it all. The bundling discounts will likely make the price very competitive.

- The “Relationship” Buyer: You hate call centers. You value the idea of sitting down with a person once a year to review your policies and build a long-term relationship. You see insurance as financial planning, not a commodity.

- Parents of New Drivers: The Good Student and Steer Clear programs are excellent, and having an agent to guide you through the sticker shock of adding a teen is a major benefit.

State Farm is probably not worth it for:

- The “Price-Only” Shopper: If your #1 and only goal is to find the cheapest possible legal minimum coverage, you will beat State Farm’s price online.

- The “High-Risk” Driver: If you have a recent DUI or multiple at-fault accidents, State Farm may not even offer you a policy, and if they do, the rate will be extremely high.

- The “DIY Tech Whiz”: If you prefer to manage 100% of your finances via an app, never want to speak to a human, and enjoy “gaming” your insurance by shopping around every 6 months, the agent model will just get in your way.

Ultimately, State Farm isn’t just selling insurance. It’s selling service, stability, and simplicity. If those things are worth a few extra dollars a month to you, then you are exactly the customer State Farm is built for.