The hidden benefits of premium cards that almost no one uses

You’ve seen them. The heavy, metal cards. The cards that come with a jaw-dropping $695 annual fee. The cards that promise access to exclusive airport lounges, massive sign-up bonuses, and fancy concierge services.

People get these premium credit cards—like the Chase Sapphire Reserve®, The Platinum Card® from American Express, or the Capital One Venture X Rewards—for the status and the obvious perks. They get a huge thrill the first time they bypass the airport crowds and walk into a plush lounge for a free drink.

But here’s the secret the banks don’t publicize: Most cardholders leave hundreds, if not thousands, of dollars in value on the table every single year.

Why? Because the real power of these cards isn’t just in the lounge access. It’s buried deep in the “Guide to Benefits,” a boring, 50-page PDF that 99% of people never read. These “hidden” benefits are a suite of powerful insurance policies and protections that can save you from financial headaches.

You are paying a subscription for these benefits. It’s time you learned how to use them. This guide is a treasure map to the perks you’re paying for but probably not using.

What Are Premium Cards (And Why Do They Cost So Much)?

First, let’s clarify what we’re talking about. A “premium” card is any card with a high annual fee (typically $395 or more) that is bundled with a long list of travel and lifestyle benefits.

The high fee isn’t just for the metal card or the ability to earn points. You are paying for a bundle of services. The most well-known are:

- Airport Lounge Access: (e.g., Priority Pass, Centurion Lounges)

- Big Sign-Up Bonuses: (e.g., 60,000+ points)

- High Point Multipliers: (e.g., 3x on dining, 5x on flights)

- Annual Statement Credits: (e.g., a $300 travel credit)

These are great, but they’re just the tip of the iceberg. The real value is in the built-in insurance and purchase protections that can cover your purchases, your health, and your travel plans.

Your Card’s Secret ‘Undo Button’: Mastering Purchase Protection

This is one of the most valuable and underused perks. Purchase Protection covers your new purchases against accidental damage, theft, or sometimes even loss for a set period, usually 90 to 120 days.

Here’s a real-world example:

You buy a new pair of $200 noise-canceling headphones. A week later, you accidentally drop them, and they crack. The store’s return policy won’t cover this. But if you paid with your premium card, you’re covered.

How to use it:

- Call your card’s benefits administrator (the number is on the back of your card or in your “Guide toBenefits”).

- File a claim. You’ll need your receipt and sometimes a photo of the damaged item.

- Get reimbursed. The administrator will typically send you a check or a statement credit for the repair cost or the full purchase price.

This is like having a free, 90-day, all-risk insurance policy on almost everything you buy. Think of the items you’ve dropped or broken just after buying them. This one perk alone could save you hundreds per year.

How Your Card Doubles Your Product’s Life with Extended Warranty

Have you ever had an expensive appliance die just one month after the one-year manufacturer’s warranty expired? It’s infuriating.

Extended Warranty Protection solves this. This benefit automatically extends the manufacturer’s warranty on eligible items, usually adding one extra year to warranties of three years or less.

Here’s a real-world example:

You buy a new $1,500 laptop that comes with a standard one-year warranty. In month 13, the screen goes black. The manufacturer won’t help. But your credit card will.

How to use it:

- Save your receipts! This is non-negotiable. You’ll need the original store receipt, the credit card statement showing the purchase, and the original manufacturer’s warranty.

- File a claim with the benefits administrator.

- Get it fixed. They will coordinate the repair or, in many cases, simply reimburse you for the original purchase price.

This one benefit can save you from a catastrophic, unexpected expense. A single use on a major appliance or electronic device can easily pay for your card’s annual fee.

Never Fear ‘Final Sale’ Again: The Power of Return Protection

We’ve all been burned by a “Final Sale” sign. You buy something, it doesn’t fit or it isn’t what you expected, and the store refuses to take it back.

Return Protection is your secret weapon. If you try to return an eligible item within a certain window (usually 60-90 days) and the merchant refuses, your credit card will refund you the money.

How to use it:

- You must try to return it to the merchant first. You’ll need to show your card’s benefits administrator that the merchant declined the return (a receipt showing the “final sale” policy is often enough).

- File your claim.

- Ship the item. Once your claim is approved, you will usually be required to ship the item to the benefits administrator (they provide the address).

- Get your refund. They will credit your account for the full purchase price.

There are limits (e.g., $300 per item, $1,000 per year), but this is an amazing tool for savvy shoppers that completely removes the risk of “final sale” regret.

The Built-In Safety Net: Credit Card Travel Insurance Explained

This is the single biggest-value benefit that people ignore. Cardholders often go out and buy separate travel insurance policies, not realizing they are already covered just by paying for their trip with their premium card.

This isn’t just one benefit; it’s a whole bundle of protections.

Important: To be eligible, you must pay for the entire trip (or at least the major components like flights and hotels) with that specific credit card.

1. Trip Cancellation & Interruption Insurance

If you have to cancel or cut your trip short due to a covered reason (like a severe illness, injury, or death in the family), this will reimburse you for your non-refundable, pre-paid travel expenses. Think flights, hotels, and tours. This can be worth thousands of dollars.

2. Trip Delay Reimbursement

This is a common and easy-to-use perk. If your flight or other common carrier is delayed by a set amount of time (e.g., 6 or 12 hours), your card will reimburse you for “reasonable expenses” incurred during the delay.

- What it covers: A hotel room for the night, meals at the airport, toiletries, and even a change of clothes.

- How to use it: Keep all your receipts and your statement from the airline showing the delay. File a claim, and you’ll get a check in the mail.

3. Baggage Delay Reimbursement

Your flight arrives, but your bag doesn’t. Baggage Delay Reimbursement covers the purchase of essential items while you wait. If your bag is delayed (e.g., 6+ hours), you can go buy clothes, toiletries, and other necessities, and your card will reimburse you (e.g., up to $100 per day for 3 days).

4. Lost Luggage Reimbursement

If the airline loses your bag for good, they will only pay you a limited amount. This benefit covers the difference between what the airline pays and the actual value of your belongings, often up to $3,000 per passenger.

5. Auto Rental Collision Damage Waiver (CDW)

This is a huge one. When you rent a car, the agent at the counter always tries to upsell you on their expensive “Collision Damage Waiver” (CDW), which can be $20-$30 per day.

Premium travel cards almost always offer a Primary Auto Rental CDW. This means you can decline the rental agency’s insurance entirely. If you get into an accident or the car is stolen, your credit card’s policy kicks in first. It doesn’t even touch your personal car insurance, so your premiums won’t go up. This benefit alone can save you $150-$200 on a one-week car rental.

6. Emergency Medical & Evacuation

This is the one you hope you never need. If you get sick or seriously injured while traveling abroad, your U.S. health insurance may not cover you. This benefit can cover emergency medical or dental expenses. More importantly, it can cover the cost of a medical evacuation—which can run into the tens of thousands of dollars—to get you to a proper hospital.

Saving Your $1,000 Phone: Does Your Card Offer Cell Phone Protection?

This is a newer, high-value perk being added to many premium (and even mid-tier) cards. If you pay your monthly cell phone bill with your card, you are automatically enrolled in Cell Phone Protection.

- What it covers: Damage (like a cracked screen) or theft of your phone.

- What it costs: It’s free! But you will have to pay a deductible, which is typically $25 to $100 per claim. This is significantly cheaper than the $200+ deductible from AppleCare+ or the high monthly insurance fees from carriers like Verizon or AT&T.

Paying your cell phone bill with the right card can save you $10-$15 a month on separate insurance, easily adding up to $180 a year.

Your Personal Assistant: Unlocking Concierge Services

This sounds like a gimmick, but it can be a legitimate time-saver. Premium cards offer a 24/7 concierge—a phone number you can call to speak to a real person who can act as your personal assistant.

What can they actually do?

- Book hard-to-get restaurant reservations. They often have “set-aside” tables at in-demand restaurants.

- Find and send the perfect gift. Need to send a specific item to a client in another city? They’ll research it, buy it, and have it shipped.

- Plan a trip itinerary. You can tell them, “I want to go to Italy for 10 days, I like history and good food,” and they will send you a full, bookable itinerary.

- Find sold-out tickets. (They can’t work miracles, but they have access to special blocks of tickets for cardholders).

The service is free; you just pay for whatever you purchase. The true value here is time. Outsourcing 30 minutes of research or phone calls is a massive luxury.

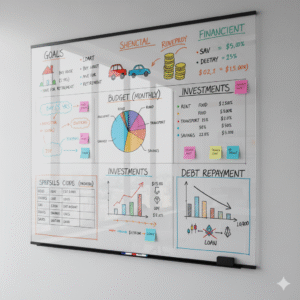

The ‘Free Money’ That Pays Your Annual Fee: Statement Credits

These aren’t as “hidden” as the insurance perks, but they are the most “unused.” Premium cards are loaded with statement credits that are designed to offset the high annual fee. But here’s the catch: Many of them require you to “enroll” or “opt-in” first.

People pay the $695 fee, forget to enroll, and get zero value.

Look for these in your benefits dashboard:

- $300 Annual Travel Credit: (e.g., Chase Sapphire Reserve)

- $200 Hotel Credit: (e.g., Amex Platinum)

- $240 Digital Entertainment Credit: ($20/month for services like Disney+, Hulu, The New York Times)

- $200 Airline Fee Credit: (Covers baggage fees, seat upgrades, etc.)

- $189 CLEAR Credit: (Gets you the annual membership for free)

- $100 Global Entry / TSA PreCheck Credit: (Covers the application fee)

- $100 Saks Fifth Ave Credit: ($50 to spend twice a year)

- Monthly Uber/Lyft Credits

- Monthly Dining/Grubhub Credits

If you add up these credits, they often exceed the annual fee. Your card isn’t “costing” you $695; it’s paying you to keep it… if you use the benefits.

How to Find and Activate These Hidden Benefits (A Step-by-Step Guide)

You’re convinced. You want to use these perks. Here’s your 4-step action plan.

- Read the “Guide to Benefits.” Yes, the boring PDF. When you get your card, it comes in the mail. If you threw it out, you can find it online. Search for your card’s name + “Guide to Benefits.” This is your legal contract and explains every perk in detail.

- Log In to Your Online Account. This is your command center. Find the “Benefits” or “Rewards & Benefits” tab.

- Activate Everything. Go through the list of benefits. You will see things like the statement credits or perks like a free ShopRunner membership. Click “Enroll” or “Activate” on every single one. This is the #1 mistake people make.

- Know Who to Call. Your benefits are often managed by a third-party administrator. Find the phone numbers for “Benefits Administrator,” “Travel Insurance,” and “Concierge” and save them in your phone. You don’t want to be searching for a number after you get in an accident.

Is a Premium Card ‘Worth It’ If You Don’t Use These Perks?

No. Absolutely not.

If you are paying a $695 annual fee just to have a metal card in your wallet, you are losing money. If you only use the lounge access twice a year, you are overpaying for airport sandwiches.

A premium card is not a status symbol; it’s a powerful financial tool. The annual fee is a subscription to a package of insurance and luxury services. The only way to “win” the game is to use benefits that are worth more than the fee you pay.

By ignoring the hidden perks—the purchase protections, the extended warranties, the travel insurance—you are letting the bank keep the money you paid them for services you’re not using.

Take an hour this week. Open your card’s benefit page. Make a checklist. And start using the perks you’ve already paid for.