Understand how to stop living paycheck to paycheck

It’s a feeling that’s all too familiar for millions of Americans. That brief, two-second wave of relief when your paycheck hits your account… immediately followed by a wave of anxiety as you watch it all disappear. Your mortgage or rent is due. The car payment is next. Then the credit card bills, the student loan payment, the utilities, and a trip to the grocery store.

By the time you’re done, you’re left with almost nothing. You’re just… surviving. You’re running on a financial treadmill, working hard all month just to end up exactly where you started.

This is the paycheck-to-paycheck cycle, and it is one of the most stressful, demoralizing traps in modern financial life. It’s the constant, low-grade fear that a single unexpected event—a car repair, a medical bill, a leaky roof—could send your entire financial house of cards tumbling down.

But here is the most important thing you need to know: This is a solvable problem.

This isn’t a life sentence. It doesn’t matter if you make $30,000 or $130,000; the trap can catch anyone. Breaking free isn’t about some secret “get rich quick” scheme. It’s about a deliberate, step-by-step change in your system. It’s about building a buffer between you and the financial edge, and then slowly, systematically, pushing that edge further and further away.

This is your comprehensive guide to dismantling the trap and building a life of financial security, one choice at a time.

First, Understand Why You’re Stuck in the Paycheck-to-Paycheck Trap

Before you can build an escape route, you have to understand the architecture of the prison. For 99% of people, living paycheck to paycheck is not an income problem. It’s a system problem.

The trap is built from a few key components:

- No Buffer: You have little to no savings. Every dollar that comes in is already “spoken for” by a bill or an expense. There is zero margin for error.

- High Debt Load: A significant portion of your income is immediately consumed by payments on past decisions (credit cards, car loans, personal loans). This is money you’re earning today to pay for things you bought months or years ago.

- Lifestyle Creep: This is the most insidious part. As your income has increased over the years, so has your spending. You got a raise, so you got a nicer car. You got a bonus, so you got a bigger apartment or house. Your “essentials” have slowly expanded to meet your exact income, leaving no room for savings.

- No Plan: Your money management strategy is “hope.” You “hope” there’s enough at the end of the month. You swipe your debit or credit card and “hope” it goes through.

The good news? Every single one of these components can be broken down and rebuilt.

The Non-Negotiable First Step: Create a Budget That Actually Works

Let’s rebrand. “Budget” is not a four-letter word. It’s not a financial diet of bread and water. A budget is simply a spending plan. It’s you telling your money where to go, instead of wondering where it went. This is the single most powerful tool for breaking the cycle.

But most budgets fail. Why? Because they’re too restrictive, too complicated, or built on fantasy numbers. You need to choose a system that works for your brain.

Budget Method 1: The Zero-Based Budget

This is the most hands-on, most effective method for stopping financial leaks. The principle is simple: Income – Expenses = $0.

This doesn’t mean you spend all your money. It means every single dollar that comes in is given a “job” before the month begins.

- $1,500 goes to Rent.

- $400 goes to Groceries.

- $200 goes to Debt.

- $150 goes to Gas.

- $100 goes to Savings.

- $75 goes to “Fun Money.”

- …and so on, until the total equals your monthly income.

Savings and debt payments are built in as expenses. You are “spending” on your future. This method forces you to be intentional with every dollar.

Budget Method 2: The 50/30/20 Rule

If the zero-based budget feels too overwhelming, this is your starting point. It’s a high-level framework:

- 50% of your take-home pay goes to NEEDS: These are the must-haves. Rent/mortgage, utilities, groceries, car payment, insurance, minimum debt payments.

- 30% goes to WANTS: Dining out, subscriptions (Netflix, etc.), hobbies, shopping, entertainment.

- 20% goes to SAVINGS & DEBT: This is the most important part. This 20% is your ticket out of the cycle. It goes toward building your emergency fund and aggressively paying down debt (more than the minimums).

The key? That 20% comes first. You “Pay Yourself First,” and then use the remaining 80% to run your life.

How to Conduct a Financial “Autopsy” (And Find Your Leaking Money)

You can’t make a plan if you don’t know your starting numbers. It’s time to play detective.

- Grab a pen and two different colored highlighters.

- Print out your last 90 days of bank and credit card statements.

- Highlighter 1 (e.g., Green): Go through and highlight every essential NEED. Your mortgage/rent, your utility bill, your car insurance, your basic grocery runs.

- Highlighter 2 (e.g., Pink): Go through and highlight every non-essential WANT. Every drive-thru coffee, every lunch ordered to the office, every streaming service, every impulse “Target run,” every subscription box you forgot you had.

This is your “Aha!” moment. You will be shocked at what the “pink” category adds up to. That $6 coffee, $15 lunch, and $12 subscription don’t feel like much in the moment, but they add up to $300-$500 a month. This is your “leaking money.” This is the money you will redirect to build your freedom.

Build Your “Freedom Fund”: The $1,000 Starter Emergency Fund

This is your first, most critical mission. Before you aggressively attack debt, before you start investing, you must build a small buffer.

Why? Because the next time you get a flat tire ($150), you won’t put it on a 24% APR credit card. You will pay for it in cash from your Starter Emergency Fund.

This $1,000 (or $500, if $1k feels impossible) is the firewall that stops you from going deeper into debt. It breaks the cycle of “one step forward, one step back.”

How to Get Your First $1,000 Fast:

- Sell stuff: Go through your house. That old bike, the video game system you don’t use, the clothes in your closet. List them on Facebook Marketplace or eBay. Be ruthless.

- Use your “Autopsy” money: The $300 you found in “leaking money”? Redirect it here for 3-4 months.

- Take an extra shift: Work one weekend.

- Pause everything: For 30 days, go on a “spending freeze.” No eating out, no shopping, no non-essential spending at all. Throw every spare dollar into this account.

Put this $1,000 in a separate savings account (preferably a High-Yield Savings Account, or HYSA) and do not touch it except for a true emergency.

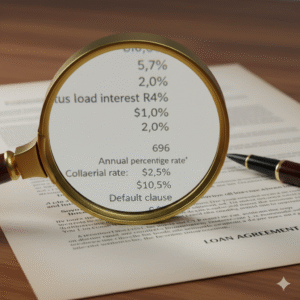

The Elephant in the Room: Creating a Debt-Attack Plan

You cannot get ahead if you are constantly dragging the anchor of high-interest debt. That $5,000 on a credit card at 22% interest is a five-alarm financial fire. It’s costing you over $1,000 a year just in interest.

Once your $1,000 buffer is in place, you take all the “leaking money” you found, plus any other cash you can find, and aim it at your debt. But how?

Strategy 1: The Debt Snowball (The Psychological Win)

Popularized by Dave Ramsey, this method is about building momentum.

- List all your debts (excluding your mortgage) from smallest balance to largest balance, regardless of interest rate.

- Pay the minimum payment on all of them…

- …except the smallest one. You throw every extra dollar you have at that smallest debt until it’s GONE.

- You take the money you were paying on that (plus the minimum payment) and “snowball” it onto the next-smallest debt.

- Repeat. The “snowball” gets bigger and bigger, and you get “quick wins” that keep you motivated.

Strategy 2: The Debt Avalanche (The Mathematical Win)

This method saves you the most money in interest.

- List all your debts from highest interest rate (APR) to lowest interest rate.

- Pay the minimum payment on all of them…

- …except the one with the highest APR. You throw every extra dollar you have at that debt first.

- Once it’s gone, you “avalanche” that full payment onto the next-highest APR debt.

Which is better? The math says the Avalanche. But human psychology says the Snowball. The best plan is the one you will actually stick with. If you need quick wins to stay in the fight, use the Snowball.

Why You Can’t “Save” Your Way Out: The Importance of Increasing Your Income

Here’s the hard truth: there is a limit to how much you can cut. You can only cut your lattes and subscriptions to $0. But there is no limit to how much you can earn.

Attacking this problem from both sides—cutting expenses and increasing income—is how you supercharge your escape.

Short-Term Income Boosters:

The goal here is a quick cash injection to fund your $1k emergency fund or throw at your first “snowball” debt.

- Gig Work: Drive for Uber or Lyft, deliver for DoorDash or Instacart. A few nights or weekends can net you a few hundred dollars.

- Sell a Skill: Are you good at writing? Editing? Graphic design? Babysitting? Landscaping? Post your services on local forums or sites like Upwork or Fiver.

- Overtime: Ask your boss for extra hours.

- Seasonal Work: Get a temporary job during the holidays or tax season.

Long-Term Income Strategy:

This is how you permanently change your financial reality.

- Ask for a Raise: Don’t just ask. Build your case. Track your “wins” and accomplishments for 6 months. Research your market value on sites like Glassdoor. Schedule a formal meeting and present your case for why you are more valuable than you were a year ago.

- Get a New Certification: What skills can you learn in 6 months that would make you more valuable in your industry?

- Change Jobs: The fastest way to get a significant (10-20%) pay bump is often to move to a new company.

- Start a Real Side Hustle: Turn your skill or hobby (photography, woodworking, web design, writing) into a small, legitimate business.

The Golden Rule: Every new dollar from this extra income does not go to lifestyle. It goes directly to your financial goals (debt, savings).

From Buffer to True Security: Building Your 3-6 Month Emergency Fund

After your $1,000 buffer is set and your high-interest (credit card) debt is gone, you have a new mission. Now you build your real emergency fund.

This is 3 to 6 months’ worth of your essential living expenses. Go back to your budget. Add up your Needs (rent, food, utilities, gas, insurance). If that number is $2,500, your goal is to save $7,500 (for 3 months) to $15,000 (for 6 months).

Yes, this is a big number. It will take time. But this is the pot of gold. This is what true financial security feels like. This is the money that says, “If I lose my job, I have 6 months to find a new one without panicking.” This fund officially, permanently, and unequivocally ends the paycheck-to-paycheck cycle.

This money belongs in a High-Yield Savings Account (HYSA) where it’s safe, liquid, and earning some interest.

The Final Step: How to Stay Out of the Cycle for Good

You’ve built your buffer. You’ve killed your debt. You’ve built your full emergency fund. How do you ensure you never slide back?

Automation. Automation. Automation.

You must build a system where the default choice is the correct one. Human willpower is weak. A good system is strong.

- Set up your direct deposit.

- Have a portion automatically go to your 401(k) (at least enough to get your employer match—it’s free money).

- Have a portion automatically transfer to your HYSA (for your long-term goals, like a house or a new car).

- Have a portion automatically transfer to a separate investment account (a Roth IRA, for example).

- Set all your essential bills (mortgage, utilities) to autopay.

What’s left in your checking account is what you have to live on for “wants” and groceries. You have already paid yourself, your future, and your bills. You have removed the temptation and the need for constant “management.” Your wealth-building is now on autopilot.

Your New Life Awaits

Breaking the paycheck-to-paycheck cycle is a journey. It won’t happen overnight. It will take sacrifice, discipline, and saying “no” to some things now so you can say “yes” to a much bigger future.

The goal isn’t just to have more money in the bank. The goal is freedom. It’s the freedom to quit a job you hate. The freedom to handle an emergency without a panic attack. The freedom to make choices based on your values, not your bank balance.

Start today. Not “after the holidays.” Not “when things calm down.” Today. Pick one step—just one. Go conduct your financial autopsy. That one small, decisive action is the first step off the treadmill and onto the path to financial freedom.