What is currency hedging and when is it useful?

Imagine you are an American investor. You did your homework, analyzed the charts, and bought stock in a fantastic European car company. Over the next year, the company performs brilliantly, and its stock price on the German exchange rises by 10%.

You pop the champagne, log into your brokerage account, and… wait. You’ve actually lost money.

How is that possible?

While you were busy watching the stock price, you forgot to watch the Exchange Rate. During that same year, the Euro weakened by 15% against the US Dollar. When you converted your German profits back into dollars, that currency drop wiped out your gains and put you in the red.

This is called Currency Risk (or FX Risk), and for many Americans, it is the silent killer of international returns.

The solution to this problem is a financial strategy called Currency Hedging. While it sounds like something only Wall Street bankers do in skyscrapers, it is a tool that is increasingly available—and necessary—for everyday investors and small business owners.

In this guide, we will strip away the complexity of the foreign exchange market. We will explain exactly what hedging is, how it protects your wallet, and crucially, when you should use it (and when you should skip it).

1. What Is Currency Hedging? The “Insurance” Analogy

To understand hedging, stop thinking about finance and start thinking about insurance.

When you buy a house, you buy homeowner’s insurance. You hope your house never burns down, but if it does, the insurance company writes you a check to offset the loss. You pay a small cost (the premium) to avoid a catastrophic loss.

Currency Hedging is insurance for money.

It is a financial strategy used to reduce or eliminate the risk that an unfavorable move in exchange rates will hurt your investment or business deal.

How It Works (The Simple Version)

When you hedge, you take a position in the market that is the exact opposite of your current risk.

-

The Investment: You own European stocks. You want the Euro to go UP.

-

The Hedge: You buy a contract that makes money if the Euro goes DOWN.

If the Euro crashes, your stocks lose value, but your hedge makes money. The profit from the hedge offsets the loss from the stocks. You have effectively “neutralized” the currency movement, leaving you with just the performance of the actual company you invested in.

2. The Mechanics: How the “Strong Dollar” Affects You

For American investors, the strength of the US Dollar (USD) is the single most important factor in international investing.

We often hear on the news, “The Dollar is Strong!” and think that’s a good thing. For a tourist visiting Paris, it is great—your coffee is cheaper. But for your portfolio, a strong dollar can be a drag.

The Math of International Returns

When you invest overseas, two engines drive your returns:

-

Asset Performance: Did the stock/bond go up?

-

Currency Performance: Did the foreign currency gain value against the Dollar?

The Formula:

-

Scenario A (The Tailwind): You buy Japanese stocks. The stock goes up 10%. The Yen also goes up 10% against the Dollar.

-

Result: You make 20%. (This is the dream).

-

-

Scenario B (The Headwind): You buy Japanese stocks. The stock goes up 10%. The Yen falls 10% against the Dollar.

-

Result: You make 0%. (You ran in place).

-

-

Scenario C (The Disaster): The stock stays flat (0%). The Yen falls 10%.

-

Result: You lose 10%, even though the company did nothing wrong.

-

Hedging is the tool you use to remove “Currency Return” from the equation, ensuring that Scenario B and C don’t happen.

3. The Toolkit: How Do You Actually Hedge?

You don’t need to call a broker on the floor of the New York Stock Exchange to hedge anymore. There are several ways to do it, ranging from simple to complex.

A. For the Average Investor: Hedged ETFs

This is the easiest method. In the last decade, ETF providers (like BlackRock, WisdomTree, and Vanguard) have created funds that do the hedging for you.

-

Unhedged ETF: Example: MSCI Japan ETF (EWJ). This holds Japanese stocks. You are exposed to the Yen.

-

Hedged ETF: Example: MSCI Japan Hedged Equity ETF (DXJ). This holds the same stocks but uses financial contracts to cancel out the Yen fluctuations.

If you believe the Dollar will get stronger, you buy the Hedged version. If you believe the Dollar will get weaker, you buy the Unhedged version.

B. For Business Owners: Forward Contracts

If you run a small business that imports wine from Italy, you have to pay your supplier in Euros in 90 days. You are terrified that the Euro will spike in cost before you pay.

You can go to your bank and sign a Forward Contract. This locks in an exchange rate today for a transaction that will happen in the future.

-

Today’s Rate: 1 Euro = $1.10.

-

Contract: You agree to buy 10,000 Euros at $1.10 in 90 days.

No matter what happens in the market (even if the Euro goes to $1.50), you get your rate. You have hedged your cost.

C. For Advanced Traders: Options and Futures

These are speculative tools used on platforms like the CME Group or Forex brokers.

-

Put Options: You buy the right to sell a currency at a specific price.

-

Futures: A standardized contract to exchange currency at a set date.

-

Warning: These involve leverage and high risk. They are not recommended for the average “buy and hold” retirement investor.

4. When Is Hedging Useful? (The Checklist)

Should you hedge everything? Absolutely not. Hedging costs money and limits potential upside. Here are the specific scenarios where hedging makes sense.

Scenario 1: You Expect a “King Dollar” Cycle

The currency market moves in long cycles (often 5 to 10 years). If the US Federal Reserve is raising interest rates higher than other countries, the Dollar tends to soar. In this environment, foreign currencies bleed value.

-

Action: Switch your international exposure to Currency-Hedged ETFs. You want to own the foreign companies (like Toyota or Nestle) without holding their weakening currency.

Scenario 2: Liability Matching (Business)

If you have a defined bill to pay in a foreign currency in the future, you should almost always hedge.

-

Example: You are getting married in Italy next summer. You know the venue costs 20,000 Euros. Don’t gamble. Convert the money now or use a forward contract. If the Euro rises 20%, your wedding just got 20% more expensive.

Scenario 3: Fixed Income (Bonds)

This is crucial. Bond yields are usually low (e.g., 3% to 5%). Currency fluctuations are volatile (e.g., 10% to 20%).

If you buy international bonds, the currency swing can easily dwarf the interest payments.

-

Rule of Thumb: Most financial advisors recommend always hedging international bond portfolios. You buy bonds for stability, and currency risk introduces volatility that defeats the purpose of the bond.

5. When Should You NOT Hedge?

Sometimes, doing nothing is the best strategy.

1. The “Natural Hedge” of Diversification

If you are a long-term investor (20+ years), currency fluctuations tend to wash out. Sometimes the Dollar is up; sometimes it is down. Over decades, the net impact is often close to zero. Paying for hedging every year might just drag down your performance due to fees.

2. When the Dollar is Weakening

If the US economy is struggling and the Dollar is falling, holding foreign currency is actually a bonus.

-

Example: You own British stocks. The Pound gets stronger against the weak Dollar. Your investment gains a “currency bonus.” If you had hedged, you would have missed out on this extra profit.

3. Investing in Emerging Markets

Hedging costs are determined by the difference in interest rates between two countries (Interest Rate Parity).

Hedging major currencies (Euro, Yen) is usually cheap.

Hedging emerging currencies (Brazilian Real, Turkish Lira) can be extremely expensive. The cost to hedge might be 5% or 10% per year, which eats up all your potential profits. Usually, it is better to leave Emerging Markets unhedged.

6. The “Carry Trade” and the Cost of Hedging

Nothing in finance is free. There is a cost to hedging, but surprisingly, sometimes that cost is a profit.

This depends on Interest Rate Differentials.

- Positive Carry (You get paid to hedge):

If US interest rates are 5% and Japanese rates are 0%, you actually earn money by hedging the Yen back to the Dollar. This has been the case recently, making hedged Japan ETFs extremely popular.

- Negative Carry (You pay to hedge):

If US interest rates are 2% and Mexican rates are 11%, it costs you roughly 9% a year to hedge the Peso. This is why hedging high-yield currencies is rarely done by retail investors.

Before entering a hedge, always check the “Cost of Carry.”

7. The Hidden Hedge: US Multinationals

You might not need to buy foreign stocks to get foreign exposure.

Look at the S&P 500. Companies like Apple, Coca-Cola, and McDonald’s generate a massive portion of their revenue overseas.

-

When McDonald’s sells a burger in Paris, they earn Euros.

-

They have to convert those Euros back to Dollars to report earnings.

These companies have massive treasury departments that do the currency hedging for you. By owning US multinationals, you are already participating in the global currency game, often with professional risk management built in.

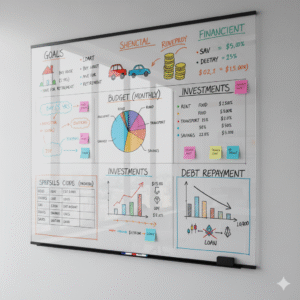

8. Strategy for the American Retiree

If you are retired or approaching retirement, your tolerance for volatility is low.

A common recommendation for a balanced US portfolio is:

-

US Stocks: 60%

-

International Stocks: 20% (Consider 50% Hedged / 50% Unhedged split).

-

Why? This is the “middle of the road” approach. You don’t bet all-in on the Dollar, but you don’t let a Dollar rally destroy your retirement savings.

-

-

Bonds: 20% (Always Hedged).

This reduces the “standard deviation” (risk) of your portfolio without significantly sacrificing returns.

9. Frequently Asked Questions (FAQ)

Is hedging considered speculation?

No, it is the opposite. Hedging is defense. Speculation is betting on where the currency will go to make a profit. Hedging is taking a position to ensure you don’t lose money due to currency moves.

Do hedged ETFs cost more?

Generally, yes. The Expense Ratio (fee) for a hedged ETF might be slightly higher (e.g., 0.35%) than a standard index ETF (e.g., 0.10%) because the fund manager has to actively manage the derivative contracts. You need to weigh if the protection is worth the extra fee.

Does Warren Buffett hedge currency?

Warren Buffett generally advises average investors to buy the S&P 500 and not worry about currency. However, his company, Berkshire Hathaway, frequently issues debt in foreign currencies (like the Euro or Yen) as a way to create a natural hedge for their foreign assets.

Can I hedge my Crypto investments?

Yes, sophisticated traders use “Perpetual Futures” to hedge Bitcoin or Ethereum exposure, but this is highly technical and risky. For most, holding “Stablecoins” (like USDC) is the closest equivalent to moving to cash/dollars during volatility.

Don’t Let the FX Market Blindside You

Currency hedging is like an umbrella. You don’t need it every day. On sunny days (when the Dollar is weak), it feels like extra weight in your bag. But when the storm hits (when the Dollar spikes), it is the only thing keeping you dry.

For the layperson, the takeaway is simple:

-

Be aware: Recognize that when you buy foreign assets, you are making two bets (the asset and the currency).

-

Check the trend: If the US Dollar is in a strong uptrend, consider Hedged ETFs for your international allocation.

-

Stick to basics: Don’t try to trade Forex futures yourself unless you are a pro. Use the tools designed for you, like ETFs or mutual funds.

The goal of investing is to compound wealth, not to gamble on the geopolitical relationship between the Euro and the Dollar. Use hedging to strip away the noise so you can focus on the signal.