Why is it so difficult to save money?

Let’s be honest: does this sound familiar?

Your paycheck hits your account. You feel good, maybe even a little rich. You pay your rent or mortgage, your car payment, and your utilities. You buy groceries. You treat yourself to a few dinners out, grab coffees on the way to work, and maybe buy that one thing you’ve been eyeing on Amazon.

Then, a week before your next paycheck, you check your account. It’s low. Dangerously low. You’re left wondering, “Where did it all go? I work so hard. Why can’t I get ahead?”

If this is you, you are not alone. And more importantly: you are not “bad with money.”

Saving money is one of the most commonly cited financial goals, yet it’s the one most people struggle with. We’re constantly told to “just save more,” as if it’s as simple as flipping a switch. But it’s not.

The truth is, saving money is incredibly difficult. It’s a battle that pits your rational “future self” against a powerful combination of your own brain’s wiring, a society built on consumption, and a financial system that often feels designed to keep you on a treadmill.

This guide will break down the real reasons why saving is so hard, and then give you a practical, step-by-step playbook to fight back.

Your Brain on Spending: The Psychological Barriers to Saving

The biggest enemy to your savings account isn’t your income; it’s your own psychology. Our brains are hardwired for survival, which, in modern terms, translates to “get the good thing now.”

1. Instant Gratification vs. Delayed Gratification

This is the classic “marshmallow test.” Our brains are wired to crave immediate rewards. When you buy a new pair of shoes or click “Order Now,” you get an instant hit of dopamine, the “feel-good” chemical. It’s a tangible, immediate pleasure.

Saving money is the exact opposite. The “reward”—financial security, a comfortable retirement, a down payment—is abstract, intangible, and years or even decades away. Your brain struggles to connect the “pain” of not buying the shoes today with the “pleasure” of a goal 10 years from now.

2. “Present Bias” and Your Future Self

Psychologists have a term called “present bias,” which means we overwhelmingly favor our current selves over our future selves. Studies have shown that when people think about their “future self,” their brain activity looks the same as when they think about a total stranger.

Think about that: you are literally trying to save money for someone you don’t know.

When you’re faced with the choice between $100 for a concert ticket tonight or $100 for your 65-year-old self’s retirement fund, “Present You” almost always wins. It’s not a character flaw; it’s a quirk of human cognition.

3. The “Pain of Paying” Is Disappearing

We are primates who evolved to understand tangible trade-offs. When you had to pay for everything in physical cash, you felt the loss. Handing over five $20 bills for a pair of jeans “hurt” more than buying a $500 plane ticket with a credit card.

Modern technology has all but eliminated this “pain of paying”:

- Credit Cards: You swipe and deal with the consequences later.

- Tap-to-Pay & Digital Wallets: It feels frictionless, almost like it’s not real money.

- One-Click Ordering & “Buy Now, Pay Later” (BNPL): These are designed to remove every single barrier between your impulse and the purchase.

When spending is painless and saving is (perceived as) painful, your brain will always choose the path of least resistance.

The “Lifestyle Creep” Trap: When More Money Doesn’t Help

Have you ever gotten a raise and thought, “Finally! I’ll be able to save so much”? And then, six months later, you’re in the exact same paycheck-to-paycheck position, just with slightly nicer things?

This is Lifestyle Creep (or lifestyle inflation), and it’s a primary reason why even high-earners struggle to save.

It happens slowly. Your raise hits. You justify a slightly better apartment. You upgrade your car. You start buying brand-name groceries instead of generic. You subscribe to a few more streaming services.

None of these individual choices feel extravagant. But in combination, they create a new, higher “floor” for your monthly expenses. Your financial obligations rise to meet your new income, leaving no room for savings. You’ve adapted to a new standard of living, and going back feels like deprivation.

This is often paired with another major headwind: Stagnant wages vs. actual inflation. Even if your salary hasn’t gone up, the cost of everything else has. Your rent, health insurance, gas, and groceries are all more expensive than they were five years ago. You aren’t “bad with money” if your paycheck simply doesn’t buy what it used to.

The Social Media Effect: How “Keeping Up” Is Keeping You Broke

It used to be that you just had to “keep up with the Joneses” on your street. Now, you have to keep up with the entire internet.

Social media platforms like Instagram and TikTok are not just entertainment; they are 24/7 marketing engines. They generate two powerful, money-draining psychological forces:

- The Comparison Trap: You are constantly scrolling through a “highlight reel” of everyone else’s life. You see their exotic vacations, their perfect home renovations, their new cars, and their expensive dinners. You are comparing your real life (with all its bills and boring nights in) to their curated fantasy. This creates a deep-seated Fear of Missing Out (FOMO) and a feeling that you are “behind.”

- You Are the Product: You are being advertised to relentlessly, often by “influencers” who make it feel like a friendly recommendation. These ads are targeted with terrifying precision to exploit your insecurities and desires.

This constant exposure makes you feel poor, even if you’re not. It convinces you that you need to spend money to have the life you’re “supposed” to have. This social pressure to consume is a massive, invisible barrier to saving.

When Your Budget Isn’t the Problem (It’s Your System)

Many people who try to save money fail because their system is broken. They approach saving with vague goals and flawed methods.

1. The “Save What’s Left” Fallacy

This is the single biggest tactical mistake in personal finance. Most people structure their finances like this:

- Get Paycheck

- Pay Bills & Spend Money

- Hope there is something left over to save.

There is never anything left. This “leftover” money gets absorbed by small, untracked purchases—a coffee here, an Uber there.

2. Vague Goals = No Motivation

“I need to save more money” is not a goal. It’s a wish. It has no power, no timeline, and no finish line. Your brain can’t latch onto it.

Why are you saving? What are you saving for? Without a “why,” you have no reason to say “no” to the instant gratification of spending.

3. The “All-or-Nothing” Mindset

This is the dieter’s-mentality-of-finance. You create a hyper-strict, unrealistic budget where you’ve cut out all fun. You stick to it for a week, but then you have a bad day and “splurge” on a $75 dinner.

You feel guilty. You think, “Well, I already blew my budget for the month… I might as well give up and try again next month.” This “all-or-nothing” cycle prevents you from making consistent, long-term progress.

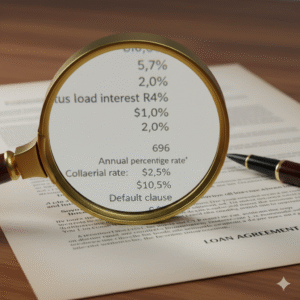

The Debt Spiral: Why You Can’t Save When You’re Drowning

This is the mathematical reality for millions of Americans. It’s not that saving is “hard”—it’s that it’s mathematically impossible when you’re trapped in a debt cycle.

High-interest debt, particularly credit card debt, is the anti-savings.

- Saving: You earn a small amount of interest (your money makes money).

- Debt: You pay a large amount of interest (your money loses money, fast).

If you have $5,000 in a savings account earning 4% and $5,000 in credit card debt at 22%, you are not breaking even. You are losing a financial war. The interest you pay on your debt is crushing the interest you earn on your savings.

For many, every “extra” dollar is immediately consumed by minimum payments that barely cover the interest. This is a treadmill you can’t get off, and it’s the most significant barrier of all. You can’t fill a bucket (savings) that is riddled with holes (debt).

How to “Trick” Your Brain Into Saving Money (Actionable Solutions)

Okay, we’ve established the problem. It’s hard. Your brain, society, and your debts are working against you. Now, here’s how you fight back. You don’t need more willpower; you need a better system.

1. The Golden Rule: Pay Yourself First

This single change will revolutionize your finances. It flips the “save what’s left” model on its head.

- Get Paycheck.

- Immediately save a set amount.

- Pay Bills & Spend what is left over.

You must treat your savings like your most important bill. It’s a non-negotiable payment you make to “Future You.”

2. AUTOMATE. EVERYTHING.

This is how you defeat “present bias” and “decision fatigue.” Take your flawed, impulsive, human brain out of the equation.

- Set up an automatic transfer from your checking account to a separate savings account.

- Time it perfectly: Have the transfer happen the day after your paycheck hits. You will save money before you even have the chance to miss it or spend it.

- Start small. Can you spare $50 per paycheck? $25? Start there. The amount isn’t as important as building the habit. You can increase it every six months.

3. Give Your Savings a Name (And a Purpose)

Remember, “save money” is a bad goal. You need to give your brain a why.

- Instead of one giant “Savings” account, open multiple High-Yield Savings Accounts (HYSAs) and nickname them.

- “Peace of Mind Fund” (Your $1,000 emergency fund)

- “Hawaii 2026”

- “New Car Down Payment”

- “Freedom Fund” (for quitting a job you hate)

Now, when you’re tempted to buy a $150 jacket, you’re not choosing between the jacket and “savings.” You’re choosing between the jacket and “Hawaii.” Suddenly, the trade-off is real, and your “future self” has a fighting chance.

Build a System That Makes Saving Easy and Painless

Once you’ve automated, you can add other “tricks” to your system.

1. Separate Your Money (The “Digital Envelope” System)

Have your automated savings go to a completely separate bank. Ideally, an online-only bank that offers a High-Yield Savings Account (HYSA).

- Why? It adds friction. It takes 2-3 days to transfer money out. This “cooling-off” period is often enough to stop an impulse purchase.

- Bonus: HYSAs pay significantly higher interest rates than your brick-and-mortar checking account, so your money literally makes more money just by sitting there.

2. The 50/30/20 Budget: A Simple Framework

If you hate complex spreadsheets, this is for you. It’s a guideline, not a prison.

- 50% of your take-home pay goes to NEEDS: Rent/mortgage, utilities, groceries, transportation, insurance, debt minimum payments.

- 30% goes to WANTS: Dining out, shopping, hobbies, streaming, travel.

- 20% goes to SAVINGS & DEBT-PAYOFF: This is your “Pay Yourself First” number. This 20% goes first to your 401(k) match, your emergency fund, and then to aggressively paying down high-interest debt.

3. Embrace “Sinking Funds”

This is a game-changer for avoiding “surprise” expenses. A sinking fund is a mini-savings account for a known, upcoming, non-monthly expense.

- Example: You know your car insurance is $600 every 6 months. Instead of being shocked by a $600 bill, you create a sinking fund and automatically save $100 a month for it.

- Do this for car repairs, holiday gifts, annual subscriptions, etc. This isn’t “saving”; this is planning your spending. It stops those big expenses from wiping out your emergency fund.

4. What About Debt? (The $1,000 Rule)

If you’re in heavy debt, the 50/30/20 rule might seem impossible. Here’s the common-sense approach:

- Priority #1: Save a $1,000 “baby” emergency fund. Automate this first. This small buffer is your shield. It will stop you from going further into debt when a small emergency (like a flat tire) happens.

- Priority #2: Once you have $1,000, redirect all your “savings” (that 20% chunk) to aggressively paying off your highest-interest debt (likely a credit card).

- Priority #3: Once that debt is gone, you redirect that entire payment amount (your old minimum payment + the extra) to your now-growing emergency fund, aiming for 3-6 months of living expenses.

Redefining Your Relationship with Money (The Mindset Shift)

The final step is to change how you think about money.

Stop thinking of saving as deprivation. Start thinking of it as buying your freedom.

- Every dollar you save is buying you options.

- It’s buying you the freedom to quit a toxic job.

- It’s buying you the freedom to handle a medical emergency without panic.

- It’s buying you the freedom to travel, to rest, to retire, or to take a risk on a new business.

When you look at it this way, that $7 coffee or $80 pair of shoes isn’t just $7 or $80. It’s a tiny piece of your future freedom that you’re trading for a temporary buzz. Sometimes that trade is worth it! But you should make it consciously.

Saving is hard because you’re fighting biology, psychology, and a multi-trillion dollar marketing industry. It’s not a fair fight. But you can win. You don’t win with willpower. You win with a system.

Start today. Log in to your bank. Open a new savings account. Name it “Freedom Fund.” And set up an automatic transfer for $25. It’s the first and most important step to taking your power back.