Personal Loans vs. Credit Cards: Which One to Choose?

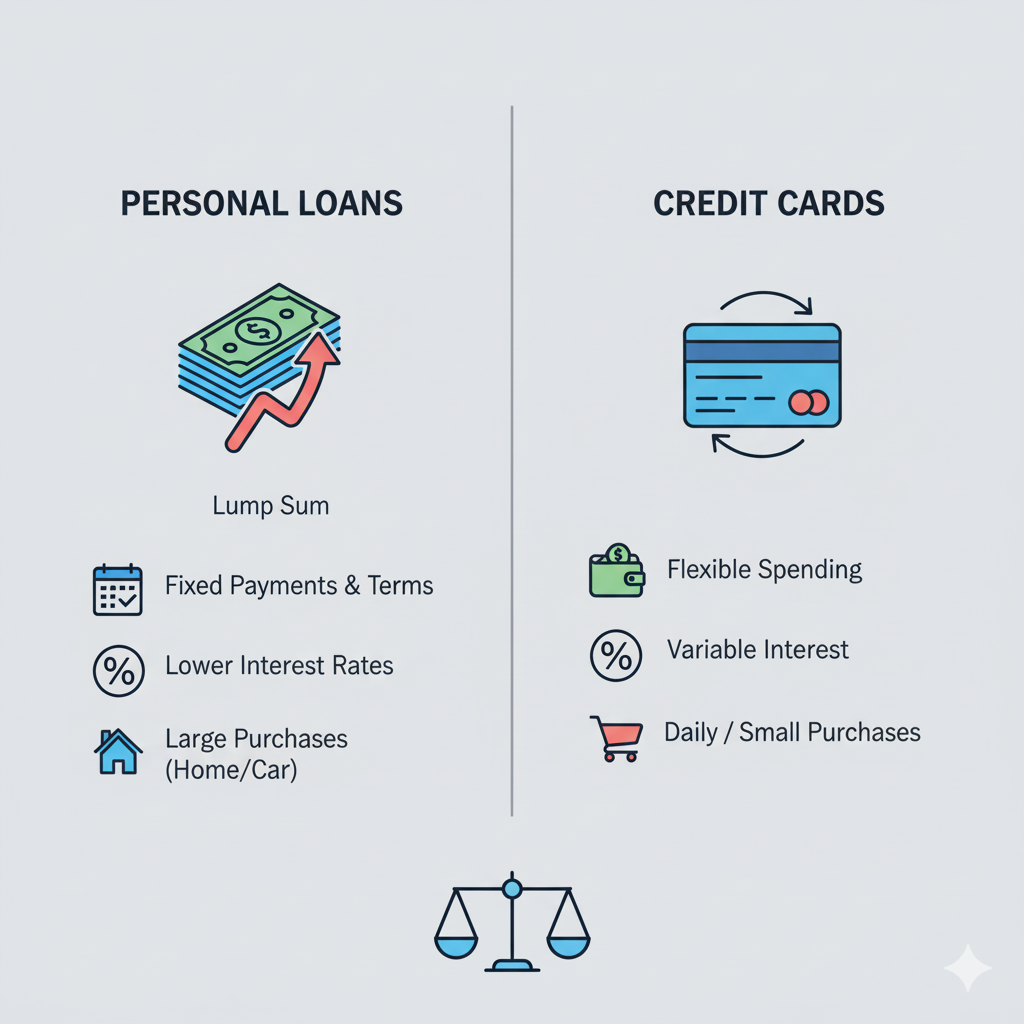

When you need to borrow money, you have a few options. Two of the most common are a personal loan and a credit card. While both allow you to access funds, they are fundamentally different tools with their own set of advantages and disadvantages. Choosing the right one can save you thousands of dollars and help you achieve your financial goals more efficiently.

This guide will break down the key differences between personal loans and credit cards, from their interest rates and repayment structures to their best use cases. By the end, you’ll have a clear understanding of which option makes the most sense for your specific needs, whether you’re consolidating debt, funding a large project, or covering an unexpected expense.

The Fundamentals of a Personal Loan: A Lump Sum with a Fixed Plan

A personal loan is a type of installment loan. When you get a personal loan, the lender gives you a lump sum of money upfront. You then pay this money back in fixed monthly installments over a set period of time, known as the loan term. This term can range from a few months to several years.

A key feature of a personal loan is that it often has a fixed interest rate. This means your monthly payment amount will stay the same for the entire life of the loan. This predictability makes a personal loan an excellent tool for budgeting and long-term financial planning.

How Personal Loans Are Structured and What They’re Best For

Personal loans are typically unsecured, meaning they don’t require collateral like your car or home. Lenders base their decision to approve you and the interest rate they offer on your credit score, income, and debt-to-income ratio. The better your credit profile, the lower the interest rate you’ll likely receive.

Personal loans are an ideal choice for:

- Debt Consolidation: If you have multiple high-interest credit card debts, a personal loan can combine them into a single, manageable monthly payment, often at a lower interest rate.

- Large, One-Time Expenses: They’re perfect for big-ticket items like a home renovation, a medical bill, or a major purchase, as they provide a large amount of cash at once.

- Funding a Specific Event: A personal loan can be used to pay for a wedding, a significant vacation, or other life events where you need a predictable, single-payment loan.

The Benefits of Using a Personal Loan for Your Next Big Project

The most significant benefit of a personal loan is its predictability. The fixed monthly payments and set repayment schedule make it easy to budget and track your progress. You know exactly when the loan will be paid off, which can be a huge motivator.

Personal loans also tend to have lower interest rates than credit cards, especially for those with good credit. This can save you a substantial amount of money over time, particularly for large-dollar amounts. Moreover, unlike a credit card, a personal loan doesn’t tempt you to overspend. Once you receive the funds, the account is closed to new borrowing.

The Flexibility of a Credit Card: A Revolving Line of Credit

A credit card works differently. Instead of a lump sum, a credit card provides you with a revolving line of credit. You can borrow up to a certain credit limit, make purchases, and pay off the balance. As you pay down your balance, the available credit becomes available again, which is why it’s called a revolving line.

Credit cards are incredibly flexible. You can use them for daily expenses, small purchases, and emergencies. However, they come with a major catch: their interest rates are almost always variable and significantly higher than those on personal loans.

Key Characteristics of a Credit Card and Their Common Uses

Credit cards are unsecured and also depend on your credit score for approval and your credit limit. They are designed for convenience and short-term borrowing.

Credit cards are a great choice for:

- Everyday Expenses: They are perfect for daily purchases, groceries, gas, and utility bills.

- Building Credit: Responsible use of a credit card, including making on-time payments and keeping your balance low, is one of the best ways to build a strong credit history.

- Short-Term Borrowing: If you can pay off your balance in full each month, a credit card can be a great tool because you won’t pay any interest.

- Emergencies: They provide quick access to funds for unexpected expenses, like a car repair or a last-minute flight.

The Dangers and Advantages of Relying on a Credit Card

The main advantage of a credit card is its flexibility and convenience. You have a line of credit ready to use whenever you need it. Credit cards also offer valuable rewards programs, including cashback, airline miles, and travel perks, which a personal loan does not.

However, the biggest danger is high, variable interest rates. If you carry a balance on your credit card from month to month, the interest charges can quickly add up, making your debt grow rapidly. This can turn a manageable debt into a massive financial burden. Another risk is the temptation to overspend, as the revolving nature of the credit line can make it feel like you have an unlimited source of funds.

The Great Showdown: Personal Loan vs. Credit Card for Debt Consolidation

One of the most common reasons people consider a personal loan is to consolidate debt. Is it always the right choice?

Imagine you have three credit cards with balances totaling $15,000, and they all have a 22% average interest rate. You’re making the minimum payments, but the balances are barely going down because of the high interest.

- Option A: A Personal Loan. You take out a $15,000 personal loan with a 10% interest rate over a three-year term. Your new single monthly payment is fixed and significantly lower than the sum of your credit card minimums. You’ve locked in a lower rate, and in three years, the debt will be completely gone. This is a very common and effective strategy.

- Option B: A Balance Transfer Credit Card. You open a new credit card that offers a 0% introductory APR for 18 months on balance transfers. You move your $15,000 balance to this new card. For 18 months, you can make payments without any interest being charged. This allows you to pay down the principal balance aggressively.

While the 0% APR offer is tempting, it comes with a few conditions. First, you usually have to pay a balance transfer fee (typically 3-5% of the transferred amount). Second, if you don’t pay off the balance before the 0% period ends, the remaining balance will be subject to the card’s high, standard APR. This requires a lot of discipline and a concrete plan to pay off the debt in time.

For most people, a personal loan for debt consolidation provides a clearer, more predictable path to becoming debt-free without the risk of an expiring promotional rate.

When to Use Each for Specific Needs: A Practical Guide

To help you decide, let’s look at a few common scenarios.

Scenario 1: You Need to Finance a Major Purchase

- The Best Choice: A personal loan.

- Why: You get the full amount of cash at once to pay for the purchase. The interest rate will be lower and fixed, so you’ll know exactly what your payments are and when the debt will be paid off. A credit card is a bad choice here unless you can pay it off within a month or two, as a large balance will quickly rack up huge interest charges.

Scenario 2: You Need a Financial Safety Net for Emergencies

- The Best Choice: A credit card.

- Why: A credit card offers immediate access to a line of credit for unexpected expenses. You don’t need to go through an application and approval process when you’re in a pinch. Plus, if you can pay off the emergency expense within the grace period, you won’t owe any interest.

Scenario 3: You Want to Pay for Daily Expenses and Earn Rewards

- The Best Choice: A credit card.

- Why: Using a credit card for everyday spending and paying the balance in full each month is an excellent financial habit. You get the convenience, the security of not carrying cash, and you can earn valuable rewards without paying a dime in interest.

Scenario 4: You’re Planning to Make a Series of Small, Frequent Purchases

- The Best Choice: A credit card.

- Why: The revolving nature of a credit card is perfect for this. You can make purchases over time as needed, and as you pay down your balance, you free up more credit. A personal loan would give you a lump sum you may not need all at once and would require you to pay interest on the full amount from day one.

Choosing the Right Tool for the Job

Neither personal loans nor credit cards are inherently “good” or “bad.” They are simply different financial tools designed for different purposes. The best choice for you depends entirely on your specific needs, your financial discipline, and the amount of money you need to borrow.

- Choose a Personal Loan for large, one-time expenses, debt consolidation, and when you need the certainty of a fixed payment and a clear end date.

- Choose a Credit Card for everyday spending, building credit, and short-term or emergency borrowing that you can pay off quickly.

Before you make a decision, always compare offers, understand the fine print, and consider your financial situation honestly. By making an informed choice, you can use these tools to your advantage and pave the way to a more secure financial future.